The latest factors impacting propane demand

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews propane demand.

Catch up on last week’s Trader’s Corner here: How arbitrage impacts propane retailers

We read that China’s propane dehydrogenation (PDH) plants only ran at 75.6 percent in August and are expected to rise to 80.7 percent in September. That is still a low rate. PDH plants turn propane into propylene. The propylene is then used to make plastics. Because of weak economic conditions resulting in lower demand for plastics, propylene prices have not risen as fast as propane prices this summer. The resulting squeeze in propylene margin is resulting in lower PDH capacity utilization. There are many new PDH plants scheduled to come online over the next few months. Their startup could be delayed if economics do not improve.

PDH plants are huge consumers of propane, and in many ways their current low utilization rate is concerning. If the demand for propylene picks up and PDH plant margins improve, not only could the utilization rate of existing plants increase, the new plants would certainly come online as well. If one or both things occur, we could see a significant rise in propane exports.

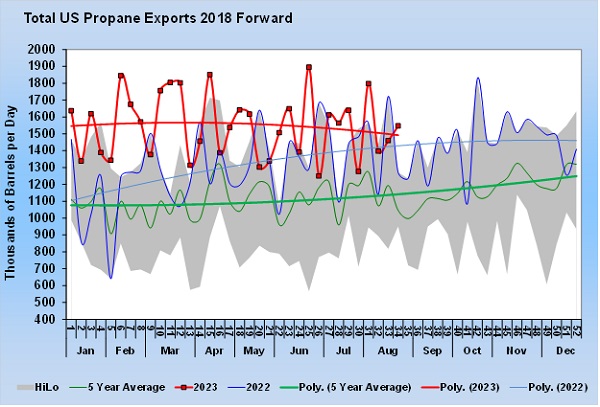

Propane exports started the year very strong but have been tapering off recently. For the year, exports have averaged 247,000 barrels per day (bpd) more than in 2022. However, since the beginning of July, the difference has only been 128,000 bpd, and the current trajectory will put this year on par with last year very soon.

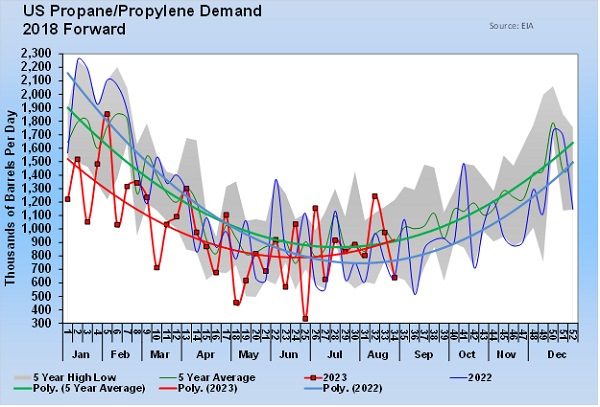

The slowing of export demand has been somewhat offset by an improvement in U.S. domestic demand.

Domestic demand for propane was well down at the start of the year and has averaged 190,000 bpd less than 2022. However, since July, domestic propane demand has averaged 110,000 bpd more than it did during the same period last year.

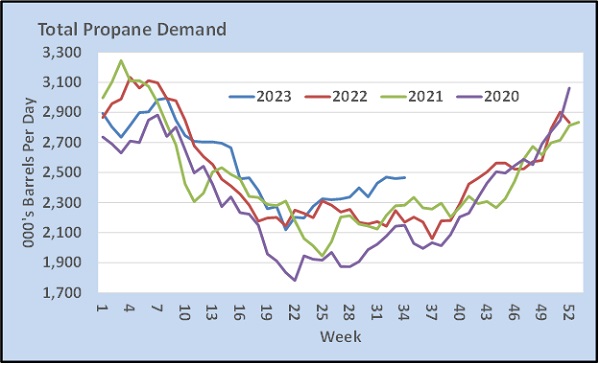

Chart 3 uses the four-week average of total demand (domestic and exports) to take some of the weekly volatility out of the numbers and compares the current demand to the previous three years. Current total demand is well above the previous three years.

Strong propane production has offset the strong demand. U.S. propane production hit a new all-time high three weeks ago. Consequently, propane inventories are setting five-year highs for this time of year, and we all feel very comfortable with the propane supply situation for good reason. All indications are we will have plenty of propane this winter for both domestic and export demand.

We had warned at the beginning of the year that domestic demand was uncharacteristically low, even factoring in the mild winter. We believe those warnings turned out to be justified given what we see with domestic demand in Chart 2. But we think this improvement might end soon. Given high temperatures and lack of precipitation across most of the corn belt, we think crops will dry naturally in the field if they haven’t burned up altogether. There is also the probability of an El Nino this year that could really hurt winter demand in the northern tier, higher demand states.

This brings us back to the PDH plants and the potential for more export demand. If we are correct that the pent-up domestic demand that has been filled recently will end once consumers complete their preparations for this winter, then actual demand this winter could be off based on the reasons mentioned above. That means exports will be critical in balancing U.S. propane supply and demand over the course of winter. For propane exports to strengthen and change their current trend, we think the demand for propylene will have to greatly improve. That means there needs to be improved economic conditions that increase the demand for plastics. It is going to be a steep hill to climb economically to have conditions that would result in higher PDH plant utilization and the startup of the new PDH plants before this coming winter is over.

We have been adamant that the prices of propane and crude would rally from the lows early this year, and they have. Propane has gone from lows of 53.875 cents at Mont Belvieu to 72 cents, Conway from 52 cents to 70.5 cents per gallon, and crude from $66.74 to $84.74 per barrel. But we now must wonder how much runway is left for propane prices to climb.

We do think propane prices will get support from higher crude. Crude fundamentals are a lot more supportive of its price than propane fundamentals are for propane’s price. But beyond the support from higher crude prices, we think that weather conditions this winter are likely to hurt domestic propane demand and keep it below normal. It may be a bridge too far to expect economic conditions to improve enough to offset the weaker domestic demand with stronger export demand.

The outlook is complicated by the fact that propane is such a cheap Btu. It makes buys here very tempting, and if propane gets support from higher crude prices, those buys are likely to be OK this winter. Buys here would eliminate the risk of winter demand being higher than we expect and export demand rebounding more quickly than probable. But the buys will not be without risk. Likely weak crop drying and El Nino conditions as well as weak economic conditions will all work against it.

Some buyers took advantage of the opportunity that low propane and crude prices offered them early this year. But the rally in prices is adding risk to any type of speculative position for this winter. Hedges, where the retailer is locking down the supply cost and making a corresponding sale to the consumer, are almost always a good thing. But be aware that speculative positions, where a supply price is committed to without a corresponding sale, have increased risk – not only because of the rally in propane’s price to this point but also due to the uncertainty about propane’s supply/demand balance this winter.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.