Part III: Could the inventory trend change in 2023?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, shifts focus to possible changes in propane demand and how it will impact inventory.

Catch up on last week’s Trader’s Corner here: Part II: Could the inventory trend change in 2023?

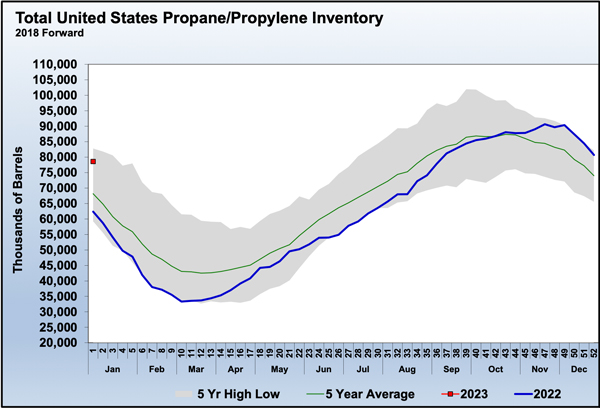

In the last couple of Trader’s Corners, we looked at the significant flip in propane/propylene inventory over the course of 2022. Inventory came out of last winter at five-year lows. In July, inventory was still at five-year lows. But, from August to the end of November, inventories had gone from five-year lows to setting a five-year high.

Inventory is no longer setting five-year highs, but it is still significantly above last year and the five-year average. We have been looking at reasons that the inventory trend might go back the other way. Obviously, the remarkable rise in inventory reflected weak fundamental conditions where supply was outpacing demand. So, if supply falls or demand increases, there may be less inventory build or more calls on inventory that would undoubtedly increase the price of propane.

In the first two parts of this series, we focused on the supply side. In the first, we pointed out that refineries have been yielding more fuel-use propane recently at the expense of propylene output. If economic conditions improve, propylene demand will likely improve, and the refineries could revert to their trend of producing more propylene at the expense of fuel-use propane. We quantified that risk at around 10,000 barrels per day (bpd) less fuel-use propane. That doesn’t sound like much, but it represents 3.6 million barrels over the course of a year. Inventories increased 14 million barrels over the course of last year, so just that change makes a major difference. In a way, that is the moral of this story. What seem to be relatively minor changes in supply and demand can make a huge difference in propane inventory and pricing.

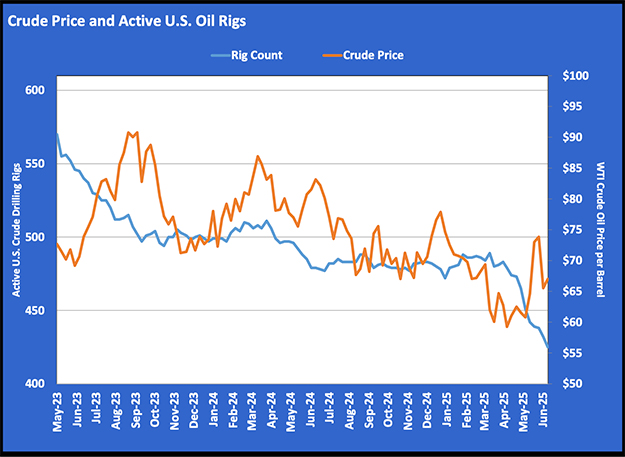

The second point we made on the supply side was how the growth in drilling activity, which was robust last year, has already started to slow. Last year, the growth in supply was able to keep up with the growth in export demand, which ultimately led to the unusual winter inventory build. If the slower drilling activity persists, the impact won’t be felt for a while, but it would have the potential to impact the start of next winter.

There are too many variables to quantify how much the slower drilling activity will impact supply. At this point, we can only suggest there is the potential for the growth in propane supply this year to be less than the growth in supply last year.

Natural gas prices are a third of what they were at the peak last year. One issue is that the Freeport LNG export terminal that was supposed to be back online before the end of the year still hasn’t resumed operation. The company says it will be online by the end of this month, but it wouldn’t be the first time they were overly optimistic. Some believe it will be February before that facility will be back in operation. Natural gas prices have a good chance of improving when that occurs, but given that winter demand will fade soon, the major pressure on natural gas prices that the opening of Freeport may have caused is likely to be avoided.

Now, we want to shift our focus to propane demand.

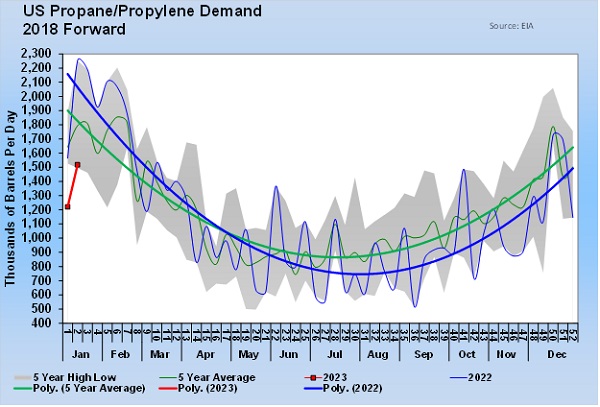

Chart 2 shows U.S. propane/propylene demand. From May last year until now, it is running well below average. For calendar year 2022, it’s 119,000 bpd less than 2021. That has happened even though heating degree-days in the U.S. since June have been 14 percent higher than the previous year. The demand comes from propane retail and petrochemicals. We know that petrochemicals have been consuming less propane.

In 2019, petrochemicals consumed 290,000 bpd of propane, which represented 14 percent of their feedstock stream of 2.065 million bpd. This past year, petrochemicals consumed 2.455 million bpd of total feedstocks, but propane consumption was 282,000 bpd, an average of 11.5 percent of the feedstock stream.

When propane was more of the feedstock stream, monthly consumption rates could run over 340,000 bpd. Ethane had been increasing in price, which had the potential for causing more propane consumption. Ethane prices firmed at about 39 percent of propane at one point last year but have recently collapsed to just 27 percent. Still, as petrochemical throughput rises, there is the potential for more propane consumption. It’s hard to quantify, but right now it doesn’t look like there is the potential for a significant increase in propane consumption by U.S. petrochemicals.

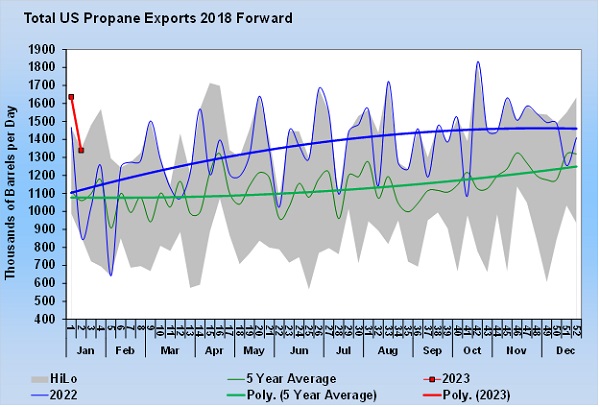

There are many new propane dehydrogenation units around the world, especially in China. They will consume fuel-use propane to yield propylene. That should keep exports humming in 2023 like they were in 2022.

Propane exports have started this year at an even more robust rate than last year.

While there is some chance of more U.S. petrochemical consumption and the likelihood of exports to be at least as high as last year, the wild card seems to be U.S. retail demand. Remember, overall demand was down 119,000 bpd this past year, and not much of that appears to be attributable to petrochemicals. Heating degree-days were up from July 1, 2022, through Jan. 14, 2023, compared to the same period last year, but primary inventory increased or had below-average draws all winter.

We have no way to quantify propane in secondary and tertiary storage, but the numbers would suggest that inventory has been drawn down at the retailer and consumer levels. At some point, we would think those inventories will get replenished. Or there is the potential for this winter’s demand to drag on longer than normal if retailers and consumers are getting by on lower volumes in their tanks.

Either way, the numbers suggest there is the potential for more retail/consumer demand if inflation continues to slow and consumers feel less of a household budget squeeze. About 38,000 bpd of more consumer demand in 2023 over 2022 would be the equivalent of all the inventory build experienced last year of around 14 million barrels. That is only an increase in domestic, non-petrochemical demand of 32 percent. Again, we can’t predict it will happen. However, we can say there is room for more domestic demand in 2023 that could result in less inventory build this year.

A lot of little things could make a big difference in propane inventory and pricing in the coming months: A little less fuel-use propane from refiners, a little slowdown in drilling activity resulting in less growth in propane supply from natural gas processing, a little increase in petrochemical consumption and a little rebound in demand at the consumer level could all add up to a big change in the propane pricing environment.

Read the rest of this four-part series: Part IV

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.