Domestic propane demand is recovering

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the changes in domestic propane demand and what that might mean for the upcoming winter.

Catch up on last week’s Trader’s Corner here: Part IV: Evaluating the state of crude prices

If you are a regular reader of Trader’s Corner, you know we have written about the extremely low domestic demand for propane this year ad nauseam. As analysts, we look for things that are different from what we have seen historically or seem unusual. We want to know why and how those anomalies impact the price of propane. We know the market generally corrects toward norms unless there has been a significant change such as the addition of more export or production capacity.

As we plotted, propane demand through the first half of the year was exceptionally low. In fact, at several points during the year, record low domestic demand was reported. We wrote about one such event in May when propane demand dropped to 570,000 barrels per day (bpd). Demand dropped to just 333,000 bpd at the end of June, which was an incredible 783,000 bpd less than the same week in 2022.

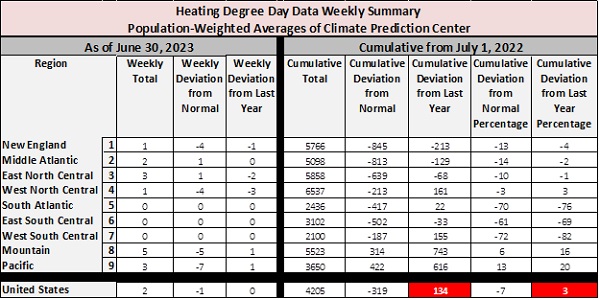

Many people point to the mild winter as the reason for low demand. It certainly was an overall mild winter, and it was below normal almost everywhere. Yet, heating degree-days overall from July 1, 2022, through June 30, 2023, were higher than during the same time frame last year.

As Chart 1 shows, the cumulative deviation from last year was a gain of 134 heating degree-days, up 3 percent for the year.

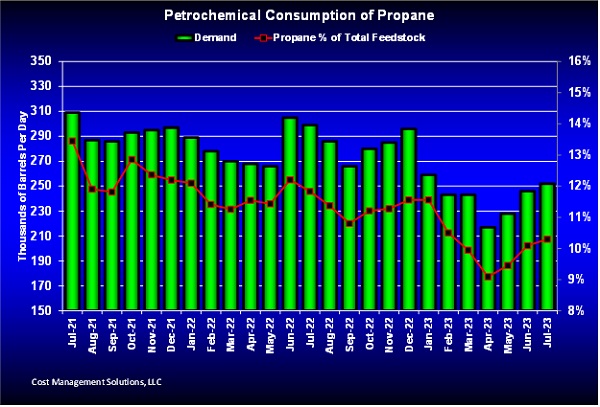

Petrochemical demand through July has been lower this year by 38,000 bpd than the same period last year, but that does not come close to accounting for the extremely low overall domestic demand drop.

In trying to explain the demand drop, we theorized that inflation had caused consumers to hold less propane in their tanks. In one Trader’s Corner, we showed storage at the primary, secondary and tertiary (consumer) level. The amount of consumer level storage is so high it would only take a small change in levels to have a major impact on propane inventory at the primary level (trading hubs).

What has us revisiting this subject is what we are seeing in domestic demand now.

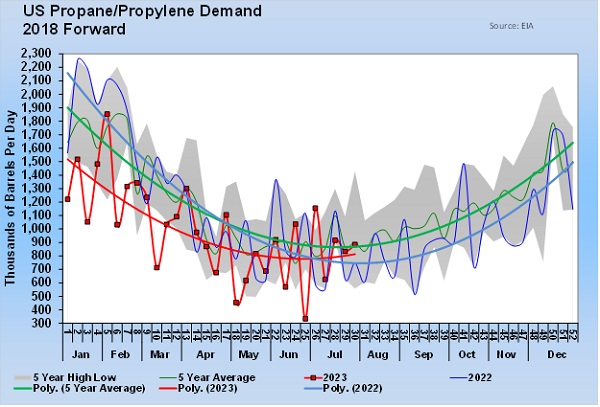

Chart 3 shows U.S. domestic propane demand. As you can see, the weekly changes in demand are quite high. We have added trend lines to make comparisons easier, so focus on those smoother trend lines as you look at the chart. The red line is this year, the blue last year, and the green is the five-year average.

Focus on the beginning of the year and note the dramatic difference between this year, the five-year average and especially 2022. This is exactly why this subject became so important to us as analysts. We need answers for such anomalies.

Now, look at the first of July. Note how this year’s demand line has broken above last year’s demand line. Propane inventory builds that had been well above normal all year became normal to below normal in July as demand moved above last year and nearly on par with the five-year average. Consequently, propane’s value has been going up. Its relative value to crude has gone up from about 30 percent to 38 percent. In the month of July, propane increased 20.25 cents. That was a 37.67 percent increase at Mont Belvieu and a 39.51 percent increase at Conway.

We know for sure it wasn’t because the weather was cold in July. So, we must wonder if consumers had indeed held lower inventories in their tanks and may now be demanding a little more to get those levels closer to normal in preparation for this winter. While temperatures have been hot in July, inflationary pressures have certainly been cooler. Perhaps this theory is off-base, but one thing that is not is the recent change in domestic demand, and what that has done to the value of propane.

This demand trend remains a data point worth watching. Clearly, the demand trend and propane values have been closely linked. Propane values were down when domestic propane demand was so low through the first half of this year, but values have recovered as demand has recovered.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Mark, thanks for a thoughtful analysis on these trends. We have not seen any demand destruction in the retail volume on a year over year basis either. Your insight into the EIA data is helpful.