Make cleaner propane swaps

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates how a propane retailer can determine all the available knowns when pricing propane for the future.

Catch up on last week’s Trader’s Corner here: US propane inventories highest ever

In today’s Trader’s Corner, we will look at a current anomaly in Mont Belvieu and how it will force us to fine-tune our propane swaps in the future to make them cleaner. But before we get into that topic, let’s do an addendum to last week’s Trader’s Corner.

We began last week’s article with the following:

In last week’s Trader’s Corner, we presented our case that the draw on inventories three weeks ago was likely due to unusual circumstances, that inventory builds had gotten back on track, and that conditions were such that builds would likely continue for a while longer.

As we wrote the article, we imagined several more weeks of smaller builds that cumulatively might take inventories to a new record. What we did not foresee is the massive 3.366-million-barrel build just reported by the Energy Information Administration (EIA) in its Weekly Petroleum Status Report for the week ending October 11 that in one fell swoop would take inventories to an all-time high.

For the week ending Oct. 18, the EIA reported an equally surprising inventory draw of 1.369 million barrels. On average, industry analysts were expecting a 1.57-million-barrel build. We think it is highly probable that this week’s drop was a bit of a correction to last week’s unusually high build. The average over the two weeks would be about a million-barrel-per-week build. We think that is more likely what took place. Consequently, despite the 1.369-million-barrel draw reported in the last report, we would not be surprised if inventories were reported as building again in the next EIA report.

Now, on to cleaner hedges/swaps.

In September and October, Mont Belvieu had a very unusual pricing situation.

There are three pricing points at the Mont Belvieu, Texas trading hub. Energy Transfer (ETR, commonly referred to as TET), Enterprise (ENT, commonly referred to as Non-TET), and Targa (TAR, commonly referred to as Other-TET).

ETR prices came under extreme downward pricing pressure starting in September when it was learned that planned maintenance at Energy Transfer’s Nederland NGL export terminal would not be completed before the end of the month. At one point in intraday trade, ETR was priced at 19 cents below ENT during September.

The first assumption was that pricing relationships would return to normal at the month’s change. There was a significant improvement in the spread at that point, but soon after, it was discovered that Nederland had propane compressor issues at restart. The spread expanded again. Then, the assumption was that spreads would return to normal when the compressor issue was resolved.

The market participants we talked to believed that the compressor issues were resolved, yet the price spreads never returned to normal. At best, October ETR traded 4 cents below ENT. Over the last few days, the spread has ballooned to 10.25 cents.

In recent days, we justified the continued spread as likely because Energy Transfer was awash with propane, having been unable to export for weeks, and ENT and TAR were tight as spot buyers went to them while ETR was down. We made that argument because ETR is trading at 41 percent of crude, which has been near normal for this year. Meanwhile, ENT and TAR trade at 48 percent of WTI.

In our view, those locations are at a premium, more so than ETR, which is at a discount at this point. That was not the case in September when ETR was priced as low as 31 percent of crude. In other words, in September, the spread widened because Mont Belvieu ETR prices were being pushed down. In October, the spread is wider because Mont Belvieu ENT and TAR prices are being pushed up.

But with the spread widening more dramatically recently, it became obvious that something was still wrong. We are now hearing that Nederland is loading at reduced rates. That is likely forcing buyers who expected to ship products in October to sell in October and buy in November, thus keeping ETR October prices from rising. Meanwhile, buyers who need product quickly are forced to Mont Belvieu ETR and TAR, pushing prices at those points up.

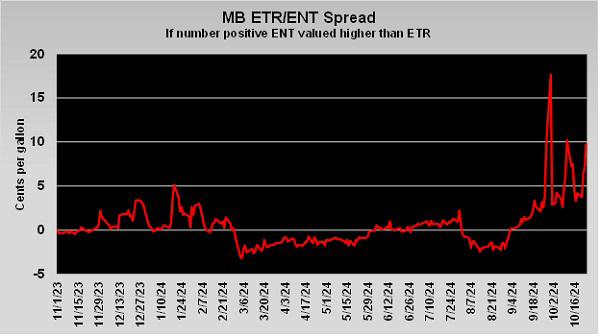

The chart below shows the price spread between the two primary Mont Belvieu pricing points of ETR and ENT over the last year to illustrate the unusual nature of the current situation.

Chart 1: Mont Belvieu ETR/ENT spread. (Chart courtesy of Cost Management Solutions)

This event has highlighted the importance of ensuring swaps and physical buys are more closely aligned. So, if a retailer is buying physical supply from Enterprise, it is important that swaps be settled against Mont Belvieu ENT, also called Mont Belvieu NON-TET.

Historically, most swaps have settled against TET propane, which is synonymous with ETR. That probably works okay 95 percent of the time, even if a retailer’s physical propane is bought at Enterprise posting or a Mont Belvieu ENT index, since the spread between the pricing points is generally narrow and their price movement in tandem.

In the rare Mont Belvieu pricing situation currently happening, a retailer buying physical supply from Enterprise but holding a swap settling against Mont Belvieu ETR is getting hurt. Because ETR is priced so much lower than ENT, a swap based on ETR is not doing what it is supposed to, which is offset by the changes in the value of the physical supply bought by the retailer. It would be better if a retailer that has indexed their physical supply off ENT or buys at Enterprise’s posting also bases their swap settlements against ENT.

On some pipeline systems, a propane retailer might have the option to buy from several suppliers. It is not inconceivable to have physical supply contracts based on both ENT and ETR propane. Let’s say a retailer plans to physically buy 100,000 gallons of propane from Enterprise at a specific pipeline location indexed to Mont Belvieu ENT’s price next month. Additionally, a retailer plans to buy another 100,000 gallons from a different supply at the same terminal indexed to Mont Belvieu ETR. In the past, for the sake of convenience, the retailer may have done all their swaps against those physical buys based on one of the pricing points or the other. Again, 95 percent of the time, that wouldn’t be an issue, but currently, it is an issue. Therefore, a retailer in that situation would be better served in the future by having some swaps settled against MB ETR and some settled at MB ENT.

The term “basis risk” is used to describe the possibility that prices of propane at two physical points or two pricing points might be different. In the Sept. 30 Trader’s Corner, we talked about removing unknowns from pricing by buying on an indexed price basis rather than posting. When a retailer buys at posting, the margin the wholesaler charges can vary, thus increasing basis risk. If the retailer buys at a price based on a fixed differential to the hub basis, the risk is reduced by correcting the margin the wholesaler receives.

But in the case we are reviewing today, basis risk could be created by physically buying propane based off one pricing point and doing swaps settling against another pricing point. The way for a retailer to eliminate that basis risk is to make sure that the swap settles against the same pricing point that his physical supply cost is based upon. By removing basis risk, the retailer creates a cleaner hedge more likely to perform as expected.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Read more about propane swaps: