Propane exports reach record high

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, analyzes propane exports.

Catch up on last week’s Trader’s Corner here: Crude releases could make propane buyers complacent

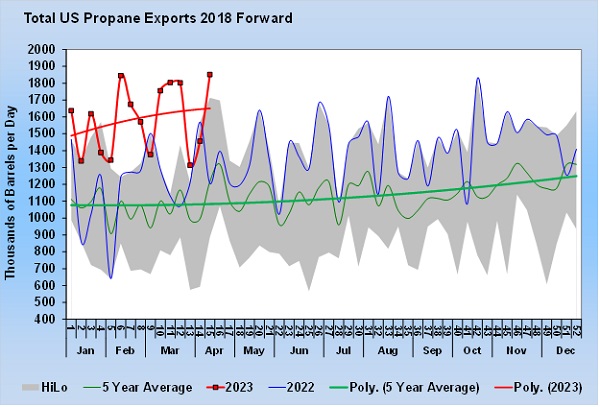

The most recent Weekly Petroleum Status Report from the U.S. Energy Information Administration reported that U.S. propane exports hit a record high of 1.851 million barrels per day (bpd) for the week that ended April 14.

Because the weekly numbers are volatile, we have added trend lines in Chart 1 for this year and the five-year average for an easier comparison.

U.S. propane export capacity is 1.8 million bpd, making the reported export number slightly higher than capacity. The likely explanation of how exports could exceed capacity is simply a report timing issue. All it would take is a couple of cargoes that loaded late in the previous week to be reported as loading in the current week to make the difference.

Regardless of how 1.851 million bpd of exports occurred, the U.S. is exporting at a record pace. So far this year, propane exports have averaged 1.585 million bpd, which is 384,000 bpd higher than during the same period last year. Due to the weekly volatility, it is sometimes beneficial to look at average exports in a four-week period. The current four-week average is 1.606 million bpd. As we came out of winter with high propane inventory levels and robust production, many were predicting propane inventories would build to very high levels this summer, driving down prices.

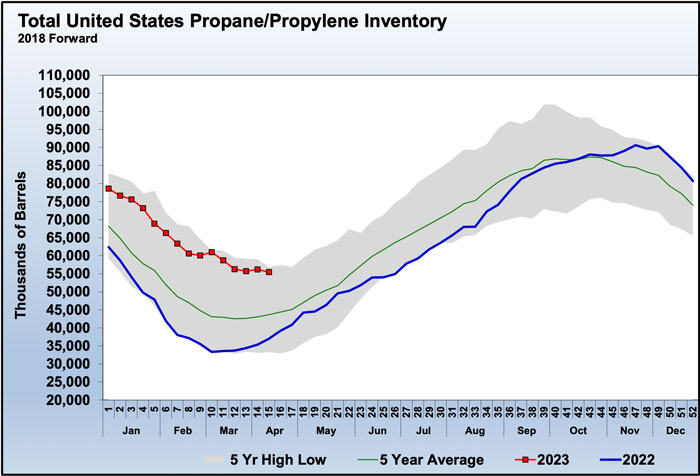

That may still occur, but currently inventories are declining slightly. The inventory drawdown period for this year has not yet ended. Therefore, the accumulation period for next year has not officially begun despite a couple of reported inventory builds. Last week, U.S. inventory declined 721,000 barrels to 55.456 million barrels, the lowest level this year. The 15th week of the year just ended. On average, the inventory drawdown period usually ends during the 12th week of the year. We have seen the inventory drawdown last until as late as the 19th week of the year.

Regardless of when the inventory drawdown ends, the fact that it is continuing to this point reduces the number of weeks that inventory can accumulate to the extreme highs that some were expecting. Further, if propane exports were to continue to average the 1.6 million bpd they have averaged over the past four weeks, there is a good possibility that the pricing environment for propane will not be as bearish as predicted.

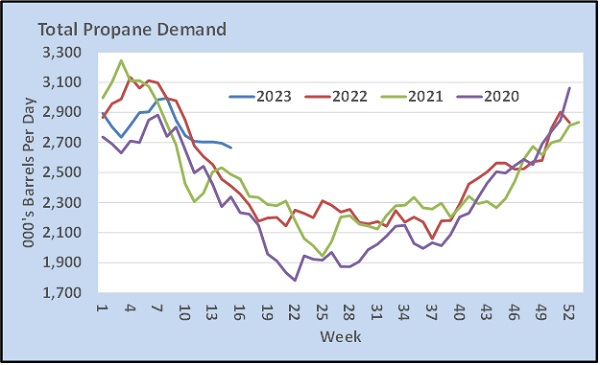

Chart 2 shows total U.S. propane demand, including domestic demand and exports. At the beginning of the year, demand was running well below 2021 and 2022, limiting calls on inventory and keeping inventory levels high. The current demand rate has supply and demand better balanced such that there are still calls on inventories during some weeks, and when builds have occurred, they have been on the lighter side.

During the month of January, we wrote a four-part series for Trader’s Corner exploring small changes that could occur in the propane inventory trend that could make the propane pricing environment less bearish than what many were predicting at the time. At that point, U.S. propane inventory was near five-year highs, and that has not changed.

In fact, propane inventory is nearer a five-year high right now than it was when we wrote that series. However, it is worth noting the difference in the way inventory is trending right now compared to last year and the five-year average. Last year at this time, propane inventory was already in a sharp uptrend compared to this year, which is still in a slight downtrend. Remember, it was a bullish price environment coming out of the winter of 2021-22, with many predicting very high prices for this past winter. That never developed due to robust growth in propane production and weak demand, especially domestically, which caused a rapid increase in inventory.

Though there was a strong uptick in propane production this past week, it has been trending along where it was last year. Even with last week’s big jump in production, it has only outpaced 2022 by 7,000 bpd. If we couple the slower growth in supply with the total demand we looked at above, you can definitely see the possibility of a less aggressive growth in propane inventory this year.

We can’t know at this point if propane exports, and overall demand, will continue to be strong, nor can we say that propane production won’t take more big jumps like it did this past week. That combination would likely lead to a rapid acceleration in inventory accumulation that would drive down prices.

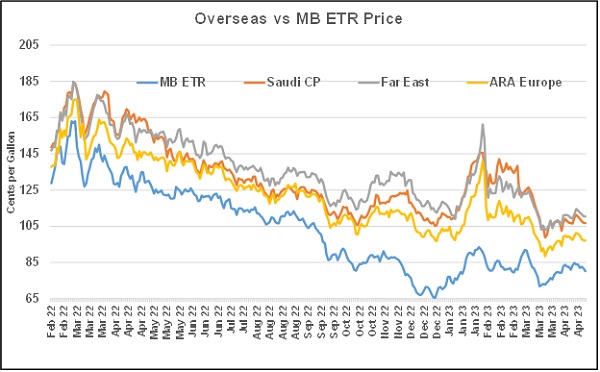

The export window is not as wide open as it was at the beginning of the year, meaning the price difference between the U.S. and foreign markets is not as high. But, as last week’s record export number shows, foreign demand for U.S. propane has not slowed.

There is one final observation to make. OPEC+ will begin cutting its crude production another 1.66 million bpd starting in May. That production cut is expected to persist through the end of the year. Lower crude production will likely mean lower natural gas liquids (NGL) production from those producers. There will be less natural gas and natural gas liquids produced in association with crude. Also, there will be less natural gas used in refining and processing, which could further slow NGL output. This development could mean that foreign consumers/importers of propane will need more from the U.S. It’s a possibility that could keep propane inventory on a shallower build curve than we saw last year.

During the last few Trader’s Corners, we have been discussing the possibility of higher crude prices that could lift propane prices even if propane fundamentals remain unsupportive. This analysis also shows that propane fundamentals have a chance of being more supportive of prices than expected. What we can say is that if the current inventory, demand and production trends remain, the bearish environment so widely predicted for propane prices this year should not be adopted as a foregone conclusion.

Charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.