Why get price protection at all?

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Wednesday, June 26 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains the reason propane retailers should consider buying price protection in the summer for the winter months.

Catch up on last week’s Trader’s Corner here: Propane storage strategies sought in federal legislation

We have been looking at price comparisons between summer and winter prices. Let’s start with this:

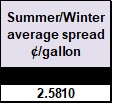

In our study, we used the average price of propane from May-August and compared it to the average price of propane from October-March. Those first months are the traditional period when propane retailers buy price protection for the second group of months which is, of course, the primary sales period for retailers. It is an annual look at pricing activity by retailers’ natural buying and selling cycle from May to April.

The average price of October-March propane has only averaged 2.5810 cents higher than propane prices in May-August. And that number is only relevant if the propane bought in May-August is stored until the winter months. Why is that? Because the market is already pricing in the summer-to-winter difference. Whether you are pre-buying or using financial tools such as swaps and options, the summer/winter spread is priced in. For example: Front month June propane at Mont Belvieu is trading at 78.25 cents as we write, and winter (October-March) propane has an average value of 82 cents. So, more than the typical spread is already priced into the winter months.

If we were to stop this analysis at this point, one would be left with only one conclusion: There is no reason to buy price protection in the summer for the winter months. If this were only a math problem, then we have solved the equation and found the right answer: Don’t buy price protection in the summer for the upcoming winter.

However, this is not a math problem, it is a risk management problem. A retail propane company has physical assets, but the real value of the company is in the customers that it has worked for years to cultivate. The primary value of the business is the relationship that has been developed with each customer. Consequently, the primary goal of price protection is to remove the risk of extremely high prices that could hurt the relationships with our customers. That makes this next number highly relevant.

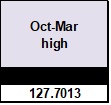

That number is the highest price that propane prices have averaged during the winter months over the last 10 years. When a retailer passes on a price built from that kind of Mont Belvieu price to customers over the course of a winter, it does damage, period. One can say, “Well, that doesn’t matter because other retailers were charging high prices.” The non-math problem there is that the customers didn’t buy from those companies. Those companies’ names were not at the top of the invoice. The fact of the matter is, we cash out a lot of goodwill built with our customers over many years when we put all the risk of high prices on their shoulders. Nine out of ten years it might not be an issue, but all it takes is one year to make a huge withdrawal from the relationship bank account.

Some customers may come to the retailer and ask for help eliminating the risk of higher prices. Commercial customers needing to meet budgets are highly inclined to seek out a known cost of propane. Or the retailer may offer ways to mitigate the risk, such as summer fills or budget billing, for example. In those cases, the retailer is hedging because the supply side price and the sales prices are both locked down. There really is no risk to the retailer in those situations.

Of course, not all customers are going to actively manage the risk of higher prices. That puts the retailer in the position of trying to proactively manage it for them. But as the retailer tries to take some of the 127.7013 cents price risks off the table for his customer, he assumes another risk. When a retailer is locking in supply cost without a corresponding sale, he is speculating. It might be smart speculation, since it is aimed at managing price risk for the customer base, which is the most important component of the business, but it is nonetheless a risk because the retailer now has exposure to falling prices. That makes the following number relevant.

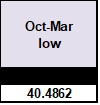

This number is the lowest propane prices have averaged over winter during the last 10 years. The average price has been 78.4848 cents over the last 10 winters. The difference between the average and high price over the last 10 winters was 49.2166 cents. The difference between the average and the low price was 37.9986 cents. Assuming the retailer was consistent over 10 years in trying to manage upside price risk for his valued customers he would have had the unpleasant task of managing around some high buys in the winter of 2015-16. That seems like too big of a risk for the retailer to have taken, despite the noble cause of trying to keep his customers protected.

But let’s think this through a bit and ask if it was as big of a risk as it first appears. The high price in the second table is the reason that some price protection is needed. How much price protection we take will be highly dependent on what winter prices can be bought for during the summer buying period. We might start out with a goal of protecting the price on 40 percent of our winter sales volumes that are not pre-sold in some way. But we would not force it and would only price protect on that much if we got favorable buying conditions during the summer. We might do more if the buying conditions were very favorable.

The reality is, we would almost never speculate on all our supply, not even close. If we bought price protection, it would only be a part of our expected sales. We would still be passing on a chunk of high prices, but our price protection will help the customer to some degree. It is the last table that prevents us from being too aggressive on speculative buying. We simply must keep plenty of propane out there that will be bought at market prices to make sure we remain in the ballpark in a falling market.

Now let’s think about consumer psychology in the high-priced market and the low-priced market. The consumer is going to be shocked by the price of propane in the high-priced market either way. It is in that environment that the customer is going to be the most motivated to check our price against the competition. If we have done no price protection, he is likely going to find out we are at the top of the pricing in our market. That is not the place to be with already stressed consumers.

On the other hand, if we have taken some price protection and passed that on to the customer, he might find we are doing a good job for him despite the unpleasant bill. In that case, we have managed the risk of higher prices for our customer, and we have reduced the risk that he will be motivated to leave us. In fact, there may be a chance we built more goodwill in a bad situation.

In the low-priced winter market, any price protection taken is almost certainly higher than the prevailing market price. That may put us in the position of having a retail price higher than our competitors. But in a winter where retail propane prices are being built from a 40-cent Mont Belvieu base, is the customer likely to be shocked into shopping us? It’s highly unlikely. In fact, he would probably be more inclined to buy his retailer a cup of coffee when he sees him at the local cafe.

Here is another important factor when considering the risks of price protection: Propane retailers generally lag raising prices in a sharply rising or high-priced market. Therefore, any price protection that is in place is going to help offset this natural tendency. Further, a retailer that has no price protection in play is going to be even more likely to lower the margin to reduce the risk of losing customers. That is a position that every retailer needs to avoid. With costs high and recent winters weak, retailers must protect margins. Having price protection in place allows us to help our customers while maintaining margins.

On the other hand, retailers tend to lag in lowering prices in a falling market, so margins naturally increase in a falling market. That would mean that the retailer that has some supply bought at higher than market prices is unlikely to have to deal with the full difference between his speculative buys and the price that is on the street during a low-price winter.

If a retailer uses all the tools and analysis at his disposal, he can greatly increase the odds of being in a good supply position, providing price protection for his valued customers but not assuming undue risk for himself in the endeavor.

But the reality, is we should assume any speculative supply price taken has about a 50/50 chance of being lower than the actual market price. Again, that is math, but we can’t lose sight of the fact that our purpose is not solving math equations.

Price risk management is all about managing the risks in the situations that are most likely to hurt our business. In our view, not taking action to mitigate the risk of very high prices is more likely to cause discontent with customers than maintaining a higher retail price than our competition in a low-priced market. That is a consumer psychology problem and being smart about price protection helps us solve it.

All images courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.