How to use swaps as price protection

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, details the process of using swaps as price protection when buying propane.

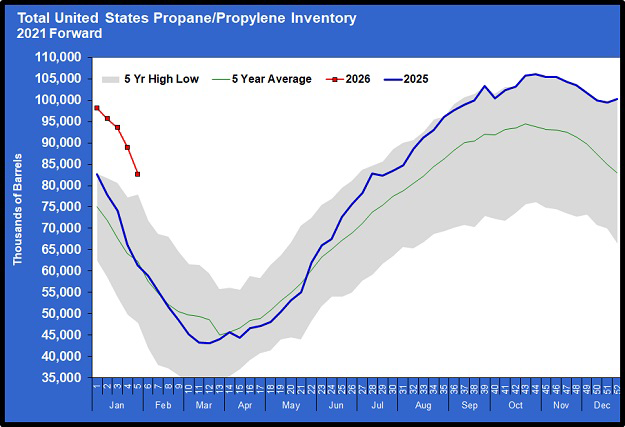

Catch up on last week’s Trader’s Corner here: Draw on propane inventories is a setback for buyers

In this Trader’s Corner, we are going to explore the process that a propane retailer would take to begin using swaps to protect valued customers against high prices. Swaps are financial instruments that are used to counter the volatile movement in market prices, providing a predictable outcome on price. No retailer can know for sure what the market price of propane will be this winter, but swaps allow retailers to have more certainty about their future supply costs.

Swaps work in conjunction with what the retailer is already doing with their supplier. A retailer does not have to change their already established supply arrangements to use swaps to turn the unknown future cost of propane into a known cost. However, to help the swap work more cleanly with the supply arrangements, we recommend buying wet barrels from your supplier on a fixed differential to a trading hub rather than at the supplier’s posted price at a certain supply point.

Swaps are valued against the value of propane at trading hubs like Mont Belvieu and Conway. So, buying from your supplier at a fixed differential to the hub allows for a better connection between the swap and what the retailer will be paying their supplier. We will discuss how that works in a second, but first, let’s discuss the steps to begin using swaps in the first place.

The retailer must establish a relationship with at least one swap provider to use swaps. We recommend setting up relationships with several swap providers that act as the counterparty to the retailer in the swap transactions. The counterparties for retailers are trading companies that have relationships with retailers (buyers) and producers (sellers). The trading companies get orders to sell propane from the producers and orders to buy propane from the retailers. The job of the trader is to try to make the volume that buyers want to sell match as closely as possible with what buyers want to buy, thereby keeping their trading book in balance.

Our company, Cost Management Solutions, represents retailers helping them establish trading relationships with counterparties. The counterparty is the trading company, not the actual producer or retailer. The retailer provides financial information to the trading companies, resulting in the trading companies giving them a line of credit that allows the trading process to be conducted quickly without the need to exchange funds when the trade is opened. Funds are exchanged when the position settles at some point in the future.

Assuming the retailer has taken the first step of establishing a line of crude with a trading company or companies that will act as his counterparty, here is how the process works:

1) Cost Management Solutions conducts routine communication throughout each trading day to its clients, providing indications of the value of propane for each month for the next 36 months.

2) The retailer uses this information to look for months when the value of propane is in line with what they would like to establish as the future cost of their supply.

3) When values reach that point, the retailer decides which months they want to establish the cost of supply for, and what specific volume they would like to establish for each month.

4) The retailer contacts Cost Management Solutions, providing details about the trade or swap transactions they would like to make.

5) Cost Management Solutions then secures offers from each of the established trading partners via instant messenger on a trading platform and conveys those offers to the retailer.

6) The retailer decides which offer he would like to accept.

7) Cost Management Solutions then informs the counterparty that their offer was accepted via instant messaging on a trading platform.

8) The counterparty acknowledges the request.

9) Cost Management Solutions then writes a summary of the deal on the trading platform. Assuming the counterparty trader agrees with the summary, he will confirm the trade.

10) Cost Management Solutions will send a copy of the instant message via email to the retailer, allowing the retailer to review the transaction and acknowledge that it was in accordance with his wishes.

11) Cost Management Solutions will then make a record of the trade in their clients’ trading ledger and send formal confirmation to both the retailer and the trading company.

12) The trading company will send a contract to the retailer, which they will compare with Cost Management’s Solutions’ confirmation and, if in agreement, will sign and return the contract.

13) Each month, Cost Management Solutions will send a report to the client showing how their position stands relative to the market price at the time.

Let’s walk through an example of how this might work in real time:

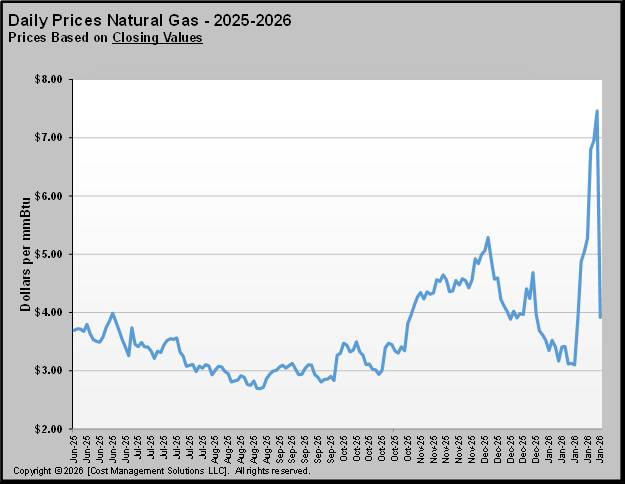

I’m writing this at 9:15 a.m. on Friday, Aug. 1. Propane prices moved lower to start the new month. Many of our clients use the 10-year winter price average as a buying benchmark. Currently, propane for October 2025-March 2026 is valued higher than that benchmark, so a buyer using the 10-year average might not be interested. However, at Mont Belvieu, this morning’s pullback has October 2026-March 2027 valued below that benchmark.

That development causes our client to begin the process outlined above. Let’s say he decides to buy 10,000 gallons per month of October 2026-March 2027 Mont Belvieu propane. He gets an offer that is below his buying benchmark from one of the trading companies and executes the trade.

So, what has he done exactly? Swaps are month- and volume-specific. By executing the trade, the retailer has established six swaps, one for each month, with a specific volume of 10,000 gallons per month. The retailer can have each month’s swap priced separately, which means each month would have a different price. But it is common to ask the counterparty to provide an average price that will be used for all the months. Let’s assume that is what the retailer decides in the case and that the average price is 72 cents, which is 1.5 cents below the 10-year winter price average.

The value of 72 cents is called the strike price of the swap. It is that price that will be compared with the actual price of propane during the months above to determine which direction money will flow. Remember, no money exchanges hands when the trade is initially established. The first 12 steps above will be completed on Aug. 1, 2025.

Then, between the end of August and the completion of all the swaps at the end of March 2027, Cost Management will send the monthly position summaries (step 13). The monthly report will tell the retailer whether the market is currently higher than the strike price of his swaps or lower.

The retailer has established a known cost at Mont Belvieu, Texas, of 10,000 gallons per month of his October 2026-March 2027 supply at 72 cents. Obviously, he will not be selling his propane at Mont Belvieu, Texas, so they need to establish the value difference between Mont Belvieu and their storage tank. That is where buying at the fixed differential to Mont Belvieu, known as an index price, is better than buying at the posted price.

Let’s say the fixed differential is 10 cents between Mont Belvieu and a pipeline terminal where the retailer will pick up his propane from the supplier. Then let’s say it costs 8 cents to transport the propane from the terminal to the retailer’s tank. The value of the propane in the retailer’s storage tank is 90 cents. That is a swap strike at 72 cents, plus the fixed differential at the terminal of 10 cents, plus the truck transport from the terminal to the storage tank of 8 cents. To this, the retailer can add their desired retail margin and establish a price to their customers, or they can simply use this as price protection on their overall supply cost.

No matter where propane trades from that point, the retailer should consider 90 cents as their laid-in cost of propane on the 10,000 gallons per month, October 2026-March 2027. This is the same situation that would be created if the retailer bought 60,000 gallons of propane on August 1 at 90 cents laid-in and put it into a 60,000-gallon tank in their yard and held it until selling it at a rate of 10,000 gallons per month from October 2026 to March 2027, except that the retailer does not have to tie up his storage or consider the cost of money for about a year and a half.

Now we need to go through an example of the process of taking delivery of propane starting in October 2026 and settling the swaps.

In October 2026, the retailer will receive 10,000 gallons of propane into his storage tank. That propane will be valued based on the price of propane at Mont Belvieu. Let’s say that Mont Belvieu is valued at 82 cents. When the retailer picks up the load at his terminal, he will be billed by the supplier at 92 cents (MB plus 10 cents fixed differential). The trucking company will bill their 8 cents, resulting in a cost of supply of 100 cents.

At the end of October, the October swap will settle. The monthly average will be compared to the strike price of the swap. Let’s assume the monthly average is 82 cents against a strike price of 72 cents. As a buyer of a swap, the retailer will receive from his counterparty 10 cents per gallon on 10,000 gallons. When the physical gas cost is combined with the swap payment, the cost of supply is at 90 cents free on board (FOB) the retailer’s tank on those 10,000 gallons for October 2026.

If the value of propane were low in October 2026, let’s say 62 cents at Month Belvieu, the laid-in wet barrel cost of the supply would be 80 cents. However, in this case, the 10 cents of extra margin made by the retailer will be paid to cover the swap loss. Remember, the retailer must price his gas to the customer as if the cost of the supply was 90 cents, even though prices are lower. That is where the 10 cents will come from to cover the swap loss.

This process will repeat five more times until all six swaps have settled. Let’s finish our review of the process by addressing two very important points:

1) In our example, the retailer is only covering 10,000 gallons per month, or the equivalent of about one load of propane. If the retailer is getting billed on the price of propane on the day of lifting, the price on that day is likely to be different than the monthly average. This issue resolves if the retailer has a higher monthly volume and receives deliveries ratably through the month. Let’s say the swap is 40,000 gallons and they buy a load per week, then the amount billed by the supplier is likely to be much closer to the month’s average. Otherwise, the way to reduce this risk is to see if the propane supplier will base its price on the month’s average, which would provide the cleanest connection between the swap and the cost of the physical propane.

2) Even with a line of credit established with a counterparty, there is the possibility that the retailer would have to pay a margin call before the swaps settle. A margin call occurs only when market prices fall below the strike price enough to use up the retailer’s credit line with the counterparty. Let’s say a $50,000 credit line was established. Each 1-cent move lower in the market would use $600 of the credit line. With such a low volume, the credit line would be plenty, and no margin call would occur. But if the volume was 40,000 gallons per month or 240,000 gallons total, a one-cent move would use $2,400 of the credit line. If the price dropped to around 52 cents, a margin call could occur. If the position loss nears the credit limit, the retailer will be given the option to close the position or make a margin call to keep the position active. The margin call is a deposit, not a fee. If the market goes back up, the margin call can be returned to the retailer. Having relationships with several counterparties can provide more credit and help mitigate margin call risk if all the counterparties are used. Obviously, if the credit amounts are small and the swap volumes are large, a margin call becomes far more likely.

As mentioned, to establish a credit line, a retailer must provide financial statements to the counterparties, and their review usually takes about a week. The retailer also must register with the government as a swap trader. It is a formality that does not take long. Basically, it takes about a week to complete the process of being able to use swaps to manage supply costs and protect against higher prices.

The process may sound complicated, but it really isn’t. Steps 1-11 in the process above are done in a matter of minutes. Contracts from the counterparty are usually sent out electronically the day after the deal is made and are then signed electronically by the retailer the same day.

The hard part is knowing when to pull the trigger on establishing price protection (step 3 of the process above). Once that decision is made, the rest flows easily. In addition to acting as the advocate for the retailer in the trading process, Cost Management Solutions’ primary role is to provide market analysis and trading disciplines that make step three much easier.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.