Propane price protection preserves customers

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, August 27 at 10 a.m. CDT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains the current pricing market and why buyers might consider a business model to protect propane customers from extreme price fluctuations.

Catch up on last week’s Trader’s Corner here: Buy window for propane finally open again

Our ongoing topic in recent Trader’s Corners has been obtaining propane price protection against rising prices for this winter.

We have covered the topic in many ways, including asking why get price protection at all. We must know why we are doing it to be interested in when to do it.

A propane retailer can just wait until winter, buy propane off the rack at whatever price market conditions dictate, add an acceptable margin, and let the customer deal with whatever that price turns out to be.

If one buys into the idea that customers are the most valuable part of a retail propane business, then retailers are likely to realize it behooves them to insulate those customers from exceptionally high prices if possible. This is the kind of propane bill that can cause loyal and valued customers to question if the retailer is treating them fairly. The kind of bill that could cause them to change energy sources or look for a new propane supplier.

Buying at market prices, marking it up and letting the customer deal with the consequences may feel like a risk-free way to run a retail propane company, but is it? A retailer that uses that model certainly doesn’t have to deal with having propane price protection that turns out to be higher than market prices come winter. But in a high-priced market, they may find they have a lot fewer customers to deal with too.

All business models have risk, so it is a matter of figuring out the model that provides the best chance of managing risks to achieve a favorable outcome. To us, a favorable outcome is keeping propane consumers happy by protecting them from higher prices without their propane retailer taking on too much risk to falling prices.

At Cost Management Solutions, we accept it as a given that the long-term players in the retail propane business will be those that help their customers manage upside price risk, and it is our role to help retailers offer that at the least possible risk. In other words, help them buy right.

No matter how hard a retailer may try to protect customers from high prices, there will come a time when their customers will be presented with an unpleasant propane bill. But with propane price protection in place, the retailer can mitigate those high prices to some degree. Then if customers call the competition, they will learn that their retailer is treating them as best as possible in a bad pricing environment.

If we agree that trying to protect our customers from high prices is really a way to protect our business by preserving customers, then we realize getting protection is a necessary evil. It’s evil because taking supply positions to protect customers from high prices means the retailer assumes some risk of prices falling below the price of the protection. That could put him at a competitive disadvantage to retailers that didn’t try to protect their customers. It’s darned unfair, but it is a fact of the matter.

So if retailers are going to do what is right, they must buy right. That is why we have talked so much about the buying window. The buying window opens when buying price protection is at or below the average price of propane over the past 10 years. If the retailer buys propane price protection right at the price average, the likelihood of having to deal with a low-priced market is reduced to 50 percent. Buying at the winter price average or below yields a manageable risk to a low-priced winter market in our view. There are other methods, disciplines and strategies for buying right if you don’t like the 10-year average winter price benchmark.

Propane fundamentals

We just used the terms high-priced and low-priced winter markets. We know what you are thinking. We could stop wasting everyone’s time preaching about what is right and explaining all of these strategies if we would simply reveal whether this winter will be a high-priced or a low-priced one. If we do that, it is worth reading this article, but if not, it’s just a bunch of noise. That is absolutely what you are thinking, isn’t it?

We will admit to not knowing the future, but it doesn’t mean we don’t have some opinions on the matter. So here you go: Do with these thoughts what you will, and make all the noise you want.

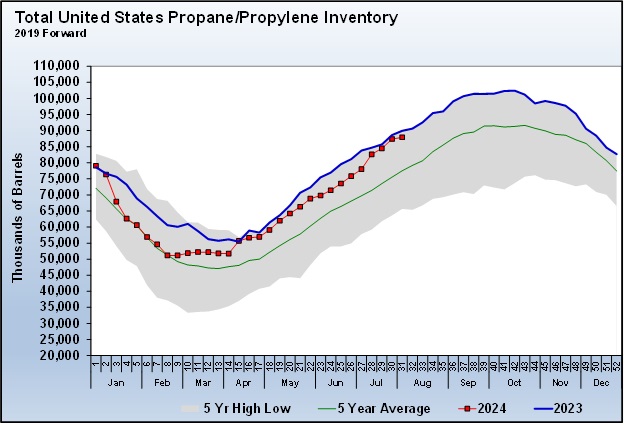

Propane fundamentals are looking good now with inventories high.

Inventories are about where they were last year and 14.02 percent above the five-year average. We got through last year without prices blowing out, so the odds are it will be a repeat. From October 2024 to March 2025, Mont Belvieu propane averaged 75.3207 cents per gallon. That was just under the 75.8-cent 10-year average.

Unless something changes concerning propane production, imports, exports and domestic demand that alters the current fundamental picture, thereby putting inventories on a lower trajectory than last year, why would we expect a different pricing environment?

What we are about to say may sound completely off the wall, but if we had a winter for a change, that could make a difference. For now, that seems too far-fetched to contemplate. If we assume the same old disappointing winter, then conditions look just hunky-dory from a propane fundamental perspective.

Crude may hold the key

With propane fundamentals in good shape, whether the winter of 2024-25 turns out to be a high-priced or low-priced winter likely hinges on crude’s price. If propane supply is sound, then propane is generally going to get its price direction from crude.

WTI crude finished Thursday at $76.19. Over the past 10 years, WTI crude has averaged $63.41 per barrel. The five-year average was $67, and the 15-year average was $71. By any of those measures, we are in a high-priced crude market. If that holds, then propane pricing this winter could be above average.

RELATED: Crude inventory pattern impacts propane prices

Crude prices are elevated for two primary reasons. First, OPEC+ has been limiting its output to the tune of 5.8 million barrels per day to support prices. Second, the war in Gaza could spread to a regional conflict that causes more disruptions to crude supply. Right now, crude’s price is high on the increased possibility of that occurring. If it becomes a reality, then a high-priced winter becomes more of a certainty.

Opposing the bullish case for crude are signs of weakening economic conditions in the U.S. and China, the world’s two largest crude consumers. A weaker economy could slow crude demand and likely cause its price to go down, resulting in a low-priced winter.

If we knew how the situation in the Middle East was going to play out, if we knew exactly how the global economy was going to perform over the next nine months, and exactly the impact that would have on energy demand, and what the heck OPEC+ is thinking or is going to do, we could predict, with relatively high confidence, though still with lack of total certainty, if this will be a high-priced or a low-priced winter. And did we mention reading the mind of Mother Nature?

As disappointing to you as it must be, we will admit that what drives people to do what they do in the Middle East is a mystery to us. Our version of the economic outlook and what that will do to energy demand is about as good as the other 60,000 opinions you could read on the matter. And, no, we can’t predict the weather any better than we can read the minds of OPEC+ members.

And, yes, that puts us right back to where we started: trying to do the right thing the hard way. Knowing the future would be cool though … or would it? From a propane-buying perspective, it would, absolutely.

Chart courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.