Propane prices point to buying opportunity

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, analyzes propane prices in relation to crude prices.

Catch up on last week’s Trader’s Corner here: Storage opportunities sought through farm bill, CFATS program

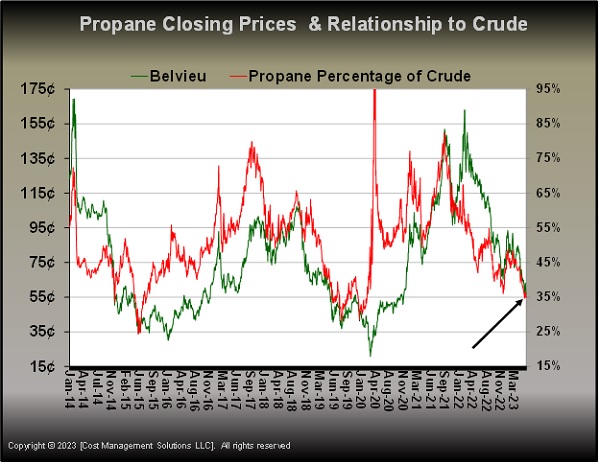

Propane has recently dipped to around 55 cents at the Mont Belvieu ETR pricing point and is valued at around 34 percent of West Texas Intermediate (WTI) crude. The most recent close for WTI crude was $70.79. We are going to use a chart that plots both propane’s closing price and propane’s value relative to crude since the start of 2014 to point out the potential opportunity for propane buyers. We will repeat the same chart a couple of times during the discussion, highlighting different areas.

Chart 1 simply points to the current value of propane around 55 cents and its 34 percent relative valuation to crude. Note that we are entering rarefied valuations at this point. Look at the span between 35-cent to 55-cent propane and a relative valuation of 25 percent to 35 percent of WTI crude. When prices get into that zone, it could mark an exceptional buying opportunity. In fact, being in that zone this time around could be considered exceptional as we will point out.

Since 2022, the drop in both propane’s price and its valuation relative to crude has been acute. Propane fundamentals went from very supportive at the beginning of 2022 to very unsupportive of prices from late 2022 to today. We could say, during the past 10 years, propane fundamentals have not been that supportive, with propane prices often under the relative valuation. One could say that propane oversupply has not been uncommon during the past 10 years. Or to put it another way, propane prices have generally needed high crude prices to be high. Also, times that both crude prices and propane fundamentals have been price supportive for propane, causing its price to go to the upper end of the range, have been rare.

The next thing to note is how infrequently propane has been valued below where it is today relative to crude despite weak fundamental support. You simply don’t see that red line below where it is now very much.

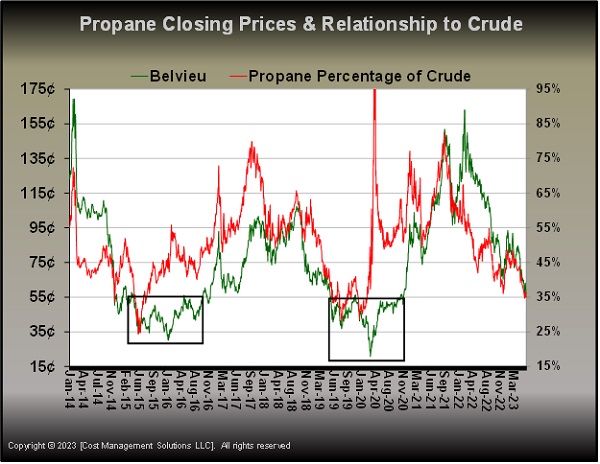

Now let’s focus on the two black boxes in Chart 2 when propane prices were below the 55-cent mark. Both of those areas are periods of very low crude prices. The first is between April 2015 and November 2015 when WTI crude averaged $45.47 per barrel. Remarkably, in the second instance, which occurred from June 2019 through November 2020, the average crude price was $45.50 per barrel.

During the earlier period, propane’s relative valuation to crude was above its actual price line, which would point to propane fundamentals on the supportive side, yet weak crude prices still resulted in low propane prices. The second period was greatly influenced by the pandemic, conditions which we all hope will never repeat. It was a time when energy demand went full stop due to pandemic-related lockdowns, while production was much slower to respond. Remember, during that period, we had a day when crude went negative. Basically, we should just ignore that period when the relative value of propane to crude literally goes off the chart, and propane prices dip to nearly 15 cents. Again, you can see it was a period when propane fundamentals were more on the supportive side, causing propane’s relative value to crude to be on the higher side. Once again, ultra-low propane prices were more the result of exceptionally low crude prices than propane’s fundamentals.

Based on this study, it would be logical to conclude that for propane to go significantly below where it is now, WTI crude will have to fall from its current price of $70.79. Most forecasters simply aren’t that bearish on crude prices. The latest poll of analysts expects WTI to average $79.20 this year, $81.79 in 2024 and $77.21 in 2025. If those forecasts for crude hold up, it means propane’s relative valuation to crude will have to drop into areas that, historically, it rarely has gone. And when it has dropped into that area, it has been only briefly. It is true that propane fundamentals are exceptionally weak, and this just may be the time propane spends an extended period below its current 34 percent relationship to crude.

But remember that OPEC+ has cut its production of crude, which should have the impact of lowering associated natural gas liquids production. Meanwhile, U.S. producers are showing remarkable discipline in holding U.S. crude production about 700,000 barrels per day (bpd) below the 13.1-million-bpd peak. Lower prices for crude and natural gas have drilling activity for both below where they were this time last year. Basically, this means that without an unexpected collapse in crude prices, it would take an exceptional situation in propane fundamentals to drive propane prices into areas like the two black boxes above. The temptation is to see the prices in those two black boxes and wait for those kinds of prices to repeat this time around. If a buyer is going to succumb to that temptation, they run some risk in seeing a great opportunity pass by. As they say, the worst enemy of a good battle plan is the hope of a perfect battle plan. Similarly, we could say the worst enemy of a good buying opportunity is the hope of a perfect buying opportunity.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.