Storage opportunities sought through farm bill, CFATS program

Propane industry members meet with U.S. Rep. Bob Latta, R-Ohio, during Propane Days last week in Washington, D.C. (Photo: LP Gas staff)

A congressional staffer who met with propane industry members during the Propane Days lobbying event last week in Washington, D.C., posed a question about pricing.

The National Propane Gas Association (NPGA) had identified six issues for attendees to address with members of Congress during meetings on Capitol Hill. A couple of the issues led the conversation to propane supply, and conversations about propane supply naturally lead to pricing. So, it wasn’t a complete surprise to hear the staffer’s question on the direction of prices, knowing congressional leaders are looking out for their constituents and monitoring energy expenditures. Who better to ask than propane retailers serving on the front lines of the energy industry?

Prices were under control, propane industry members responded about the current state of the market. Propane fundamentals, including higher-than-average U.S. inventories, have been working to keep prices in check. In fact, a report last month by the U.S. Energy Information Administration (EIA) shows how the tone for fundamentals had been set during and after the winter.

Low propane consumption

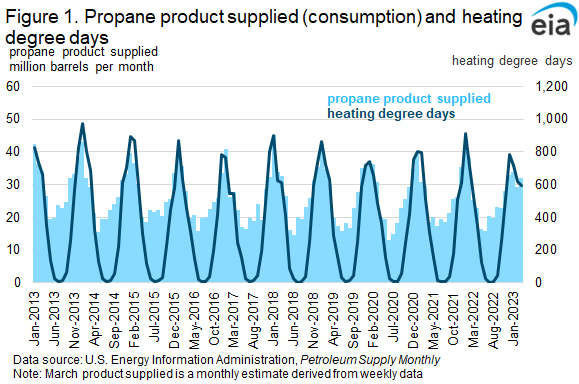

U.S. propane consumption during the 2022-23 winter heating season – 29.9 million barrels per month, or 1 million barrels per day – was the lowest on record for a heating season, starting in 2010, according to EIA. Less consumption during the coldest winter months of December, January and February influenced average winter U.S. propane consumption overall.

Chart 1: Propane product supplied (consumption) and heating degree-days Click to expand. (Chart: EIA)

Mild winter temperatures in much of the country – save for parts of the West – contributed to reduced demand for heating, leading to lower levels of propane consumption in the U.S. residential and commercial sectors.

The lower propane demand, combined with strong propane production, also reduced U.S. propane prices compared with the previous winter. Wholesale prices at Mont Belvieu averaged 81 cents a gallon during the 2022-23 winter heating season, compared with an average of $1.28 a gallon for the previous winter. Prices have trended downward since winter’s end, to 60 cents a gallon as of June 8.

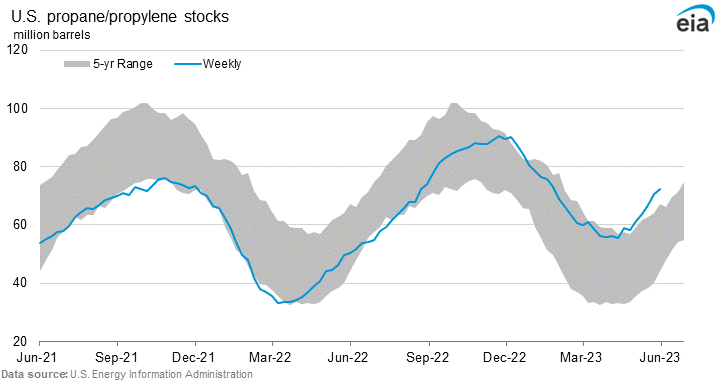

As we reported in Trader’s Corner last week, a trend of higher inventories is gaining momentum and having a bearish impact on prices. Inventories ended the winter heating season at 55.7 million barrels, 22 million more than at the end of the previous winter, EIA reports. U.S. propane inventories have continued to grow since winter’s end and have climbed above the five-year average. As of June 2, they had topped 72 million barrels, about 22 million above year-ago levels. We seem destined for another 100-million-barrel build, which we last saw in October 2020, even with record U.S. propane exports this year.

Supply and price impacts

While propane fundamentals are influencing current prices (to the downside), two issues discussed at Propane Days look to address supply and pricing into the future.

Propane industry members shared information about the farm bill and the Department of Homeland Security’s Chemical Facility Anti-Terrorism Standards (CFATS) program.

NPGA says regulatory decisions and inflation have limited the ability of agriculture producers and rural communities to increase on-site propane storage. So, when a harvest is wet or late, propane consumption increases – sometimes dramatically – which can lead many propane retailers undersupplied.

Eliminating storage barriers, increasing collaboration and incentivizing increased storage will significantly benefit downstream impacts for agriculture producers and rural America by putting more propane gallons into their communities, according to NPGA.

“We’re looking for ways that we can address that through the farm bill,” says Andrew Healey, senior manager of legislative affairs at NPGA. The current bill expires Sept. 30.

NPGA is seeking in the farm bill a retail agriculture CFATS exemption for propane.

In 2006, Congress authorized DHS to establish CFATS, a program managed by the Cybersecurity and Infrastructure Security Agency that identifies and regulates high-risk chemical facilities to reduce the risk of certain hazardous chemicals being weaponized.

A retail agriculture CFATS exemption for propane would address the “arbitrary ceiling on the amount of propane any agriculture producer, household or retailer can store,” set at 60,000 pounds or about 14,200 gallons, without being subject to onerous reporting requirements, NPGA says. DHS granted agriculture facilities exemptions from CFATS for products used in preparation for the treatment of crops, feed, land, livestock and other areas of an agricultural production facility – but the exemptions do not include fuel or propane used for heating.

Propane is also left out of the Farm Storage Facility Loan Program, which provides financing to grain producers to build or upgrade commodity storage facilities. NPGA is asking Congress in the next farm bill to help codify propane’s inclusion in the loan program – which makes sense considering 80 percent of grain dryers run on propane.

NPGA addresses CFATS directly in a second issue brief, as the program is up for reauthorization this year. Propane is one of over 340 substances on the chemical-of-interest list, though the association argues that it’s a fuel better described as a “community commodity” than a chemical and is already subject to security measures in other state and federal regulations.

Having CFATS establish a ceiling for propane storage, as referenced above, ultimately raises consumer prices and limits supply during times of peak consumption, NPGA adds. Therefore, Congress should exempt propane when used as a heating fuel or held for direct sale at a retail facility from the CFATS program.

“This relatively new regulatory scheme does not make propane any safer than what it was in 2006. Propane is a clean and safe fuel today,” Healey says. “All CFATS does is provide an extra layer of red tape to our industry that ultimately impacts consumer pricing.”