Could propane prices fall in December?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why propane prices could fall this month.

Catch up on last week’s Trader’s Corner here: Use swaps, pre-buys and physicals to manage risk

We think there is a good chance for propane prices to fall in December. Propane prices have been on a strong run higher this month, which makes such a prediction sound a bit foolish – and it may very well be. But we will present a few arguments as to why we think it is possible.

Our first argument, and perhaps our best, is simple history.

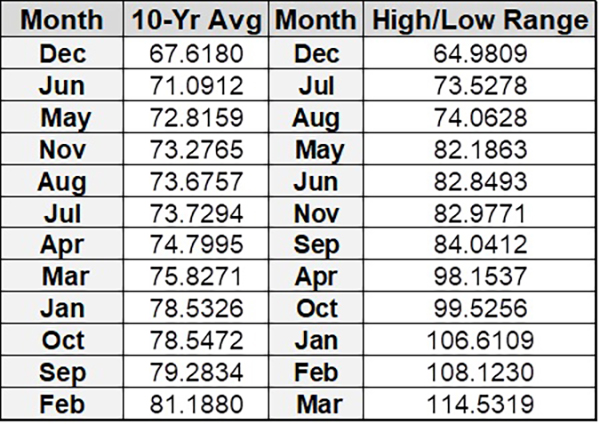

The left side of the table above ranks each month by the average price of propane over the last 10 years. Shockingly, December propane has had the lowest monthly average price of any month. That seems absolutely bonkers, but there are some reasons for it.

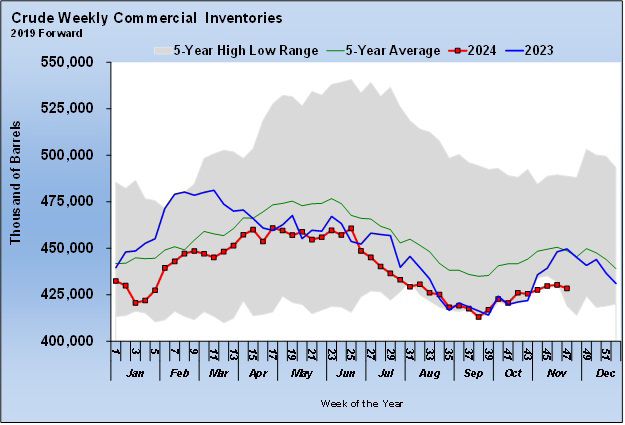

The summer driving season has ended, and crude inventories, more often than not, are recovering this time of year, which can push crude prices lower in November, thus creating a bit of a bearish environment for the energy complex overall heading into December.

Since the softness in energy prices is driven by this seasonal pattern in crude inventories, it is more likely and more predictable, and we believe that is why December also has the narrowest range between its highest and lowest monthly average over the last 10 years. What this pattern means to us is that crude is more likely to be around its 10-year average now than in any other month.

Having used history to argue for a weak crude pricing environment in December, let us offer a couple of arguments as to why crude’s pricing environment may not be as weak this December.

Though crude’s inventory is following the seasonal pattern and recovering the last couple of months, inventory is still relatively low. Inventories haven’t built nearly as strongly as they did last year. Also, there is geopolitical turmoil in the market that isn’t always there. Obviously, if the wars in the Middle East and Europe escalate, crude’s price could move against its typical trend.

With this look into crude, let’s turn our focus to propane fundamentals for hints that prices could go lower in December.

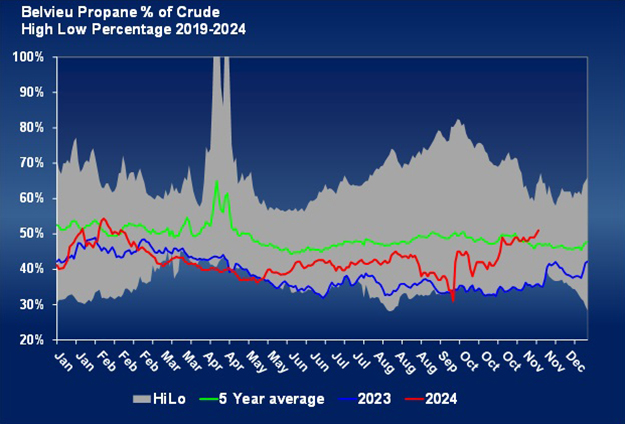

Propane is currently valued highly relative to WTI crude. Chart 2 plots propane value as a percentage of crude’s value over time. The red line is this year, and you can see Mont Belvieu propane is valued at 51 percent of WTI crude this year compared to 36 percent last year and a five-year average of 47 percent. An increase in relative valuation would generally mean either crude fundamentals are not at all price supportive of crude or that propane fundamentals are very price supportive.

We have already acknowledged above that crude inventories and fundamentals look more, not less, price supportive than last year. So, that must mean propane supply must be very tight, right? Well, not really.

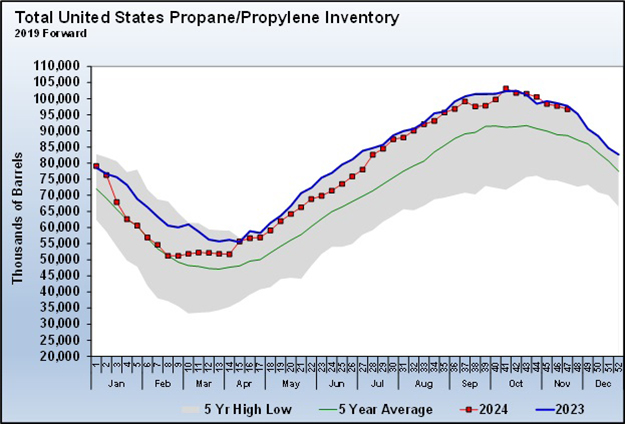

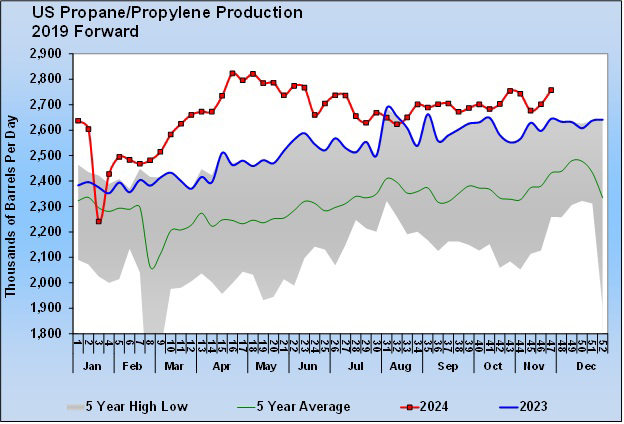

U.S. propane inventories are high and only 2.1 percent below last year and 9.32 percent above the five-year average. There is no shortage of propane inventories. Furthermore, there is no shortage of propane production to replenish any inventory that is used.

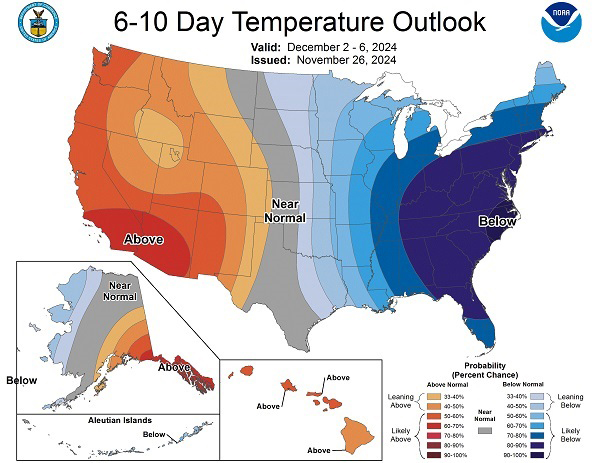

Propane production is easily setting five-year highs. A winter storm this week could hurt propane production as the storm a couple of years ago did, which could keep prices elevated in December. But at least for now, the worst of the weather looks like it will stay away from production areas.

Additionally, propane exports are near their current capacity, and that is not going to be resolved this winter, which should help keep pressure off domestic supplies. That situation could change by next winter, though.

There are things in play that could make December propane prices above normal, but we believe that current fundamentals and history suggest the possibility of a significant fall in propane values during December. For that reason, we would caution against buyers getting overly bulled up in the current environment and too aggressive with buying for December.

The bottom line is that the market can get a little bulled up at the beginning of winter. But December’s price history shows that once that initial bullishness wears off and traders begin to see there is plenty of propane to make it through winter, a more bearish tone can quickly emerge.

Images courtesy of Cost Management Solutions and the National Oceanic and Atmospheric Administration

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Read more Trader’s Corner: