Inventory position has changed price curve

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, analyzes the latest propane inventory build and how it will impact the forward price of propane.

Catch up on last week’s Trader’s Corner here: Propane inventories are setting five-year highs

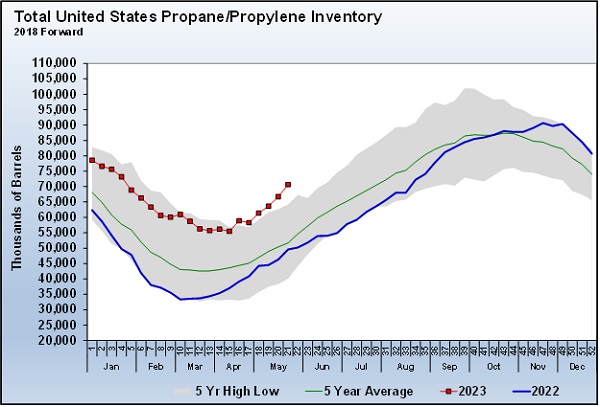

The U.S. Energy Information Administration reported another huge propane inventory build for the week ending May 26. Inventory was up 3.957 million barrels, which dwarfed the five-year average build for week 21 of the year of 1.008 million barrels. Let’s take a close look at the inventory in Chart 1 and compare the difference between last year and this year. Then, we want to show how that change has impacted the forward price of propane.

The first thing you notice is U.S. propane inventories have been setting new five-year highs for this time of year for six weeks in a row (red line). Further, the trend of higher inventories is gaining momentum. Of course, that is extremely bearish for prices.

Now, focus on the blue line, which is last year’s inventory position. There were some big gains in inventory at this time last year, but the market retained its bullish tone through most of the year. Let’s go back to last year and see how the low inventory position impacted prices. Then we will contrast last year’s forward price curve with this year’s.

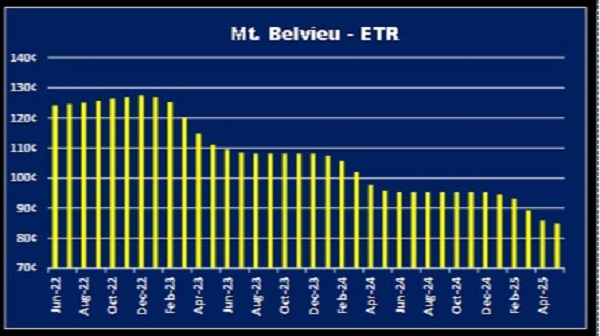

Chart 2 shows the propane forward price curve on June 2, 2022, one year ago. Producers of propane are constantly in the market trying to hedge their future production. In other words, they want to know what they can get for the propane they will produce in the future. At the same time, buyers of propane are wanting to hedge their future supply cost. The two sides negotiate on the forward price, and when deals are done, it establishes the future value of propane. Chart 2 reflects the value of propane from the current month to three years out as determined by negotiations between buyers and sellers.

Remember, Chart 2 simply reflects where buyers and sellers could come to terms on forward values for propane and is not a prediction of where prices will be in the future. The prices simply reflect the overall view of the pricing environment for propane currently. Of course, the view of the market reflected the low inventory levels. A tightly supplied market will result in a forward price curve shaped like the one above. It is referred to as backwardated because the values in the future are priced lower than the current or nearby prices.

Because the supply is tight, the market values the supply it is currently demanding more than it does product it will need in the future. That drives the prices at the front of the forward curve up relative to the months further out. The market also assumes that whatever conditions are causing supply to be tight will resolve themselves. Basically, the high prices at the front of the curve will either slow down demand or increase supply. If they don’t, as time passes, the further out prices move up toward the value in the front of the curve.

On the day the curve was established, a buyer of propane forwards would have paid an average of 126 cents to cover the six winter months of October 2022-March 2023. That price shocked a lot of buyers, and they were interested in bringing down the cost of supply for the 2022-23 winter. As they looked at the curve, they realized they could lower the 2022-23 price by hedging further out. The winter of 2023-24 was 108 cents. The winter of 2024-25 was at 94 cents. A trader buying a three-year strip of forwards could get an average price of 108 cents. That was great for lowering the cost for the winter of 2022-23, but as we now know, the tight supply conditions did resolve, and the price of propane has fallen. Even more dramatic than the market was anticipating when the forward curve above was negotiated. A forward price of 108 cents does not look good now because of how much the price of propane has fallen due to the record high inventories.

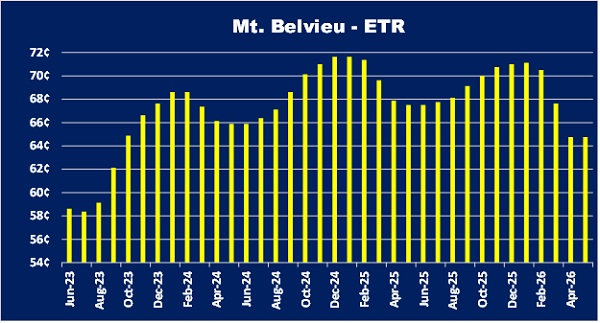

Now let’s look at the propane forward price curve today.

Before we discuss the shape of the curve, simply note how much lower the overall price of propane is compared to where it was this time last year. As far as the shape, the prices are lower in the front of the curve and higher further out (to a point), and then they are mostly neutral. When prices are higher further out, the curve is said to be contangoed.

Because propane is considered oversupplied, the market does not value the propane needed now as much as it does the propane it will need in the future. Basically, sellers have too much propane on hand and will take less for it. However, they want to believe the conditions that are causing the oversupply will resolve themselves over time and they will be able to get more for their propane. If the oversupply does not resolve as time passes, prices further out will gravitate downward toward values reflected in the front of the curve.

The mindset of the buyer that wants to hedge the future cost of propane supply would be totally different this year than last. The most important element is that the overall cost of propane across the entire curve has taken much of the downside price risk out of the market. If the oversupply does correct itself (it certainly has not to this point), values will start moving upward toward the values further out in the curve. Sellers are going to want to believe that will happen and will be reticent to sell their forward production at low prices, which will help keep the further out prices elevated compared to the front few months. That is reflected by how sharply prices rise after August.

Further, buyers may still be tempted to hedge three years out at this point. Under current conditions, the further out months would raise the price of this coming winter a little. To hedge this winter is around 68 cents. The 2024-25 winter is 72 cents, and the 2025-26 winter is 71 cents. So, the three-year strip of winter months would be around 71 cents. Of course, a buyer could just lock in the prices above for the individual winters. However, the buyer might like paying just a little more this year, since the price is relatively low, to have an even pricing situation for three consecutive years.

The motivation to buy the three-year strip last year was to lower the cost of the upcoming winter, but with that came the increased risk that falling prices would hurt the position long term, and they did. Because of the lower overall price today, the risk of falling prices is inherently lower. Of course, prices could go lower, and the current inventory trend suggests they will, but the odds of significantly lower prices for the next three years are somewhat long.

The bottom line is that buyers are in a much better position this year than last. The high price to hedge last winter caught a lot of buyers off guard, and that resulted in many taking longer-term risks to get the cost of last winter’s hedges down. This year is an opportunity to take advantage of a favorable pricing environment throughout the price curve.

We must say, though, that propane buyers tend to respond more to threats than opportunity. The pricing environment last year felt threatening to buyers, so there was an eagerness to take longer-term risk associated with the three-year positions to mitigate the high current winter prices that were present at the time. This year’s low pricing environment does not feel threatening, which generally results in opportunities being allowed to slip by.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.