US propane inventories highest ever

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores the recent moves in propane inventories.

Catch up on last week’s Trader’s Corner here: Propane inventories back on track

In last week’s Trader’s Corner, we presented our case that the draw on inventories three weeks ago was likely due to unusual circumstances, that inventory builds had gotten back on track and that conditions were such that builds would likely continue for a while longer.

As we wrote the article, we imagined several more weeks of smaller builds that cumulatively might take inventories to a new record. What we did not foresee was the massive 3.366-million-barrel build just reported by the Energy Information Administration in its Weekly Petroleum Status Report for the week ending Oct. 11 that – in one fell swoop – would take inventories to an all-time high of 103 million barrels.

Regardless of the path taken, U.S. propane inventories are the highest they have ever been and may go even higher before the sustained drawdown begins. As we said last week, U.S. propane production is strong, export capacity is limited to about 1.8 million barrels per day (bpd) and outlooks are for a weather pattern this winter that will lead to milder temperatures in most of the higher-consuming areas of the country.

The market always has the potential to surprise us, but conditions are in place for a tame pricing environment during the winter of 2024-25. Therefore, propane buyers should probably lean to the lighter side when obtaining price protection for the coming months. Don’t chase any high prices and only buy if the prices to cover the next few months are below the 10-year average for the months in question.

A huge component in the oversupply of propane is the current bottleneck in export capacity. That bottleneck will remain through this winter, but it is likely to be eliminated before the following winters. Currently, the combined U.S. propane and butane export capacity is between 2.1 and 2.2 million bpd. Propane exports have been using around 82 percent of that capacity. There are projects that will be completed in 2025 and 2026 that will take that combined capacity to 3 million bpd. That would mean having the capacity to move around 2.5 million bpd of propane. If U.S. exports reached anywhere near that capacity, we can imagine a much tighter U.S. supply situation down the road.

Consequently, propane buyers should be looking now for opportunities to buy propane price protection for further-out winters. Fortunately, market conditions are favoring buyers that are bold enough to take such action.

The further out we look at propane prices, the less current propane fundamentals impact prices and the more crude’s future price influences propane’s future price. The outlook for crude prices is bearish. Because of weak economic conditions, especially in China, the outlook is that crude will be oversupplied in 2025.

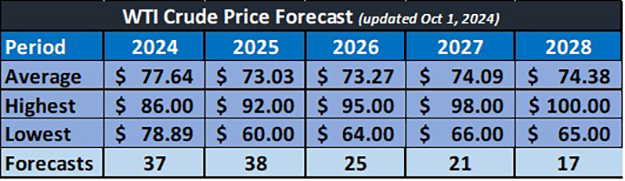

Table 1: WTI crude price forecast

The above table captures the average price forecast for WTI crude of many large investment institutions that spend millions of dollars attempting to make accurate predictions. We are talking about companies like Goldman Sachs, Citi, JP Morgan and many others. The “forecasts” show the number of those companies providing an estimate for each of the years above. The average of those estimate WTI crude at $77.64 for this year ($77.33 average price year-to-date), falling to $73.03 in 2025.

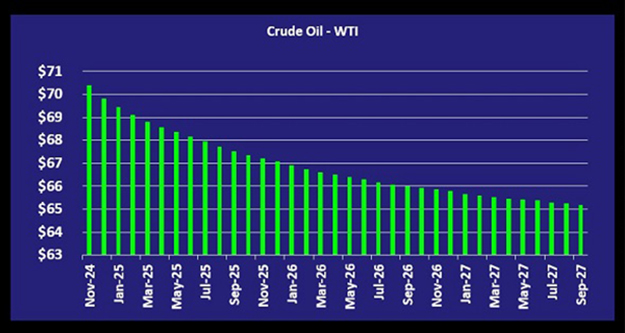

Not only are their concerns about demand on the supply side, but the U.S. just hit a record 13.5 million bpd of crude production, and OPEC+ is sitting on 5.8 million bpd of spare production capacity. When crude is well supplied, its future price curve is almost always backwardated, meaning the market prices future months less than the current month. Below is the current price curve for crude.

Chart 1: Crude Oil – WTI

Again, propane prices further out are more influenced by the price of crude than current propane fundamentals. If one buys into the potential that higher export capacity is going to tighten up propane supply in winters beyond this one, there is a need for more price protection in those winters. The backwardated price curve for crude is also providing an opportunity to buy further-out propane at good values. It is a situation where need and opportunity may be coming together for propane buyers.

Currently, propane is valued favorably for this winter, but we are not so confident in the need for a lot of price protection. Some price protection is always warranted because we never truly know how things will play out. Who knows? The weather forecast may be wrong, and winter demand ends up being epic.

We are more confident of the need for price protection beyond this winter, which has us looking at propane prices further out. For example, as we write, propane for October 2026-March 2027 is valued at 67.0833 cents at Mont Belvieu ETR. That price is about 11.5 cents below the 10-year average winter price for Mont Belvieu ETR propane. The price at Conway is about 6.5 cents below its winter average.

Given the current outlook for crude’s price and given the potential for more propane exports and tighter U.S. propane supply in the future, we believe opportunity and need is and will continue to come together for propane buyers who are willing to look a little further into the future.

Table and chart courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Related articles: