Price protection: Getting ahead of the curve

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, July 30 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why improvements in propane fundamentals have only resulted in a modest decline in prices.

Catch up on last week’s Trader’s Corner here: Crude inventory pattern impacts propane prices

The summer months are usually the buying season for propane retailers trying to get price protection against higher prices for the upcoming winter.

Because of that, almost all our recent Trader’s Corners have been focused on whether it is a good time to buy.

When we talk about price protection, we focus on protecting our valued customers from high prices. Retailers protect their customers from higher prices to protect themselves from losing customers because propane prices got out of hand.

Our Trader’s Corner released on June 17 called “Why get price protection at all?” goes into detail about obtaining price protection. If you missed that one, it would be great if you could read it because it sets the stage for most of what we write about buying propane futures.

Propane buying window

We have written a lot about the propane buying window. Before we go on, let’s define the buying window. For us, the propane buying window opens when Mont Belvieu (MB) propane reaches an average price of 78.5 cents and Conway 76.8 cents for the period between October and March. So, if we go to a trader and ask for, say, 10,000 gallons per month of propane for each of those six months and the average price comes back at 78.5 cents at MB, the buying window is open. When the price is higher, the window is closed. The more the price goes below those 78.5-cent and 76.8-cent thresholds, the wider the buying window.

Those numbers are not magic. They are what propane prices have averaged at those two hubs over the past 10 years. Being able to get price protection at that level strikes a good balance of meeting the dual mandate for propane retailers. The dual mandate is to protect our customers as best as possible from high prices while not taking an unmanageable risk to do so. When retailers take a position to protect their customers against higher prices, they assume the risk of lower prices. In our view, if price protection is obtained at the 10-year averages or below, the downside price risk is manageable. Again, a review of that June 17 Trader’s Corner would be beneficial in understanding our reasoning.

The buying window opened in late May and then closed because propane followed a strong rally in crude’s price. Crude is now in a downtrend, and prices for this coming winter are ever so close to the buying window opening again. A quick check on the morning of July 26 had the winter strip at MB ETR at 79.6250 cents and Conway at 78.8333 cents.

Though the buying window for this coming winter remains closed, prices are favorable for buyers to protect the winters of 2025-26 and 2026-27. Propane retailers willing to plan further out can get ahead of the curve, and that is the focus of today’s Trader’s Corner. For the sake of space, we will focus on MB propane, but the concept and conditions apply to Conway as well.

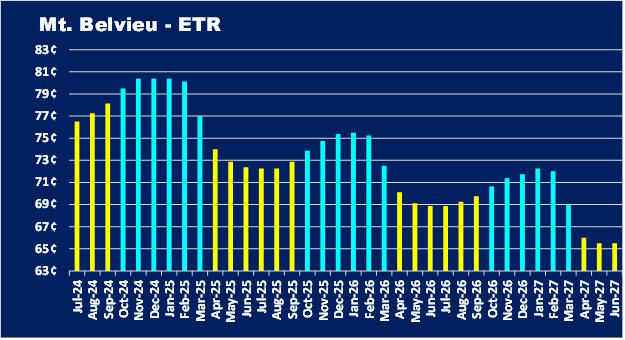

Chart 1: Mont Belvieu – ETR

Propane retailers can get price protection out to June 2027 on the futures market. Every day in our reports, we show this curve. Focus on the blue bars, which are the winter months. Note how they are stair-stepping down.

When the price curve is like this, it is an indication of a well-supplied market. Thus, the product that is needed the soonest becomes more valuable than the product needed in the future. Propane’s price curve is heavily influenced by the future price of crude.

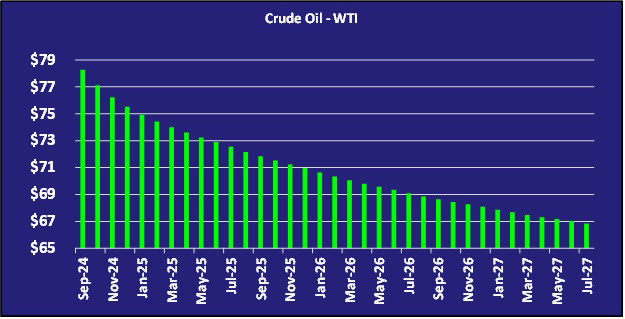

Chart 2: Crude Oil – WTI

The chart above reflects where crude is currently trading in the further-out months. The crude curve is a true backwardated curve. That is the name given to a price structure where each further-out month’s price is a little less than the month before it. Again, it reflects a well-supplied market. The propane curve is backwardated as well, but it’s not a classic backwardated curve like the crude curve.

The average propane price for October 2025 through March 2026 is 74.5417 cents, and for October 2026 through March 2027, it’s 71.1667 cents. Because of the structure of the forward propane and crude futures prices, the buying window for those winters is already open. Buyers generally will have the opportunity to get price protection for further-out winters at favorable numbers more often than price protection for the upcoming winter since price curves are more often backwardated.

Therefore, buyers that are long-term planning and getting ahead of the price curve can generally obtain price protection against higher prices with much less exposure to falling prices. It makes managing the downside price risk much easier.

Futures market

There is a risk that we need to discuss if you decide to go this route. To explain the risk, we must do a quick review of how the futures market works. To trade futures, a propane retailer enters into an agreement with a trading company. There are a handful of companies that trade propane futures. When a retailer establishes relationships with these trading companies, it provides financial statements to the trading companies, and they give the retailer a line of credit that allows the retailer to trade without any money exchanging hands until the futures contract settles.

Let’s say a propane retailer has been given a $100,000 line of credit by the trading company. On July 26, 2024, a retailer takes 10,000 gallons per month of propane price protection for each month from October 2025 to March 2026 for a total of 60,000 gallons. Let’s say the price protection is obtained at strike price of 74.5417 cents. No money changes hands on the date of the transaction.

Money will first exchange hands at the end of October 2025 when the monthly average for that month is known. If the monthly average is above the strike price from July 26, 2024, the retailer will get the difference between the strike price and the monthly average. If the monthly average is below the strike price, the propane retailer will pay the difference. This process will repeat each of the next five months until all positions are settled.

The risk we refer to is what happens from the time the transaction was initiated to when it settles. If prices fall below the strike price, some of the retailer’s credit line with the trading company is used. There is no issue if the price of propane goes up or stays the same, but if the price of propane goes down, the retailer has a potential payment obligation. Remember, if the monthly average is below the strike price, the retailer will pay the difference.

In the case above, for each penny the price falls, $600 of the retailer’s crude line is used. So, there’s no issue at all at this point because the market can’t move enough to use up the credit line. But what if the retailer starts taking positions for all three winters or starts taking more substantial volumes or both?

Let’s say that a retailer secures 500,000 gallons per year for three years. He now has 1.5 million gallons of exposure. Now each 1-cent downward move in the market uses $15,000 of his line of credit. A 6.67-cent drop in the market would exhaust the $100,000 line of credit. As the line of credit nears its limit, the trading company will give the retailer the option to close the position and settle immediately or send money that will be set aside to protect the trading company from accounts receivable risk. This is known as a margin call.

If the market goes back up to where the credit line has a comfortable balance, the retailer can request the margin call be returned. If the retailer holds the position and prices stay down, the margin call funds will be used to cover the retailer’s balance due at the time of settlement.

Getting ahead of the price curve is a smart play for retailers willing to plan further out. Getting price protection at lower prices reduces the risk for a margin call. Still, margin call risk, like other risks, must be managed. Being cognizant of the total volume exposure and how much the market can move at a given volume before a credit line is used up is a part of that management. Establishing relationships with several trading companies might increase the available credit.

When a retailer takes price protection, that is the cost of supply for those gallons, and the retail price must reflect that cost of supply. The bottom line is, if the retailer is keeping up with the cost of supply and making sure the retail price yields the proper margin, there will be enough funds to cover the risk of falling prices. And if the retailer is watching total gallons of price protection relative to available lines of credit, the retailer can reduce the risk of a margin call.

All charts courtesy of Cost Management Solutions