Midwest propane inventories on the rise

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines an unusual trend with Midwest propane inventories.

Catch up on last week’s Trader’s Corner here: What your peers are saying about propane supply

Propane fundamentals are exceedingly favorable for propane buyers. Propane prices don’t necessarily reflect the fundamental picture for propane. We think they should probably be lower and are likely to move in that direction. It is a time for buyers to be patient or look as far out as the winter of 2026-27 for favorable numbers.

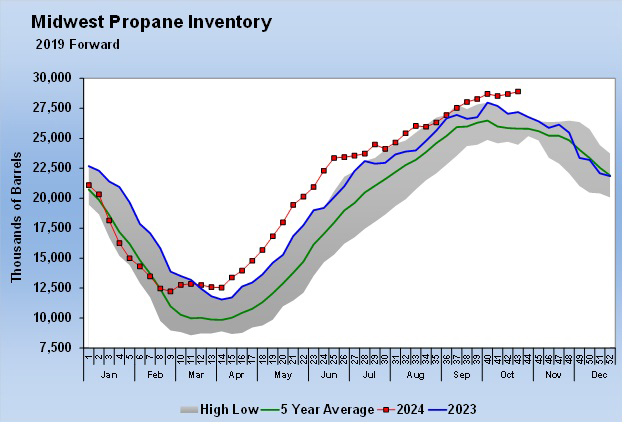

Propane inventories are high everywhere, but it was the Midwest inventory chart that stood out to us when we updated it after the last batch of data from the Energy Information Administration that was released on Nov. 6 for the week ending Nov. 1.

Midwest propane inventories made a major departure from their normal pattern back in March. Yes, it was a mild winter, but the builds in March were still unusual. We could only think that a producer that had been shipping barrels to the Gulf Coast or East Coast stopped doing so. We can’t imagine what else would have made such a dramatic change in the inventory trend.

Since then, Midwest inventories have built more or less on their typical trend line but set new five-year highs for most weeks of the year because of the unusual activity in March.

Now, we are seeing another unusual departure from the seasonal inventory pattern. Midwest inventories have continued to build when, typically, they would already be drawing.

We have heard very little about crop drying, but as has been the case in recent years, it doesn’t appear to have been much of an event if Midwest propane inventories are any indication. Temperatures have not been helping heating demand either. Each year for the last few years, we have thought, “Surely, we will have a normal winter this year,” and each year passes with fewer heating degree-days than the year before. This year is off to another horrible start.

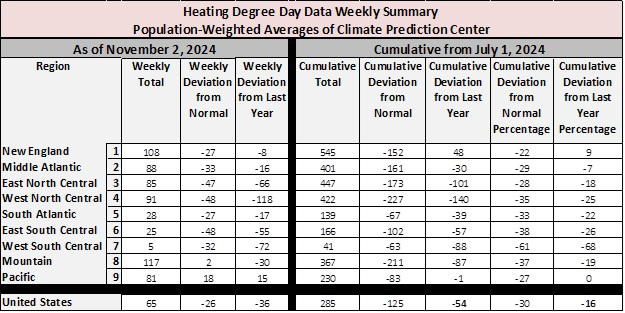

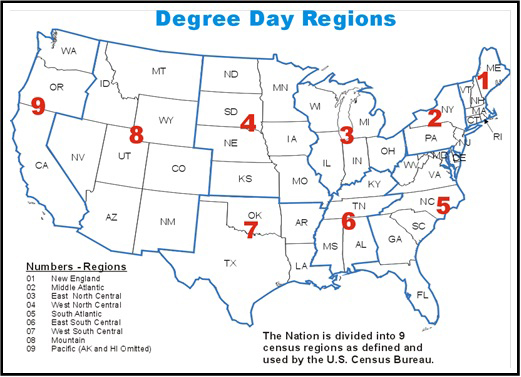

The table above shows heating degree-days, and the map below shows the corresponding regions.

The heating degree-day year begins on July 1. Since then, there have been 285 heating degree-days on a population-weighted average over the entire country. That is already 125 days, or 30 percent, below normal. It is 54 days (16 percent) below last year. Not one region is above the five-year average, and only one is above last year. The areas that constitute the Midwest are some of the worst performing.

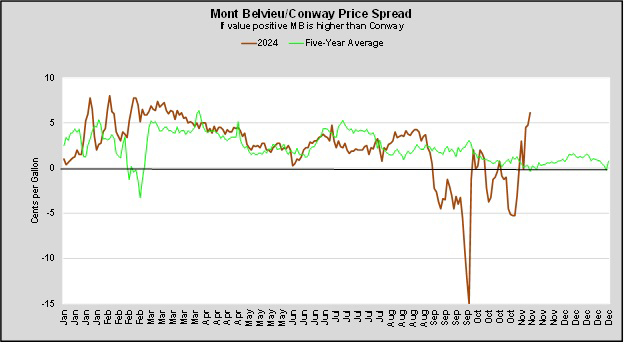

It has been an unusual time for the propane pricing relationship between Mont Belvieu ETR and Conway. Note that most of the time Mont Belvieu (MB) holds a premium to Conway propane, but the five-year line shows that spread tightens in the winter months, and sometimes Conway can price at a premium to MB, especially during a strong winter, which we are not sure we can articulate any more than that since we only have the vaguest of memories as to what a strong winter looks like.

Remember the unusual situation from September and October when MB ETR was priced significantly lower than Conway. That phenomenon was caused by an issue at Energy Transfer’s NGL export terminal that caused MB ETR propane prices to plummet. It certainly had nothing to do with demand in the Midwest.

Once the issues with Energy Transfer were resolved, the market quickly adjusted in November to MB ETR, once again trading at a premium to Conway. But now, another unusual-but-opposite situation has developed. MB ETR is now trading at a much higher-than-normal premium to Conway.

As propane buyers, the weakness in Conway may provide opportunities to fix supply at favorable numbers. Again, that is not the case right now, and we would be on the sidelines for this winter and maybe the next for price protection. But if fundamentals continue on the same path as they are now, some opportunities are likely to develop.

If we can provide some glimmer of hope for those in the upper part of regions 3, 4 and 8, it is that the expected weather pattern is likely to bring below-normal temperatures to your area. That may not apply to the southern parts of those regions. For those in the South and East, you are more likely to be wet than cold. So be cautious about getting too much price protection and leave plenty of room to buy at market prices.

We think this year’s potential price weakness could provide opportunities to pick up price protection at good numbers for further-out winters, but be cautious of getting too long propane for this winter. We know it is not what you want to hear, but that’s the way it is, we’re afraid.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Read more Trader’s Corner: