Propane prices head to the slopes

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, Sept. 24 at 10 a.m. CDT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses why propane buyers should consider expanding their price protection window.

Catch up on last week’s Trader’s Corner here: Reconsider: Is it a good time to buy propane?

We will admit to having very limited knowledge and experience with snow skiing.

It was only through an internet search that we learned the skiing season in the U.S. generally starts in November. We once lived in Colorado and felt we had to make the obligatory ski trip just to see what all the hype was about.

We went to the ski apparel store and got completely decked out. We got it all: boots, overalls, coat, hat, goggles and gloves, and then headed up to the slopes. By the way, the salesperson really liked us. We went to the training/bunny slopes and – along with the other beginners that were sitting in their nanny-powered BMW strollers – struggled to stay focused on the advice and warnings from the instructor.

Finally, it was time to make my debut, and I labored my way to the top of the slope and bravely pushed myself off. My weight and mass seemed to give me an advantage over my toddler companions. I tried to remember from my physics classes why, but I didn’t understand then and probably wasn’t going to sort it out now, so whatever, I was winning. My competitive juices kicked in, and I left those little beggars eating my powder. I made a magnificent run that far exceeded my expectations. I had a huge smile across my face as I flew past the instructor frantically waving his arms at the bottom of the slope. I was going to wave back but went past him too quickly.

Apparently, I had zoned out on the part about how to stop when going Mach 7 on a pair of snow skis. With my runway rapidly running out, as hard as I tried, my brain was pulling up nothing on braking. Besides, my hair was on fire. I was killing this ski thing, man. As the point of no return came and went, I found I did not have the available intellectual capital to simply lay over and avoid the impending disaster.

By the time my mind finally accepted that I was a passenger on a pair of runaway skis and not a skiing phenom, the only question left to be answered was how badly this was going to hurt. I was hell-bent for leather straight into the parking lot that was as unforgiving as you can imagine, thus ending an otherwise promising skiing career before it ever really got started.

I found out that when you run over people and their cars, they have very little sympathy for the injuries you sustained in the process. I also found out that if you embarrass your wife and children in front of, well, everyone, they can, quite convincingly, swear they do not know you. Did nobody see that run?

Thankfully, our focus in this Trader’s Corner is a different kind of slope. It is a propane price slope that has been a joy to run for propane buyers.

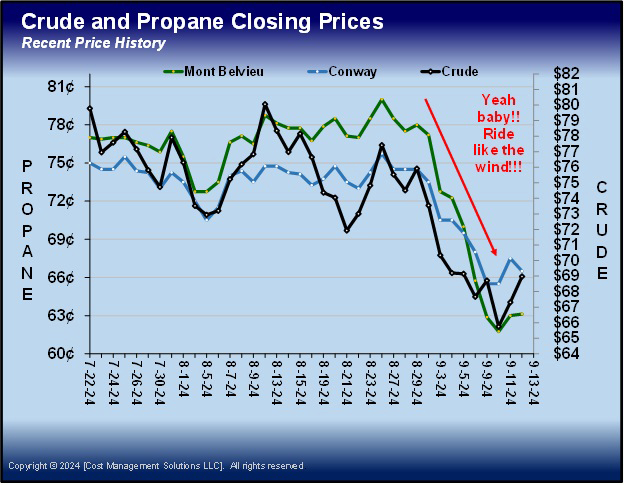

Chart 1: Crude and propane closing prices

On Aug. 26, front month Mont Belvieu ETR propane closed at 80 cents per gallon, and by Sept. 10, it closed at 18.25 cents (23 percent) lower. Conway was down 10.25 cents (14 percent) over that stretch, with a close of 65.5 cents on Sept. 10.

This kind of fall in propane prices rarely occurs in September. As we pointed out recently, September has posted the second-highest monthly average for propane prices over the past 10 years, only behind February. That is because crude prices are generally peaking around this time of year as crude inventories are hitting their annual lows due to high refinery throughput throughout the summer. Propane prices generally follow crude’s price up this time of year.

But this year, crude prices have fallen in late August and early September, even as its inventory has followed its typical seasonal pattern.

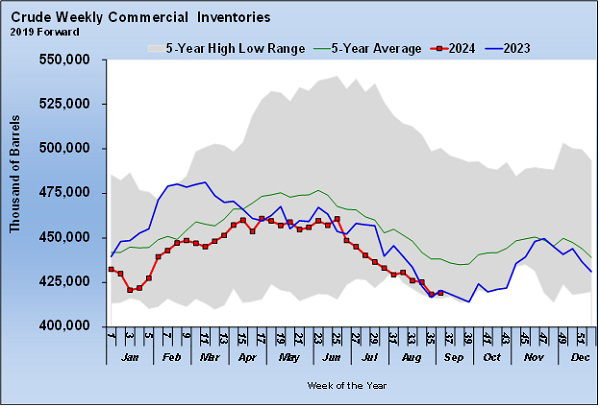

Chart 2: Crude weekly commercial inventories

West Texas Intermediate crude closed at $88.52 per barrel on Sept. 13 last year. It is currently trading at $70 per barrel, and that is after rebounding from a $65.75 close four days ago.

Crude is going against its seasonal pricing pattern because of lower crude demand. Weaker economic conditions in China and the U.S. are hurting demand growth. To try and prop up prices, OPEC+ has taken 5.8 million barrels per day (bpd) of crude production offline. Announcements of the production cuts initially supported crude’s prices, but now the market just sees spare production capacity making threats to supply less concerning.

Propane prices have been pulled lower by crude and more recently had additional price pressure put on by delays in propane exports due to maintenance work at a couple of export facilities.

Through the summer, we talked about the propane buying window, and we have seen it open very little this summer. We warned against chasing prices that were out of the buying zone and waiting for the market to give an opportunity to buy at more favorable numbers. We suggested expanding the buying horizon to two and three years out because that would increase the chance of buying propane at favorable numbers.

What you didn’t hear us suggest was waiting until September to buy propane because we didn’t see this opportunity coming. In early August, we figured that it was best for most propane buyers to go into this winter with whatever price protection they had on hand. With propane inventories high and recent winters being mild, we just didn’t want to chase price protection that was too high. We figured the odds were that price protection would only get higher during September given crude and propane’s September pricing history.

Yet, this great buy opportunity just fell into buyers’ laps at the most unexpected time. This is a great lesson in two ways. One is that every year is different and that markets will sometimes move against their norms. Fortunately, this time, it was in favor of buyers, but it can go the other way as well.

The second lesson is that if we are patient, the market generally will give us an opportunity. If our buying horizon is long enough, at some point, the market is going to give us an opportunity to get price protection at values that greatly reduce downside price risk.

During this pullback, buyers have been locking in price protection for this winter and the next two for 9 cents to 12 cents below the 10-year winter propane price average. There is no guarantee that propane prices will not be below these prices when those winters get here. However, those buyers have protected their valued customers from higher prices while greatly reducing their risk of falling prices. At the numbers bought, most retailers are confident that they can maintain their margins at acceptable levels even if their price protection turns high to above market prices.

When buyers chase a market and start buying price protection above good buying benchmarks, the risk of falling prices is much higher, and the potential for having to lower margins is greatly increased. That is just not something that most retailers can afford these days with costs up and volumes generally lower. Those buyers that have already layered in protection for the winters of 2025-26 and 2026-27 at these favorable numbers will feel much less pressure to chase markets as those winters approach.

These last few weeks have been a fun run, and we have enjoyed seeing retailers get the opportunity to get price protection at much better numbers than we thought would be available before this winter. Trust us when we say these steep downward slopes do come to an end at some point, so enjoy this one, but don’t forget to stop when she ends.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.