How propane compares with heating oil

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why propane has the cost advantage over heating oil.

Catch up on last week’s Trader’s Corner here: Domestic propane demand is recovering

Regular readers of Trader’s Corner (TC) have heard us say a lot lately that propane is a cheap Btu. We are generally talking about how it takes little supportive news on propane fundamentals to cause its price to go up because it is already low compared to other energy sources.

Because of Btu content differences in various sources of energy, it’s not always easy to make a price comparison. To do so, you must convert other energy sources to a propane Btu equivalent basis. If you do that, you will see quite readily that propane is a cheap Btu.

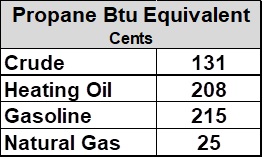

Currently, propane is trading at 71 cents at Mont Belvieu ETR and 70 cents at Conway. Chart 1 shows the propane Btu equivalent price of other energy sources.

Apart from natural gas, propane is significantly less expensive than other energy sources. We know that most readers of TC are in the propane industry, so this is good news. Some of you may sell both propane and heating oil, and you already know the price challenge on the heating oil side. If you are in the heating oil business and read TC to keep up with the competition, you already know it’s a challenging environment.

We are going to focus on heating oil data for the remainder of this TC. Whether you sell it or compete against it, you may find the information useful. But before we go on, mention of the relatively high gasoline price is worthy. Most consumers buy gasoline regularly so its relatively high price establishes a mindset that energy prices are high. That certainly gives the propane dealer the opportunity to pleasantly surprise his customers. That was the case last year, and it looks like it will be the case again this year. It is also an opportunity to make a little more margin without much pushback. We have had mild winters recently, and we aren’t seeing any expectations that will change this winter. It is important to try to make more margin if sales volumes are off. The relatively low cost of propane helps in that endeavor.

Back to the state of heating oil. We all know that propane inventories are setting five-year highs for this time of year, which reflects high supply compared to demand, a situation that is resulting in relatively low valuations. That is not the case with heating oil.

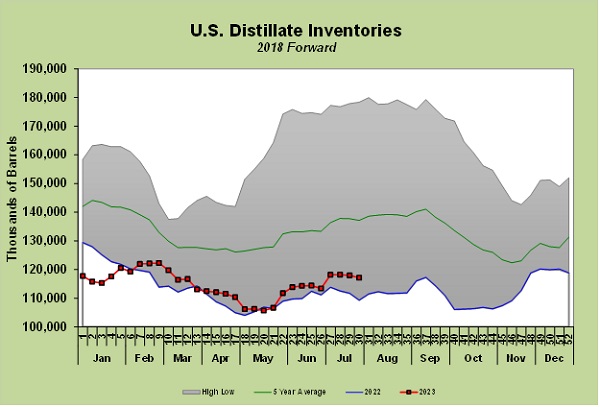

Heating oil is part of the distillates family that includes diesel. Chart 2 is for all distillates and shows inventory near five-year lows. Traditionally, a distillate with more than 500 parts-per-million sulfur was classified as heating oil. When refiners changed processes to meet lower sulfur content standards for all distillates, the amount of high sulfur content became very small. Consumers that are getting heating oil to heat their homes are likely to get lower sulfur content distillates now. The U.S. Energy Information Administration reports only around 7 million barrels of the total distillate inventory is above 500 parts-per-million sulfur content. The bottom line is that we just need to look at overall distillate inventories when evaluating the heating oil market.

Obviously, propane and heating oil are on opposite ends of the spectrum in terms of fundamentals. Propane is oversupplied with high inventories, and distillates are under supplied with low inventories. There is a global shortage of distillates. One reason is that when natural gas supplies from Russia stopped going to Europe, distillates were used to generate electrical power. This has put a strain on distillate supply globally.

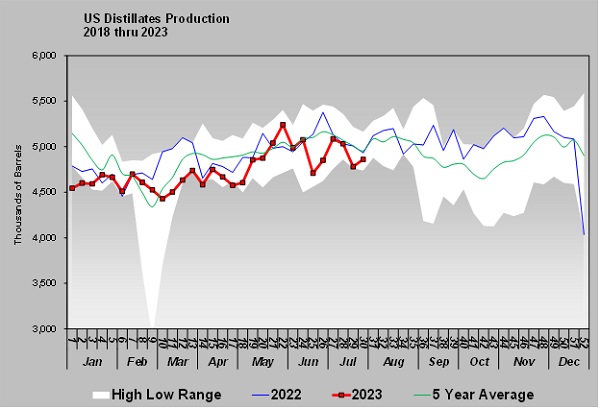

U.S. distillate production is not bad, but it is off last year’s pace. To this point in the year, production is 4.744 million barrels per day (bpd). During the same period last year, it was 4.887 million bpd. Overall, U.S. production of distillates hasn’t responded significantly to increased global demand. It has continued to run along its typical trend. The five-year average through this point in the year has been 4.892 million bpd, so this year is below trend.

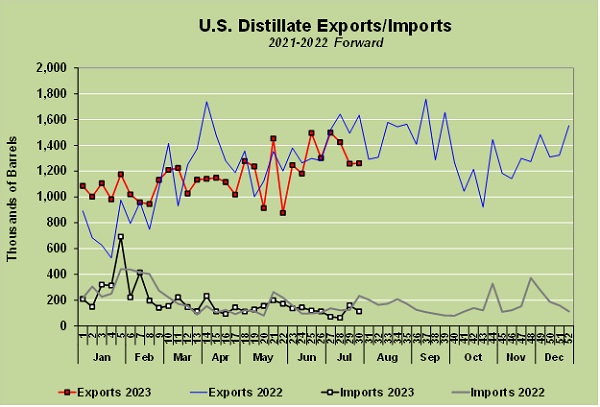

However, because of the global tightness, U.S. exports are trending higher and imports lower. This is stressing U.S. inventory given that production is not increasing in response. The export rate has slowed since last year when it was 1.240 million bpd. Last year, it ran about 52,000 bpd higher than the five-year average. Through this point in the year, exports have averaged 1.162 million bpd, about 16,000 bpd below the five-year average.

On the import side, the five-year average year-to-date is 210,000 bpd. It has averaged 185,000 bpd so far this year compared to 198,000 bpd last year over the same period. Some of the distillates that used to come to the U.S. are likely going to the higher priced European market.

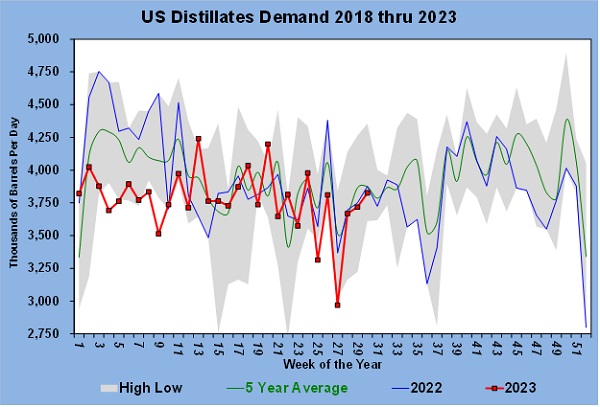

Distillate demand in the U.S. is on the low side. In 2021, demand was a little more than 4 million bpd. This year, it has averaged 3.776 million bpd. High prices are probably hurting demand.

As far as we can see, the demand for distillates is likely to remain high as long as natural gas is not flowing freely from Russia to Europe. Obviously, there is no way of knowing if or when those flows will resume. Certainly, it won’t happen as long as the war between Russia and Ukraine continues. Who knows what will happen when the war ends, though we would assume Europe will be glad to resume natural gas imports to get relief from tight supply and high prices.

Until then, it is likely to be a challenging marketing environment for heating oil. Advantage propane.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.