Buy window for propane finally open again

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why the buy window for propane has opened again.

Catch up on last week’s Trader’s Corner here: Price protection: Getting ahead of the curve

We all remember our elementary school days playing dodgeball. You were either part of a circle of throwers or in the mass of dodgers inside the circle.

Throwers threw a ball at the dodgers, and if a dodger got hit, they either sat out or became part of the circle of throwers. As a thrower, you took joy in pummeling others with the ball. A shot to the head was particularly satisfying and generally elicited an ecstatic uproar from everyone when it occurred. As a dodger, the goal was to avoid being hit until you were the last one standing.

This week, propane buyer, you have been playing dodgeball. You are the last dodger standing, and it is now a matter of determining how long you can last. The most capable thrower has the ball in his hand sporting a toothy grin, a glimmer in his eye, and he is looking right at you, mister retailer. The thrower is determined to impress Mary Sue, whom he has been infatuated with since kindergarten, though she has never paid him one bit of attention. You, mister retailer in the circle, are the object he is going to use to change his romantic fortunes.

OK, so retailers haven’t been playing that version of dodgeball, but they certainly have been playing a similar game. Our focus for weeks has been the fact that the buying window for this coming winter price protection has been closed since the end of May and that it needed to open again because many retailers still aspire to obtain more price protection at a fair price.

Crude prices have been trending lower since the beginning of July, and propane prices have followed. Propane prices for this upcoming winter have been coming down as well and had gotten tantalizingly close to being at a price that would allow retailers to obtain the price protection they need for their customers without taking too much risk.

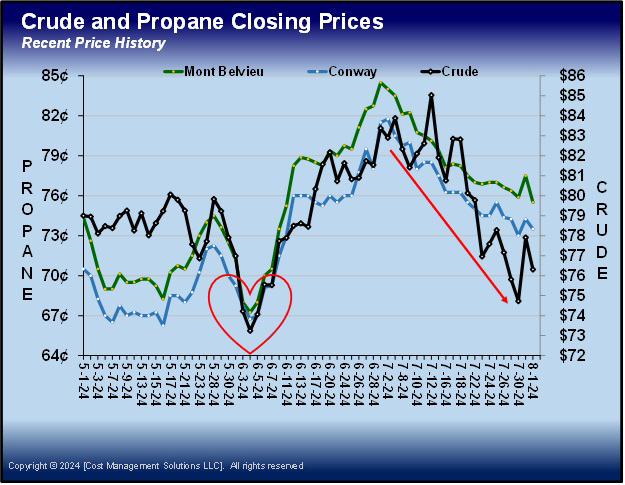

Chart 1: Crude and propane closing prices, recent price history

The chart above shows closing prices through Aug. 1. The heart shows the last time the buying window was open. But as we write on Friday morning, Aug. 2, crude is down another $2.32, and propane is being pulled lower.

Consequently, the buy window for propane has opened again for the first time since the end of May. What do we mean by the buy window being open?

It means winter price protection can now be bought at or below what the winter months (October-March) have averaged over the past 10 years. Price protection at the current price means there is about an equal chance of the actual winter price being above or below the cost of price protection.

We believe that strikes a good balance between protecting customers from higher prices and not putting the retailer in trouble should the winter price be below the cost of protection. We believe the risk of falling prices is manageable by holding prices up in a falling market to maintain margin without being at a significant competitive disadvantage at this price level.

Buyers should not overbuy at this price. However, some price protection here could make sense for some buyers. A retailer’s knowledge of their specific marketplace will always trump generalized assertions or assumptions.

Now back to our game of dodgeball. Note the sharp rise in the black line in the chart above on July 30. That is the ball buzzing just past your head, mister retailer, then rising and catching poor Mary Sue squarely in her right eye. On that day, there were significant geopolitical developments in the Middle East that caused the sharp rise in crude’s price.

The buy window for this winter’s price protection was not quite open, and we were certain these developments had slammed it shut once again. A key leader of Hamas was assassinated in Iran, prompting Iran to blame Israel and vow retaliation. Israel conducted an airstrike that killed the leader of Hezbollah, prompting that Iranian-backed group to say it was taking its fight against Israel to a new level. Meanwhile, the U.S. attacked an Iranian proxy in Iraq that it said posed threats to U.S. and coalition forces in the region.

Surely, we thought, this is the catalyst that is going to end the downtrend in crude, and rising crude is going to pull propane higher and that perhaps that would mark the end of the last and best chance to get price protection for this winter.

To our amazement, however, crude tumbled on Aug. 1 and is following that up with another major pullback as we write. WTI reached a high of $78.88 on Aug. 1 before turning lower and has reached a low of $73.18 as we write. Propane prices are following.

Weak economic data from the two most energy-consuming nations, China and the U.S., has been enough to overcome the geopolitical events that threaten crude supply. There was also a report that OPEC+ had produced 100,000 barrels per day over its quotas in July.

We are not sure how long this pullback in crude will last, because we are shocked it is happening in the first place. But we do know that in the version of dodgeball that propane retailers play, they have just made a remarkably evasive move. And the instinctive rush to check on Mary Sue looks promising as well.

Chart courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.