Propane inventories surpass 90 million barrels

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, August 27 at 10 a.m. CDT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the surge in propane inventories and trends in propane demand.

Catch up on last week’s Trader’s Corner here: Propane price protection preserves customers

The fall harvest is just around the corner, and farmers will be hoping for bountiful crops that will fill their silos, barns and warehouses, giving them plenty to sell over the winter.

Just like farmers walking down their rows of crops evaluating how their plants are yielding, propane retailers are eagerly watching how much propane is being socked away in caverns and storage facilities around the country. The propane supply situation is looking bountiful for this coming fall and winter.

For the week ending Aug. 9, the U.S. Energy Information Administration (EIA) reported U.S. propane inventories exceeded the 90-million-barrel mark.

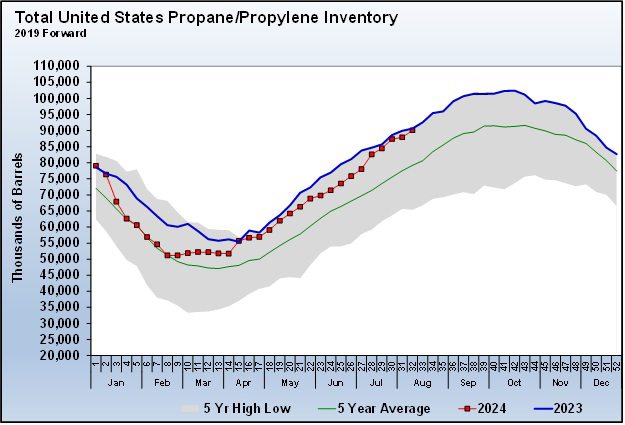

Chart 1: Total U.S. propane/propylene inventory

There is something comforting about seeing a nine as the first digit in propane inventories. The 90.082 million barrels of inventory is just 539,000 barrels below where it was this time last year. Not bad considering last year’s week 32 inventory level was a record high for that week.

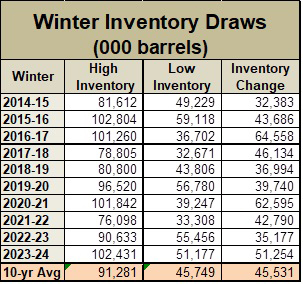

The table below shows the highest-level inventories attained prior to the start of a winter season and their low level at the end of the winter.

Table 1: Winter inventory draws

Perhaps the nine is comforting because over the past 10 years, the average start-of-winter inventory position has been 91.281 million barrels. The current inventory level is also about double the 45.531 million barrels of average inventory decline between the pre-winter high and the post-winter low. Double what will probably be needed feels pretty good.

To add to the already good news, propane inventories will almost certainly continue to increase for several more weeks. Over the past 10 years, the annual high for inventories has been reached between the 36th and 47th weeks of the year. That is somewhere between the first week of September and the third week of November. The odds are that there will be anywhere between four and 15 more weeks to pad inventories.

Since propane inventories hit their most recent low of 51.177 million barrels at the end of February, the average weekly inventory build has been 1.692 million barrels. Builds should get smaller as winter gets closer. Still, inventory will almost certainly be above the 10-year average going into this winter. It is not unreasonable to think that inventories could approach the high of 102.804 million barrels. Since the inventory builds for this year are trending very close to last year’s (Chart 1), it seems probable that inventories will reach at least 100 million barrels.

No one knows what the pinnacle for inventories will be this year, but there is comfort in knowing that if it has already been reached, there will be plenty of propane to cover typical winter demand. Again, the average winter call on inventory has been 45.531 million barrels and the high has been 64.558 million barrels over the previous 10 winters.

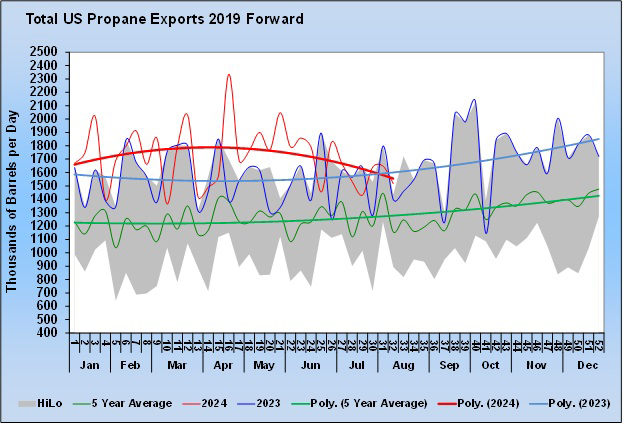

The current trend on propane exports would suggest a good chance that more propane inventory builds are ahead.

Chart 2: Total U.S. propane exports 2019 forward

With propane production good and domestic demand low, propane export rates remain the key to how inventory builds will trend. Over the past 10 weeks, propane domestic demand has been 831,000 barrels per day (bpd), and U.S. propane production has been 2.638 million bpd. That is a difference of 1.852 million bpd.

Propane exports have been tailing off recently, leaving more barrels to pad U.S. inventories. Over the past 10 weeks, exports have averaged 1.637 million bpd, leaving an average of 215,000 bpd or 1.5 million barrels per week for inventories. Further, propane imports have averaged 88,000 bpd, contributing another 617,000 barrels per week to inventory. Combined, that is 2.117 million barrels a week going to U.S. inventories, right on the 2.125 million barrels per week in inventory builds reported by the EIA.

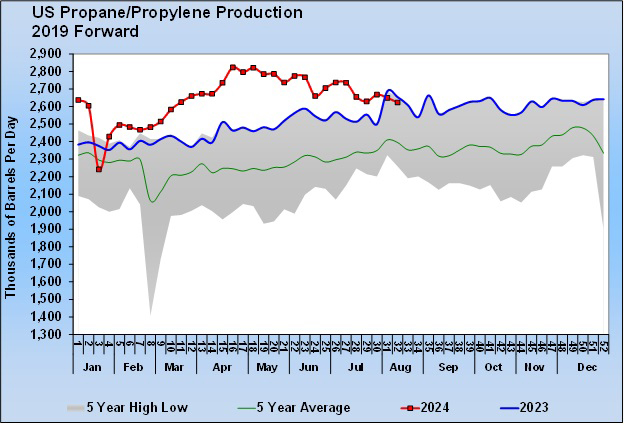

Since mid-April, propane producers have been cutting output at fractionators in response to the building inventories.

Chart 3: U.S. propane/propylene production 2019 forward

Of course, inventories would be even higher had they not done so. However, there is good news in this chart. There is a good buffer of fractionation capacity available should domestic demand and/or export demand pick up in the coming weeks. The difference between the highest production week in April of 2.823 million bpd and this past week’s 2.623 million bpd is a known 200,000 bpd in available propane production capacity, and there is probably a little more.

Given the inventory/supply position for propane, as we discussed last week, the trend in crude prices likely will have the biggest impact on propane prices in the coming weeks and months.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.