Propane market reacts as feared

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses rising crude and propane prices.

Catch up on last week’s Trader’s Corner here: Propane inventory adjustment could spike prices

This Trader’s Corner (TC) is a follow-up to the one we wrote on Jan. 5 and released on Jan. 8. In that TC, we expressed concern that propane was undervalued, especially in Conway, given the recent downward inventory adjustment. We feared that the incoming weather was going to jolt the market into realizing the undervalued nature of propane, resulting in a significant bump in prices. We ended last week’s TC with the following statement:

“If crude stays at $74 per barrel, and Conway gets revalued to 47 percent of WTI, it would be a 12-cent gain in Conway’s price. Given the situation, we think short-term price protections for propane supplies valued relative to Conway are appropriate for January. That can be done by filling tanks early, doing a pre-buy or using a forward/swap to cover short-term needs. To us, there is an increased upside price risk that is worth managing in some way.

“Further, we don’t think the risk is necessarily confined to the Midwest. If traders feel Conway needs to be revalued, that likely will carry over to Mont Belvieu as well.”

You can visit last week’s article if you would like to see our arguments for making that statement.

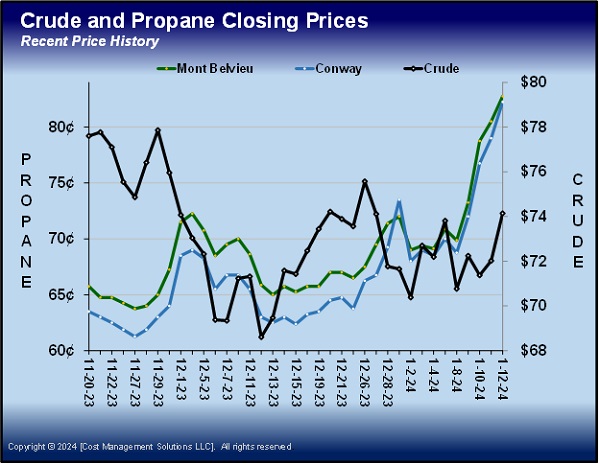

When we wrote that TC on the evening of Jan. 5, Mont Belvieu propane had closed that day at 70.875 cents, 40 percent of the value of WTI crude. Conway had closed that day at 70 cents, also 40 percent of WTI. On the morning of Jan. 12, Mont Belvieu ETR propane was trading at 82.75 cents, 47 percent of WTI, and Conway was trading at 82.25 cents, 47 percent of WTI. WTI crude has traded between a low of $72.72 and a high of $75.25 per barrel (by midday Jan. 12).

Chart 1 shows the recent closing prices for propane and crude. Propane has a tremendous amount of upward momentum. It has had some help from rising crude, but propane has easily outpaced crude to the upside. Thus, propane’s value relative to crude has increased.

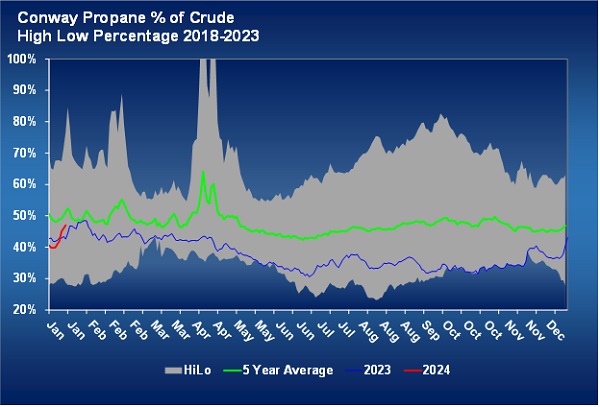

Chart 2 plots Conway propane’s value relative to WTI on a simple percentage basis. You can see that Conway has now gone a long way toward correcting its undervaluation relative to crude and is approaching the five-year average for this time of year. The chart for Mont Belvieu ETR propane shows an almost exact change.

There is no reason for propane not to continue to improve against crude, likely reaching 50 percent of crude’s value. Crude also can go higher because of an escalation in the geopolitical tensions in the Middle East that occurred overnight.

Houthis in Yemen have made nearly 30 attacks with drones and rockets on shipping in the Red Sea since November. A U.S.-led coalition has been trying to defend shipping. The U.S. knocked out more than 20 drones and missiles in one incident last week alone. The coalition decided a good offense was the best defense. The U.S. and U.K. made 60 strikes on 16 Houthi targets in Yemen. The U.S. conducted 14 of the 16 strikes, according to reports. Targets were radar systems, drone storage and launch sites, missile storage and launch sites, and Houthi command locations.

Oil tankers are said to be avoiding the Red Sea again after one was boarded off the coast of Oman last week, putting upward pressure on the price of crude. The coalition attacks against Houthis escalated the situation in the Middle East and increased threats to energy supplies.

With that said, we now want to warn that propane is likely to be overcorrected to the high side here.

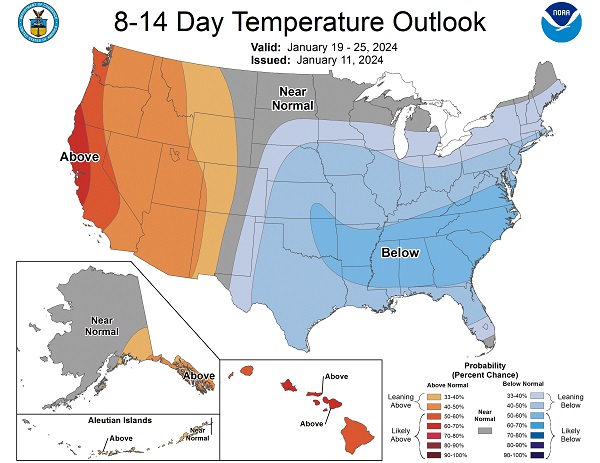

The upward momentum is going to be hard to stop. Plus, the cold currently hitting the U.S. will be far enough south to negatively impact propane supply. Price protection through January and maybe through early February remains appropriate, but we fear a retreat in prices once the current cold front moves through the country. Therefore, we will become cautious again as we move into February and beyond. Propane inventories overall are good, and production remains high when it is not being negatively impacted by weather.

Chart 3, the temperature probability map covering Jan. 19 through Jan. 25, shows much of the country likely will continue to have below-normal temperatures but nothing as dramatic as what is currently happening.

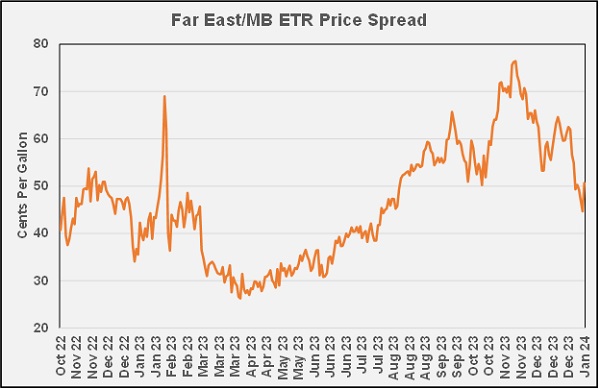

However, the most concerning issue for buyers is a trend in U.S. propane values compared to the Far East, a major U.S. export market.

Chart 4 shows the price difference between the U.S. and the Far East. The difference between the two markets is known as arbitrage. The arbitrage has been coming down recently. There has been a fall in values in the Asia market due to a lack of demand. The current rise in U.S. values is likely to hurt the arbitrage even more in the short term, which is likely to hurt U.S. propane exports.

Keep in mind that, in 2023, U.S. demand for propane averaged 1.009 million barrels per day (bpd). Meanwhile, export demand averaged 1.618 million bpd last year. With exports accounting for such a large share of overall demand, if they fall and the weather doesn’t turn out to be sustainable, U.S. propane prices are likely to fall enough to open the export window again.

The supports are:

- Potential for higher crude (geopolitical).

- Short-term disruption to propane supplies due to severe weather in the South.

- Short-term high domestic demand due to extremely cold weather over the next week.

The headwinds are:

- Potential for lower propane exports with weaker export economics.

- Cold not sustained.

- Inventories are still good for this time of year.

We suspect propane prices could go higher for a little longer, so short-term price protection remains a favorable bet. However, we do have concerns about what might occur once the impacts of the current severe weather are gone. We would be cautious and monitor how exports are going and if temperature forecasts remain favorable beyond this week.

Unless noted, all charts are courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.