Imbalances between propane production, export capacity

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, Sept. 24 at 10 a.m. CDT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the imbalances between propane production and propane export capacity.

Catch up on last week’s Trader’s Corner here: Propane prices head to the slopes

Export economics are wide open for U.S. propane.

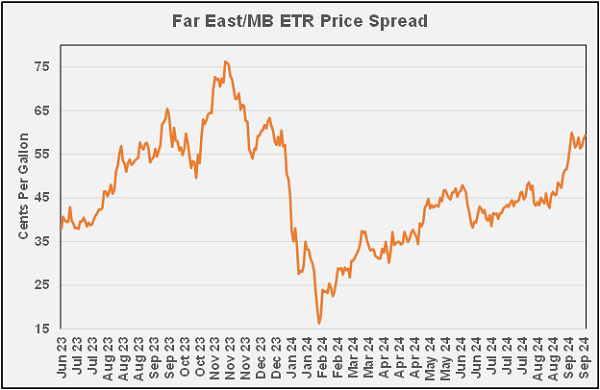

Chart 1: Far East/MB ETR price spread

The chart above shows the price premium that the Far East propane market holds over Mont Belvieu propane. The next chart shows the premium that the European market has over Mont Belvieu.

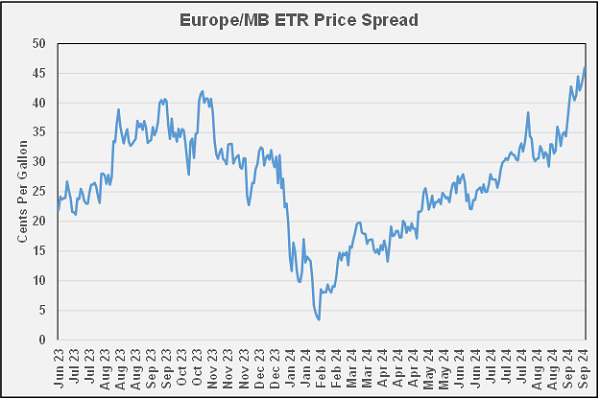

Chart 2: Europe/MB ETR price spread

Since February, there have been massive increases in the benefits to producers of exporting U.S. propane to foreign markets.

Not only are producers benefiting from this wide spread, but in an unusual twist, shipping rates are also down due to a surplus of available shipping and shorter delays getting through the Panama Canal. This is extremely unusual as high margins usually increase the need for shipping, causing increased shipping costs to eat heavily into producers’ netback.

Loading fees, however, are up at U.S. ports. Available spaces have become almost nonexistent, with most termed up for long periods of time. The fact is that U.S. propane export capacity has not increased at the same pace as propane production.

These imbalances between production and export capacity have occurred ever since the shale gas revolution made the U.S. a net exporter of propane. When it occurs, it is bearish for U.S. propane prices. Of course, it is bullish for overseas prices as they struggle to get all the propane they want from the U.S. market. Thus, the wide difference between the U.S and overseas markets.

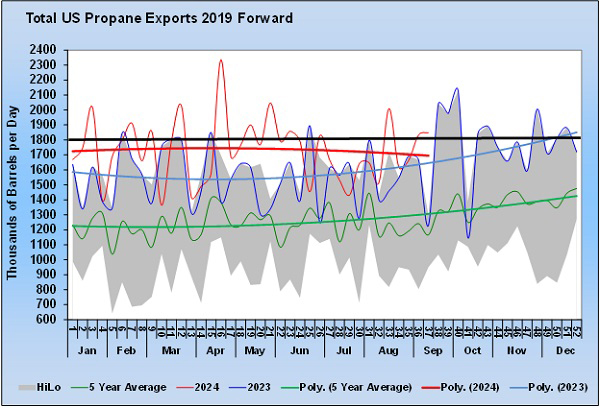

Chart 3: Total U.S. propane exports 2019 forward

The chart above shows U.S. propane exports. There is a lot going on in this chart, so let’s see if we can help bring it into focus. The thinner, volatile lines are the exports as reported by the U.S. Energy Information Administration (EIA) each week. The green line is the five-year average; the blue is last year’s average, and the red is this year’s average.

The weekly numbers are so volatile that we added trend lines to smooth things out, so it is easier to tell what is actually going on. Then we added the black line for the purpose of this discussion. The black line, at 1.8 million barrels per day (bpd), is the maximum, sustainable export capacity in the U.S. Yes, the rate goes above that line from time to time, but as we have discussed, we believe that is because of the timing of reporting to the EIA. Export cargoes are huge, approaching 600,000 barrels per cargo, so one shipment has a significant impact on the numbers, creating the week-to-week volatility.

The forays above notwithstanding, the generally accepted export capacity in the U.S. is considered 1.8 million bpd. So far this year, the U.S. has averaged 1.731 million bpd, so very near capacity. Export capacity has become a bottleneck in the supply chain.

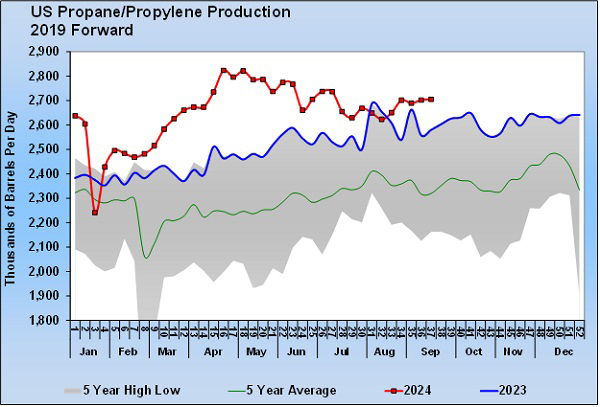

Chart 4: U.S. propane/propylene production 2019 forward

The chart above shows U.S. propane production is dynamic and growing at a time when export capacity has been stagnant. U.S. oil and gas producers have been producing more NGL mix or Y-grade, and processors in MB have been adding more fractionation capacity to handle it. Most weeks this year have set a new high for propane production.

There are projects in the works that will expand export capacity and remove the bottleneck, but those won’t start coming online until next year. Until then, limited export capacity will tend to put downward pressure on U.S. propane prices and put upward pressure on overseas prices. But no matter how wide the spread gets in the short term, exports can’t increase much beyond where they are currently.

That means any upward pressure on U.S. propane prices would have to come from two other sources: an increase in the price of crude oil that puts overall upward price pressure on the energy complex or an increase in U.S. domestic demand.

An increase in domestic demand for propane could occur during a normal winter. Surely that will happen one year. Well, probably not this year. The National Oceanic and Atmospheric Administration is predicting La Niña conditions for this year. It has the odds of La Niña pegged at 71 percent.

La Niña conditions generally lead to higher winter temperatures in the southern and eastern parts of the country. Colder temperatures could occur in the Upper Midwest from about the Great Lakes toward the west. The western half of the country could also see lower temperatures. But that leaves out the bulk of the areas that consume the most propane.

These potentially bearish fundamental conditions for propane means making sure we do not reach on obtaining price protection this winter. It likely will be a winter where a propane retailer does not want to be overbought. We never know how things are going to play out, so some protection from higher prices is always warranted. But the current and projected fundamental conditions for propane increases the odds of a bearish pricing environment this winter.

So again, that means only buy price protection when prices are favorable and don’t feel pressured to chase a rising price market if it occurs. That is why we were so happy to see the recent pullback in propane prices that allowed retailers to get price protection at much less risky numbers. The volume bought should be on the conservative side, meaning retailers should consider going into the winter with fewer gallons with a fixed price.

Remember, our discussions are always generic, applying to the market as a whole and may not apply to your specific situation. Prices are favorable for this winter currently, and a propane retailer might feel very comfortable carrying a lot of fixed-price supply into this winter. That is quite OK. We are simply conveying the overall market situation and where price risks may reside in that environment.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

Related articles: