Medford incident complicates Midwest supply

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses how the recent explosion at the ONEOK Medford, Oklahoma, fractionation plant has impacted Midwest supply.

In the Trader’s Corner we wrote on July 18, we provided the early details on the fire and explosion at the ONEOK Medford, Oklahoma, fractionation plant. Medford is a 210,000-barrels-per-day (bpd) fractionator that processes natural gas liquids (NGLs). It accounts for 27 percent of the midcontinent’s fractionation capacity.

What was unclear right after the incident was where the Y-grade/NGL mix that was going to Medford would be processed. We thought there might be a couple of options. One would be to parcel out the production to other fractionators in the Midwest. That option would have had the least impact on Midwest NGL supplies, but logistics would be difficult if not impossible.

ONEOK has fractionators at Mont Belvieu, so the other option was to send Y-grade to those fractionators for processing. That option would have the greatest impact on Midwest supply. We are not privy to ONEOK’s internal decision-making, but we had seen comments that the latter option was taken.

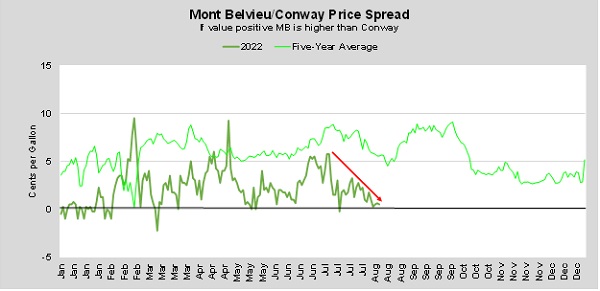

We monitor pricing and fundamental data for clues on what is happening. With about a month hence from the incident, we are starting to see impacts on fundamentals. The impact on pricing was almost immediate. Conway was trading 5 ¾ cents below Mont Belvieu ETR just before the incident and went to near even right after. The spread widened again for a while, but it has come back together recently.

After the initial drop in the spread, there were times it would widen again, increasing hope that the incident was not going to be as detrimental to Midwest supply as feared. Medford was probably yielding about 53,000 bpd of propane at the time of the incident, so its loss is potentially significant, especially when seasonal demand starts kicking in.

The collapse of the price spread discourages the movement of spec propane out of the Midwest. But that may not matter if the propane is already leaving as part of the Y-grade stream going to Mont Belvieu.

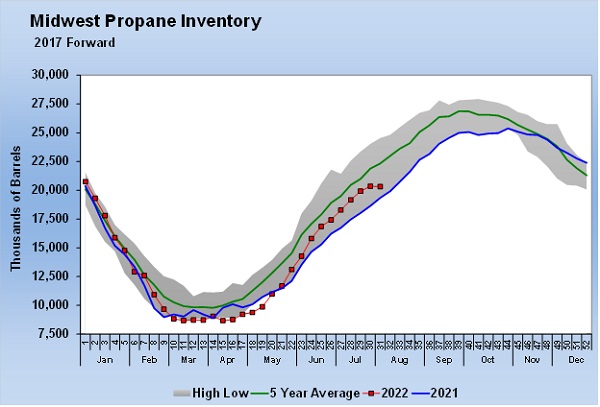

What prompted today’s article is new information on Midwest inventory from the Weekly Petroleum Status Report produced by the Energy Information Administration (EIA). For the week ending Aug. 5, the EIA reported a draw on Midwest inventory. It was only a 40,000-barrel draw, but a draw this time of year is never a good sign.

Midwest inventory is still higher than last year, but it won’t take many below-average inventory builds, much less draws, to eliminate the surplus.

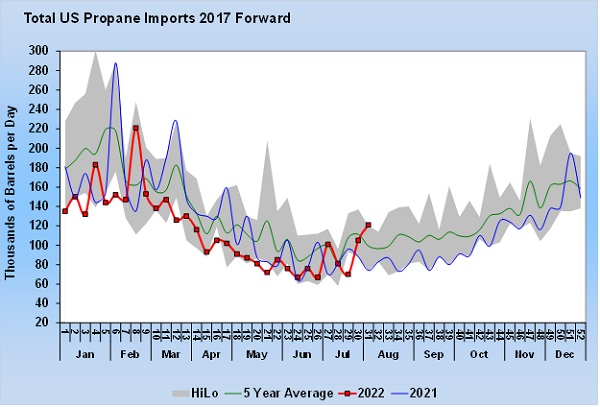

We also noted a change in propane imports.

U.S. propane imports come from Canada. Since developing waterborne export capability, exports to the U.S. have dropped. Exports so far this year have been 17,000 bpd less than last year during the same period. But note the sharp rise in imports over the past two weeks. We can speculate that this is in response to the loss of Medford and the increase in Midwest propane pricing. It will be interesting to see if imports continue to run above where they had been while Medford is down. In any case, the gain in imports from Canada has not been enough to offset all of the propane production from Medford.

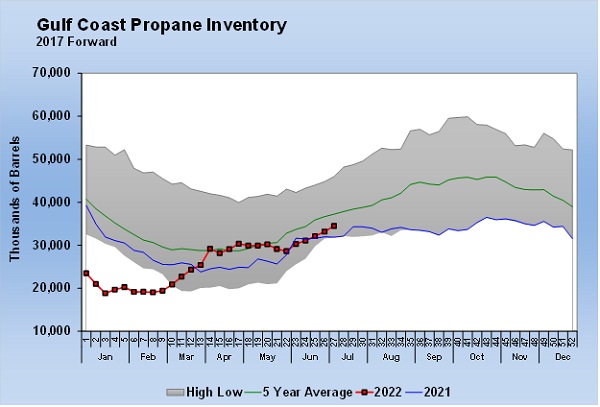

We also note that, despite very robust export activity, Gulf Coast inventories have been building a little better than before the Medford incident.

The drop in Midwest inventory, coupled with a little better inventory builds on the Gulf Coast, appear to be a solid indication that ONEOK is shipping the Y-grade it once processed at Medford to its fractionators in Mont Belvieu.

We are not sure when Medford might resume operation, but it is becoming clearer its loss is negatively impacting Midwest propane supply. At this point, one has to assume the price relationship between Mont Belvieu and Conway will continue in its current direction unless something changes. That would mean Conway could soon be valued higher than Mont Belvieu.

We do note, looking at Chart 1 on the Conway/Mont Belvieu price spread, it is normally tightening this time of year. But it is usually from a much higher differential of around 8 cents, dropping to around 5 cents, a likely reflection of the impact of farmers preparing for crop drying. So, it may not be all gloom and doom for Midwest propane supply and pricing. However, the current trend needs to change quickly or there will be little doubt remaining about the negative impact of the loss of Medford for Midwest supply. Midwest buyers can’t ignore the negative potential on pricing and supply availability and need to take action to mitigate the potential impact as soon as possible.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.