2022 State of the Industry: Propane retailers face raging forces

A global pandemic presented a historic challenge for propane industry businesses, but in the nearly three years since retailers turned their attention to heightened health and safety measures in response to a novel coronavirus, they now face a host of economic factors impacting their daily operations.

This year, propane marketers managed more pressures on business operations than usual. (Photo: Kristin Schmit/Heartland Co-op)

Where once propane retailers could focus on a select few issues while steering their businesses forward, the to-do list seems to have grown. And these aren’t small-ticket items either. Atop that list of issues to overcome are inflation, labor strife and supply chain breakdowns, all while trying to keep a keen oversight of the other integral processes involved in delivering propane safely to end-use customers.

“You’re getting hit from all sides,” says Trent Hampton, CEO of Lakes Gas.

Running a propane business in “normal” times is hard enough. But account for the challenges created in part by the COVID-19 shutdowns, including shocks to the U.S. economy and supply-and-demand imbalances, and retailers are facing another animal in today’s propane industry.

“It’s one of those situations where people who are good at what they do and managing their companies sometimes excel during the times when things are challenging and prove their worth,” says Hampton, recognizing Lakes Gas’ own managers who have proven themselves during the difficult times.

Issues at hand

Hampton isn’t alone when he says the “costs of everything,” including diesel, have risen significantly.

Average U.S. gasoline and diesel prices shot up in March following Russia’s invasion of Ukraine and set new record highs in June – at about $5.02 for regular unleaded gasoline and about $5.82 for diesel, according to AAA. The rising fuel prices this year gave propane industry leaders a chance to promote the cost benefits of fueling fleet vehicles with autogas.

“The costs associated with doing business in our industry are escalating, including the investments in storage at the customer site. So that has been quite a challenge,” says Stuart Weidie, president and CEO of Blossman Gas and chairman of the Propane Education & Research Council (PERC).

Some of the industry’s largest companies acknowledged the year’s challenges in their fiscal reports.

“Despite a challenging operating environment resulting from a warm and inconsistent weather pattern, historically high commodity prices and inflationary factors impacting expenses, we were able to effectively manage margins and expenses,” says Michael Stivala, president and CEO of Suburban Propane.

Superior Plus Corp., with operations in Canada and the U.S., notes the “increased wholesale commodity costs, fuel costs, labor costs and other costs impacted by inflation” that it worked to overcome. Ferrellgas references “inflationary costs for material and other commodities, such as steel used in tanks.”

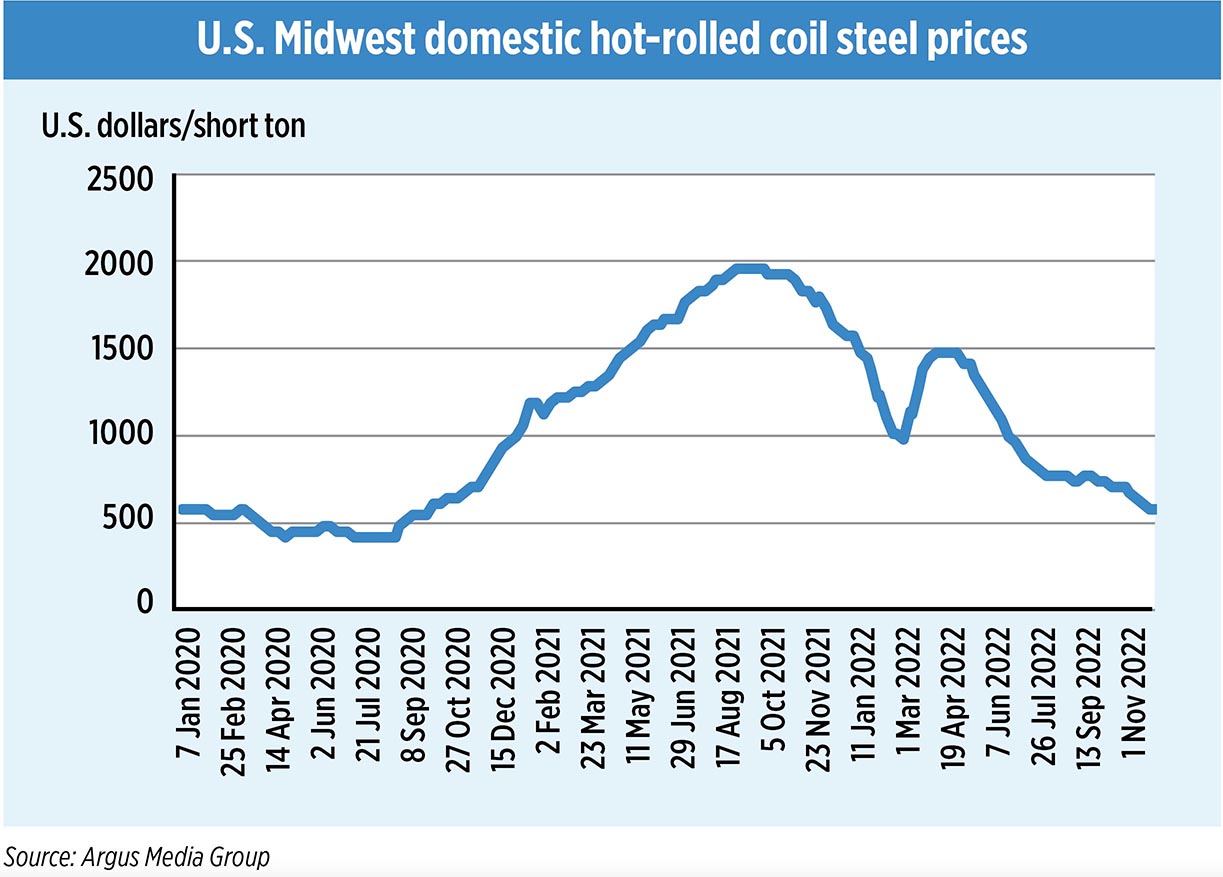

U.S. steel prices spiked in late 2021 and have since retreated. Volatile raw material costs have contributed to the higher cost of propane tanks.

The price of steel reached historical highs in late 2021 and early 2022 before retreating later in the year. Citing rising costs of raw materials and challenges in the transportation and labor markets, tank manufacturers Manchester Tank and Worthington Industries announced price increases in the spring – from 8 to 15 percent depending on the product at Manchester to 10 percent on steel portable LPG cylinders at Worthington.

Time will tell whether propane tank prices subside, says Weidie, whose concern lies in the future of the industry.

“I would hope that never slows down the opportunities for growth in our industry – the investment that’s required to get a new customer,” he says.

Storage container costs have collided with retailers’ struggles to acquire the needed equipment for their operations, as supply chain inconsistencies have proven to be another impediment to doing business. Retailers reported to LP Gas supply disruptions on propane cylinders, notably 20-pounders and forklift bottles, as well as with other equipment such as parts and fittings.

“We’re reutilizing equipment we’ve already got; we’re buying used equipment and refurbishing it; and as far as parts and fittings, we’re trying to order before [we] need it,” says Matt Drennen, propane division manager at O.E. Meyer.

Adds Donna Howay-Germond, director of supply chain management at Paraco Gas, “We took second and third vendors and started utilizing companies we may not have used before. We started to really look at everything and challenge the way we [operate] so that we began to be more proactive versus reactive to the issues.”

Employees needed

The ongoing challenge of finding employees to fill open positions is also among the industry’s chief concerns.

“Our company has more employees than we’ve ever had,” says Weidie, citing 1,000 at Blossman Gas, “but we have more openings than we’ve had ever because of the opportunities for growth.”

Filling the open positions, most notably for service technicians and delivery drivers, is the only obstacle keeping the company from “tremendous growth,” Weidie says.

Blossman Gas has engaged its local managers to work within the communities, find quality candidates “and show them what a great industry it is that they can make a really great living,” Weidie says. “They don’t have to sit behind a desk all day at a computer, and they can be out and about talking to people.”

While most propane industry leaders agree that attracting and retaining employees continues to hamper businesses, LP Gas has learned about some of the methods used by retailers to address their workforce challenges.

DCC Propane implemented an employee referral program to assist with recruiting efforts, explains COO Ron Snyder during this year’s LP Gas Growth Summit. Sharp Energy has targeted driver training schools and tech schools, adds director Steve Farkas, while Pacific States Petroleum adopted an employee stock ownership plan.

“Every employee became a 100 percent owner of the company,” says Jason Edwards, general manager of propane operations at Pacific States Petroleum.

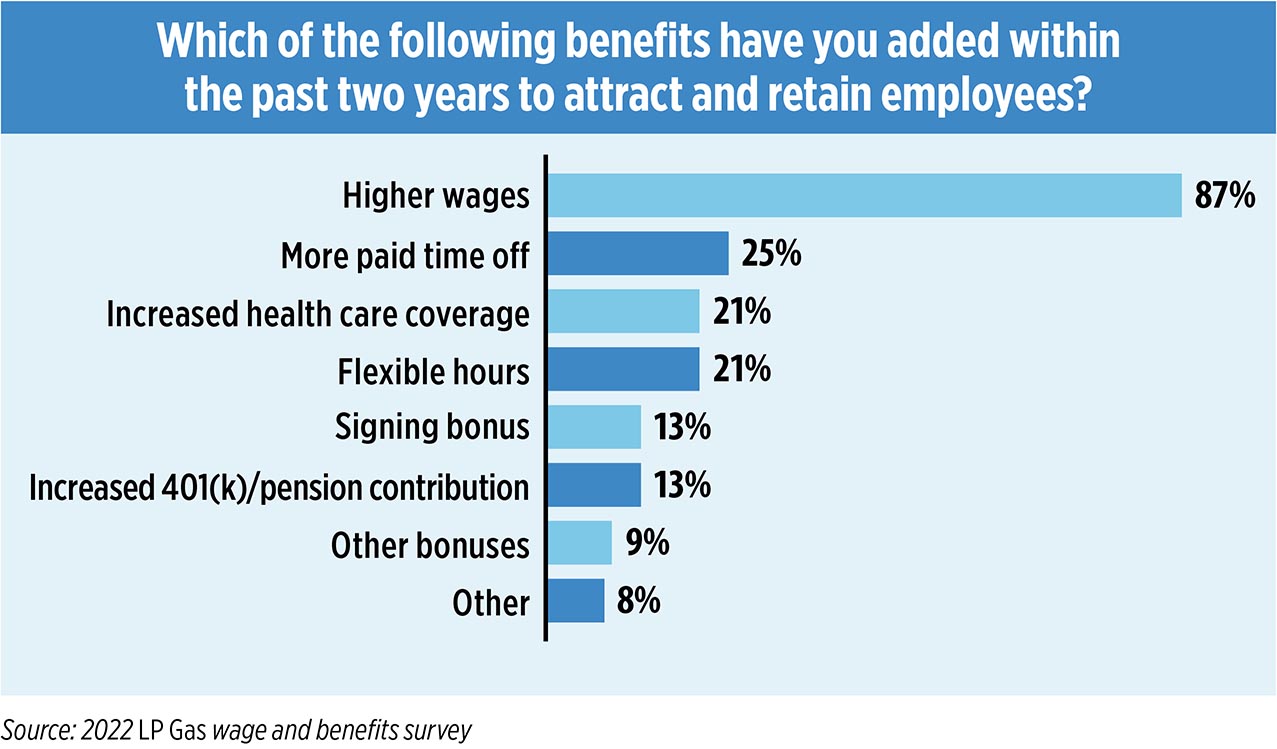

The vast majority of propane marketers that responded to LP Gas’ wage and benefits survey reported raising wages to attract and retain employees in 2022.

An LP Gas wage and benefits survey this year also found that nearly 90 percent of propane retailer respondents have raised employee wages – by 12 percent on average during a two-year time frame. A quarter of the respondents are providing more paid time off, while slightly less are offering flexible hours or increased health care coverage.

San Isabel Services Propane even offers a four-day workweek.

“We’re just trying to make sure that we maintain the integrity of the business and make sure people are happy,” says Cathy Wallace, general manager and owner of the Colorado company.

Apprenticeship programs have gained traction as well. The National Propane Gas Association (NPGA), in collaboration with PERC and the Department of Labor, offers such a program for job seekers – for service technicians and commercial drivers – while companies such as Blossman Gas and ThompsonGas have launched their own apprenticeship programs.

Meanwhile, PERC has placed a strong emphasis on workforce development and has produced tools for businesses and communities.

Council efforts include instructional webinars, school outreach kits and the promotion of regional and state association job boards. Its development of grant and scholarship programs helps get propane front and center in technical schools and community colleges.

Weidie says it’s imperative that propane industry stakeholders work together to share the resources available for propane retailers.

“We as an industry need to do a better job coordinating between PERC, who’s providing tools and methods, NPGA and the state associations to educate, particularly, the independents in our industry on how to go out and find people to serve in their companies, to serve their customers,” he says.

Power structure

Retailers are spending sleepless nights “trying to figure out how to crack the code” on the issues facing their businesses, says Snyder of DCC Propane.

While absorbing the economic forces on one side, the propane industry continues to defend against attacks on the other, often by policymakers and regulators thwarting gas in new mandates favoring electrification.

“The electrification of everything is a real movement,” Weidie says. “It is truly a threat.”

Hoping favorable results in the midterm election might stave off threats to propane in the coming years, some industry members might have lost sleep on Nov. 8 awaiting the outcomes of national and state races.

Republicans gained control of the U.S. House of Representatives, though by a slimmer majority than expected, with the victories providing more balance of power in the federal government. No matter the results of a runoff election in Georgia, the Democrats retained control of a tight Senate.

“Thankfully we have a stopgap with the new House being Republican, and I think the threat for our industry as it relates to new legislation should drastically ease in the coming year or two,” says Michael Baker, NPGA’s vice president of federal legislative affairs, during an NPGA webinar about how national energy policy toward electrification might fare following the election.

In addition, Baker says, NPGA expects House Republicans “to come out swinging with big pieces of legislation to promote domestic energy production,” even if they aren’t likely to progress further, and to ramp up oversight activities on Democratic decisions made over the past couple of years.

However, the threat remains from federal agencies.

“I’m hopeful that the federal agencies will be a little more cautious in some of their actions,” says Steve Kaminski, president and CEO of NPGA, in assessing election outcomes. “Though, to be honest, I don’t think that’s going to happen.”

In preparation for what’s ahead, NPGA has restructured its advocacy initiatives into four pillars: federal legislative, federal regulatory, state/municipal, and codes and standards.

A divided House and Senate should slow federal legislative policy in the next term, echoes Kaminski, who expects the other areas to be “extremely active.”

“We’re going to see continued, very aggressive anti-gas policies coming out of the Department of Energy, coming out of the EPA,” he says. “We are in the thick of it right now with those agencies.”

In fact, Jeff Stewart, president of Blue Star Gas and chair-elect of NPGA, outlines threats from DOE concerning proposed regulations against the use of gas appliances, including residential furnaces, consumer and commercial water heaters, and other miscellaneous gas products and direct heating equipment.

In response, Stewart adds, NPGA is building coalitions, preparing for legal challenges and putting its new slate of advocacy team members – including Benjamin Nussdorf, Kate Gaziano and Thomas Ortiz – to work on a high-stakes assignment.

The action also being taken at the state/municipal levels and with codes and standards is no less important to the propane industry than what’s happening federally.

“A lot of policymakers are using codes and standards as backdoors to try to ban gas if they’re not able to get regulations or legislation passed in their states,” Kaminski says.

The role of renewables

The global LPG industry – and to some extent the propane industry in the U.S. – has joined the environmental transition as companies have launched their own renewable energy initiatives or partnered with others on projects.

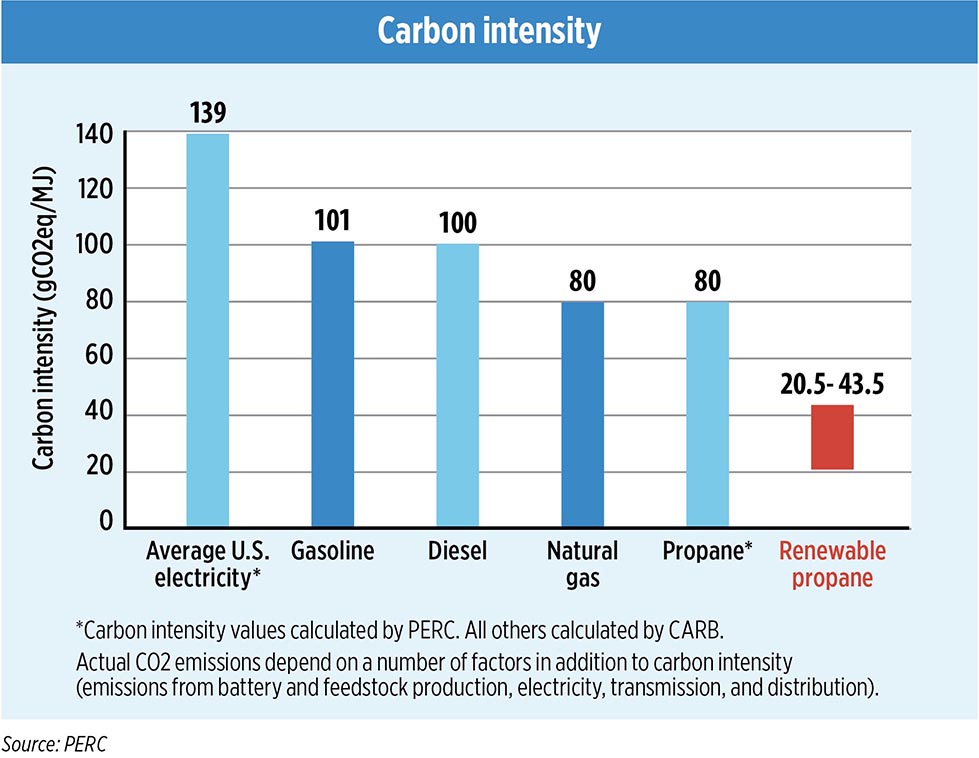

Renewable propane gives the industry a direct response to the electrification movement and an answer to those who believe clean, conventional propane isn’t enough to earn it a place in the national energy conversation.

Even if renewable propane initiatives comprise a small fraction of the overall market, industry leaders view progress in this area as a direct response to the electrification movement and an answer to those who believe clean, conventional propane isn’t enough to earn it a seat at the table.

“I see the industry continuing to move toward the renewable space,” Kaminski says.

Just this year, Suburban Propane announced its involvement in several projects: launching a propane/renewable dimethyl ether (rDME) blend with Oberon Fuels, acquiring a stake in Independence Hydrogen and partnering with Adirondack Farms to produce renewable natural gas. Suburban also has partnered with U-Haul to offer renewable propane in California.

“The more renewable sources of energy we can handle – bring to markets – completes that story that we’re not solely focused on preserving the product that we’ve been handling for the past 95 years; we’re preserving the role of Suburban in the long-term energy slate,” says Stivala during the World LPG Association’s LPG Week in November. “That’s by handling multiple renewable products that can take our customers and local communities on a low-carbon journey, starting with LPG.”

A propane supplier (Ray Energy) and retailer (Proctor Gas) also celebrated their first loads of renewable propane in 2022, demonstrating how some established U.S. companies are beginning to realize a need to offer a lower-carbon product to customers.

For the market to develop, industry leaders say, other key segments also must realize the benefits. PERC commissioned a study by the U.S. Department of Energy’s National Renewable Energy Laboratory showing how biorefineries can increase their financial returns by selling renewable propane versus using it as a processing fuel or as a hydrogen feedstock.

“We need to get the consumers and those that manufacture the products that would use our product to really be the voice to support our message for advocacy,” Stivala adds about renewable propane.

Growing the industry

Even with the challenging environment for propane businesses today, positives remain.

A new report by Frost & Sullivan on behalf of PERC shows U.S. retail odorized propane sales totaling 9.54 billion gallons in 2021, a slight year-over-year increase from the 9.44 billion gallons sold in 2020. Total sales for 2021 were 7.4 percent above the 10-year average of 8.9 billion gallons of odorized propane volumes per year.

The sales numbers reveal an industry that perseveres despite the threats and still provides a needed energy source for millions of customers every day. Kaminski recalls a conversation with a gentleman from Europe who expressed his amazement at the U.S. gallon sales numbers recorded today despite the headwinds.

“That’s a testament to NPGA, PERC and the states working well alongside the industry and keeping the industry extremely strong,” Kaminski says.

While NPGA’s work comes in the form of advocacy in Washington, D.C., and in statehouses across the country, PERC works to identify users and uses of propane. The council, which approved a $45.5 million budget for 2023, has focused on fewer but more impactful projects. Power generation applications and the development of a 6.7-liter Cummins propane engine (for 2024) are examples of that work.

But two other projects, approved at the November council meeting and totaling about $20 million, highlight another key area for PERC and the industry: communicating the positive role that propane can play in the environmental transition at the national and state levels. Enter PERC’s integrated marketing and communications plan, totaling about $13 million, and an environmental campaign and partnership with states program of $5.4 million.

“For me, it’s about environmental thought leadership and trying to engage in the conversation,” says PERC President and CEO Tucker Perkins, a highly visible representative of the industry who carries propane’s messages to wide audience segments through speaking engagements, media interviews as well as his own podcast.

In building on the momentum of PERC’s “Energy for Everyone” brand identity that it launched in 2021, the latest strategy will rely on an aggressive approach that tells propane’s story and responds to the electrification movement that continues to gain momentum nationally.

“We need to address audiences beyond just propane country,” says Erin Hatcher, senior vice president of communications and marketing at PERC, describing a new function of the 2023 program and referencing “migrating millennials” and other Americans on the move as potentially new propane users.

With industry leaders focused on growth and attracting new customers; opportunities with renewables; and finding answers to the many challenges weighing on businesses today, the propane industry seems poised to find its way forward.

Sure, it has taken hits from all sides, as Lakes Gas’ Hampton acknowledged, but that hasn’t detracted from retailers’ ultimate goal.

“I’m very positive about where we’re headed and positive about the fact that we’ve been able to address those challenges, meet them and continue to provide good service to our customers,” he says.