Could the inventory trend change in 2023?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, looks at the change in propane inventory with 2022 coming to a close.

Catch up on last week’s Trader’s Corner here: Watch propane price curves to chart a course

Read the rest of this four-part series:

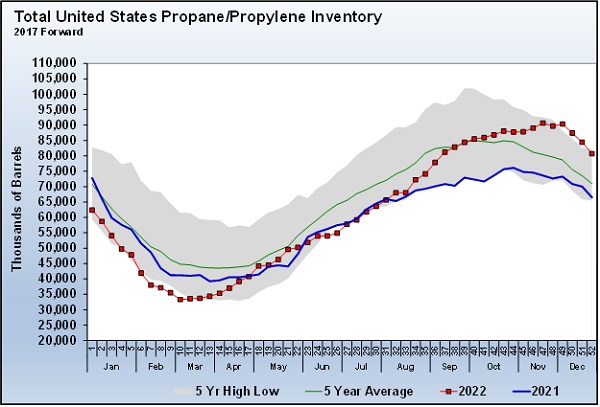

As we close out 2022, we can get a good look at the change in propane inventory over the course of the year.

Propane opened the year near a five-year low and ended the year near a five-year high. Inventory stood at 80.681 million barrels on Dec. 30. The high over the past five years was in 2019 at 82.188 million barrels, and the five-year average end-of-year position was 70.963 million barrels. From the last inventory position in 2021 to the last inventory position in 2022, the change was 14.951 million barrels, a 22.75 percent increase.

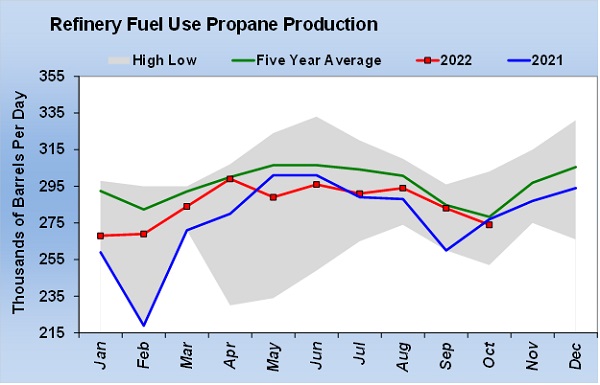

As we pointed out recently, the change in fuel-use propane was even higher because the above number includes some propylene. Given that refineries made less propylene and more fuel-use propane last year, the percentage gain in fuel-use propane, which impacts propane wholesale and retail prices, was even higher than 22.75 percent. The latest fuel-use only production data is through October. Through October, fuel-use production was up 7.7 percent, while combined fuel-use propane/propylene production was up 5.1 percent for all of 2022.

Our goal in this analysis is to imagine what could change the inventory trend in 2023 that would likely lead to higher propane pricing in the months ahead. In last week’s Trader’s Corner, we looked at the forward price curves for both propane and crude. As we pointed out, crude sets the base value for propane, and then propane’s own fundamentals will cause propane’s value relative to crude to go up or down. So, even if propane’s inventory remains high and its value relative to crude stays low, its price could still rise if there is a significant upturn in crude prices. Last week’s Trader’s Corner looked at some reasons that crude prices could go higher in 2023, so revisit those if you have time. But let’s focus this analysis on propane fundamentals and identify possibilities that could tighten up propane supply. We will begin with what we mentioned above concerning refineries’ production of propylene and fuel-use propane.

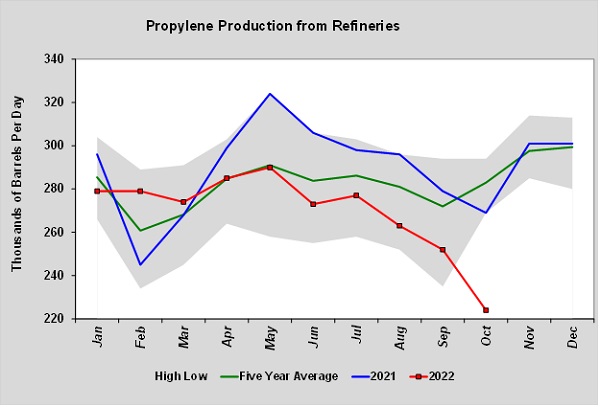

Chart 2 plots refinery propylene production. Refinery propylene production ran 18,400 barrels per day (bpd) less from January through October 2022 than it did through the same period in 2021.

The cutback in propylene production didn’t result in an equal increase in fuel-use propane, which was up about 10,000 bpd through October 2022 compared to the same period the previous year. It also reversed a trend where refiners were producing more higher-valued propylene at the expense of fuel-use propane.

If there is any improvement in the economy resulting in more petrochemical demand, we see no reason that refiners wouldn’t revert to preferring propylene over propane production. Let’s say just the 10,000-bpd gain in fuel-use propane from refiners experienced in 2022 goes away; that would decrease fuel-use propane production by 3.65 million barrels this year. That amount represents 24 percent of the increase in inventory experienced over the past 12 months.

We can’t say that will happen. In fact, with the pessimism about the global economy, it may not. On the other hand, once China gets on the other side of its current COVID-19 outbreak, its demand for all energy and petroleum chemical feedstocks has a chance to increase. It is probably going to be a rough year for the global economy, but we wanted to show what a difference just a change in focus at refineries from fuel-use propane back to propylene could have on propane supply. That change would likely put one element of upward price pressure on propane that didn’t exist in 2022.

In our next Trader’s Corner, we will continue looking at factors that could change the trajectory of propane supply and demand and threaten the current inventory position, which is keeping propane’s value to crude very low. Specifically, we will look at the change in natural gas pricing over the course of 2022. Natural gas production has been at record highs as prices reached levels not seen in decades. Natural gas processing yields 87.64 percent of propane supply. Natural gas prices have been tanking recently. Could that cause less drilling, less natural gas production, thus less natural gas processing and therefore less propane supply?

Read the rest of this four-part series:

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.