Is it a good time to buy propane?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews propane’s price and how to determine when to buy.

Catch up on last week’s Trader’s Corner here: Crude, natural gas drilling is slowing

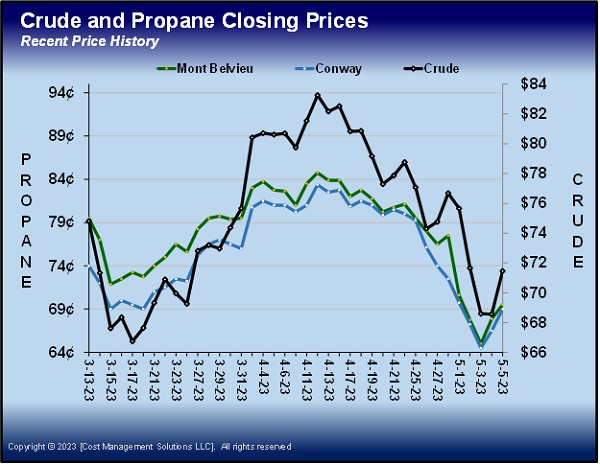

From April 12 through May 3, Mont Belvieu ETR propane declined 19.75 cents. That was a 23.3 percent downward correction that dropped the price to 65 cents. Conway saw a similar decline during that span, dropping 18.875 cents to 64.5 cents. That was a 22.64 percent correction. The decline caused significant hedging interest to form when the price hit the mid-sixties range. The subsequent buying pushed prices higher to close out the first week of May. Both pricing points were trading around the 70-cent mark by May 5.

Chart 1 shows the downward correction that eventually triggered the hedging interest. The question is whether buying at this pricing point looks reasonable. We decided to compare the current price of Mont Belvieu ETR with its price average in May during the past 10 years.

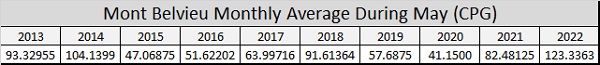

The average May price during that 10-year span is 75.6426 cents for Mont Belvieu ETR propane. The monthly average for May propane was lower than the current price five times. One of those times was May 2020 at the beginning of the pandemic. At that time, demand came to an abrupt stop that caused a collapse in all energy prices.

There was a stretch between 2015-17 when propane supply was outpacing combined domestic demand and export capacity. In the first two of those three years, propane inventories climbed to record highs of more than 100 million barrels. Since that time, the shortage of export capacity has been resolved.

The other time May averaged less than its current price was 2019. The softness that year was the result of the trade war between the U.S. and China. In response to U.S. tariffs, China put steep tariffs on U.S. propane, which caused its price to tumble. Propane was valued at 40 percent of crude that year, about where it is now. During the past 10 years, propane has averaged a value of 48 percent of crude during May.

One could correctly say that during the past 10 years, May propane is often valued higher than the current price, and those times it wasn’t were the result of exceptional situations. This May could certainly be included in the exceptional years since the most rapid interest rate hike in the history of the Federal Reserve has been underway. Indeed, the rate hike this month could mark the end of the increases.

It is true that even weaker economic conditions could be ahead. That could cause energy prices, including propane, to fall even further. Propane’s current price may not be the end of the downward cycle. Even so, many see it as a fair value for consumers, with the opportunity to lock in winter prices at a much better value than what was available at this point last year. Last year at this time, an October to March strip at Mont Belvieu was valued at 126 cents. That strip is around 76 cents currently.

In general, we believe that buys made that are an improvement upon the previous year are a win even if there are opportunities to buy even lower later. The reasoning is that consumers accepted the retail price built around the higher supply cost the previous year, so if the retailer improves on that number, even marginally, there is unlikely to be pushback from the consumer. In the current case, the cost of a winter strip this year is significantly lower than last year. That means there’s an opportunity to pleasantly surprise the consumer, which is rarely a bad thing.

We have been greatly encouraged this year by hedging activity. We have heard plenty of comments from those hedging that they see this pullback as an opportunity despite the potential for prices to go lower if the economy continues to sour. That is a change from previous years when too many were fixated on trying to “buy the bottom.”

As we have said many times before, the buyer that tries to “buy the bottom” almost never does. The bottom can only be identified when prices start going back up. Someone who fixates on buying the bottom is then paralyzed, not wanting to pay more than the lowest prices they have seen. Often, they sit on the sidelines until the opportunity has passed. The buyer that takes advantage of an opportunity is far more likely to buy near the bottom of the market.

Again, it is easy to identify what made propane prices fall so low in the previous five Mays when the monthly average was less than the current price. Those exact conditions are not in play this time around. As we have pointed out in recent Trader’s Corners, there is already a decline in drilling activity. U.S. crude producers are keeping production steady despite it being below peak production. OPEC+ is well ahead of the curve in reducing crude supply in anticipation of lower demand. All of these should limit propane supply. This was not the case at the start of the pandemic, when propane supply outpaced export capacity, and when the U.S./China trade war was underway. In this year’s Trader’s Corner, we’ve emphasized small changes that can be made that could have U.S. propane fundamentals more supportive by the start of next winter than many believe. If that turns out to be the case, then winter hedges made here would look even better. Even if not, hedges made at current values are very likely to be competitive while taking the risk of higher prices off the table.

Charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.