Propane price movement driven by export terminal maintenance

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, describes the events behind the recent change in propane prices.

Catch up on last week’s Trader’s Corner here: How to minimize the unknowns when pricing propane

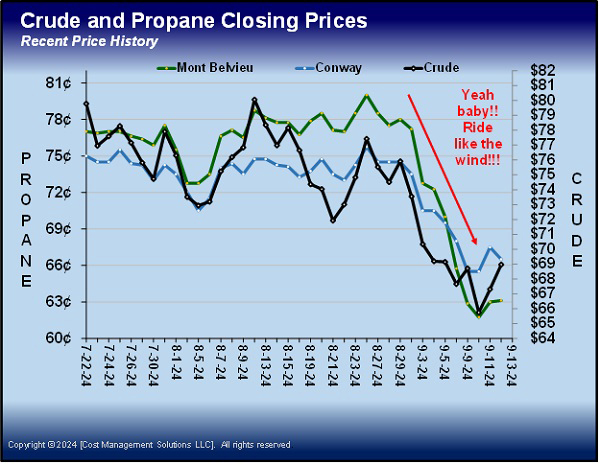

You may recall that in mid-September, we wrote a Trader’s Corner about the fortuitous fall in propane prices. The chart below from that article showed recent prices for crude and propane.

Chart 1: Crude and propane closing prices

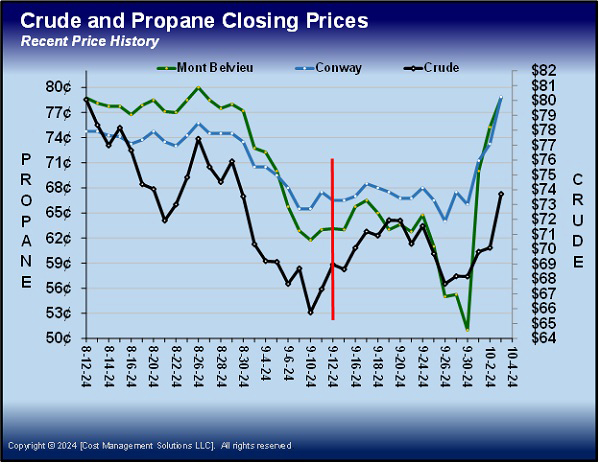

The previous Trader’s Corner was centered around the unexpected opportunity that the fall in prices above had provided propane buyers. This week’s Trader’s Corner is going to show how prices have now come nearly full circle. The chart below is the current version of the same chart.

Chart 2: Crude and propane closing prices

We placed the vertical red line in the chart to show where propane and crude prices were on the day we captured prices for the first chart.

Note that crude prices had been going down during that period, which was bringing down propane prices as well. What made the opportunity a surprise was that crude prices aren’t generally falling during that time of year. Crude inventories are often hitting their lows at the end of summer as refineries process as much crude as they can to meet gasoline demand.

As we had pointed out, September had averaged the second-highest propane price over the last 10 years, so seeing propane in such a steep downtrend that time of year was unexpected.

Even though U.S. crude inventories were indeed low as usual during that period, even eventually setting new five-year lows for some weeks, crude prices were falling. The fall came because of weak economic conditions in many parts of the world, including the highest crude consuming areas, including the U.S., China and Europe.

With crude and propane prices falling, great buys were appearing for winter propane. For example, the average value for October 2024-March 2025 propane was 70.04 cents, which was about 8.5 cents below the 10-year average winter propane price. The further-out winters were even better with 2025-26 at 69.33 cents and 2026-27 at 67.42 cents at Mount Belvieu ETR.

If those kinds of buys were available at the time of the last chart, they must have been great on Sept. 30 in Mount Belvieu with the close for Mount Belvieu ETR propane that day at 51 cents. In fact, during the course of the day, the price hit a low of 49.25 cents.

Unfortunately, the charts above capture the current-month propane prices only. So, that was the price for front-month September propane – what we call the headline number. If you were a buyer of September propane, then there was probably some opportunity, but most retailers are looking at getting price protection for October-March. So, we have to look at out-month prices, not headline (September) prices.

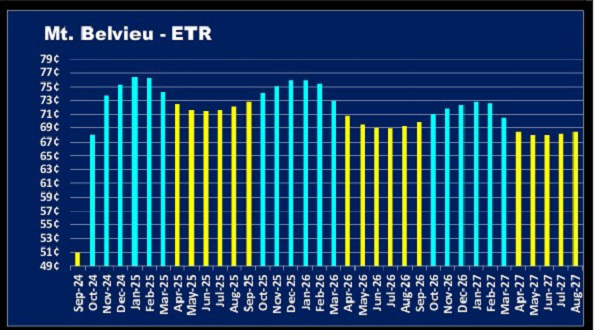

Chart 3: Mt. Belvieu – ETR

The chart above graphs not only how the market was valuing September propane, but also how it was valuing the further-out months. Note the massive spread between September and October. That spread got up to 19 cents at one point.

As a result, winter strips were not as good as they were back on Sept. 12. The winter of 2024-25 was valued at 74 cents, 2025-26 at 75 cents and 2026-27 at 72 cents. So, winter propane was getting valued 4 or 5 cents higher when September propane was around 50 cents than when September propane was valued at around 63 cents.

These kinds of situations generally happen when there are “events” in the market. In this case, the event was issues with a couple of propane export terminals in Texas. For most of September, maintenance was going on at two terminals. The expectation was that the maintenance would be over before the end of the month. Then Energy Transfer announced that its work at its Nederland, Texas, export terminal would last through the end of September.

As we have pointed out, U.S. propane markets are way oversupplied and dependent on exports to keep the market balanced. The inability to move propane through the Energy Transfer terminal at any point in September caused September propane prices at the pricing point of Mount Belvieu ETR (Energy Transfer) to collapse.

As we write, Mount Belvieu ETR propane is now priced at 78.875 cents, about 28 cents above where it was on the last trading day of September. It is still about 4 cents below other pricing points at Mount Belvieu, suggesting that the work at the Energy Transfer terminal continues.

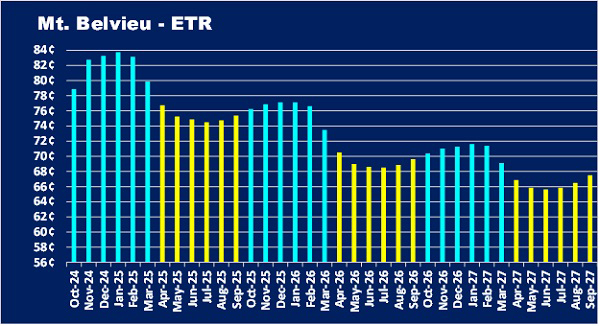

Chart 4: Mt. Belvieu – ETR

The above chart shows what the price curve looks like now. Even though it does not appear the work at Nederland is finished, the market believes it will finish soon. The market is pricing October at 4 cents less than November, but nothing near the 19 cents spread that developed last month.

Once the work at Nederland is complete, we can expect the price of Mount Belvieu ETR (Energy Transfer) propane to move closer to the values at Mount Belvieu ENT and TAR (Enterprise and Targa). We might also expect the spread between Mount Belvieu ETR October and ETR November to narrow as well – something closer to what we see in the further-out winters. Of course, this assumes the maintenance at Nederland gets done sooner rather than later.

Looking at the latest forward price curve shows this coming winter propane is no longer in the buy window at around 82 cents. That is about 3.5 cents higher than the 10-year average October-March propane price. The further-out winters are still in the window, with the best opportunity in the winter of 2026-27.

The key point is that the extreme situation that developed above was event-driven. The market is going to assess the event and value propane accordingly. In this case, the assumption is the event will be over soon. Had this situation been driven by overall propane fundamentals, the extreme month-to-month price spread would not have developed. The price pressure would have likely been more evenly distributed across the entire price curve.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Related articles: