Part IV: Evaluating the state of crude prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, continues to evaluate the current state of crude prices through 2024.

Catch up on this Trader’s Corner series here:

- Part I: Evaluating the state of crude prices

- Part II: Evaluating the state of crude prices

- Part III: Evaluating the state of crude prices

On Friday, July 7, we wrote the first in a series of articles on the state of crude. It is an important subject for propane retailers since the movement in propane prices is so closely connected to the movement in crude prices. We have linked to the previous three articles on this subject. It would be great if you could read those before continuing with this Trader’s Corner (TC) since much of what we were concerned with has come to fruition and this TC is going to show where we stand now.

We learned long ago not to predict where markets are going. There are simply too many variables that can make even the best laid predictions look foolish. What we do is focus on the data and events that suggest that something could happen. In the previous three TC, we laid the foundation for why we believe West Texas Intermediate (WTI) could continue higher and be a support for propane prices. We made our case as to why we thought crude was ready to return to a bull market after being in a bear market since August 2022 and that WTI could move to at least $80 per barrel.

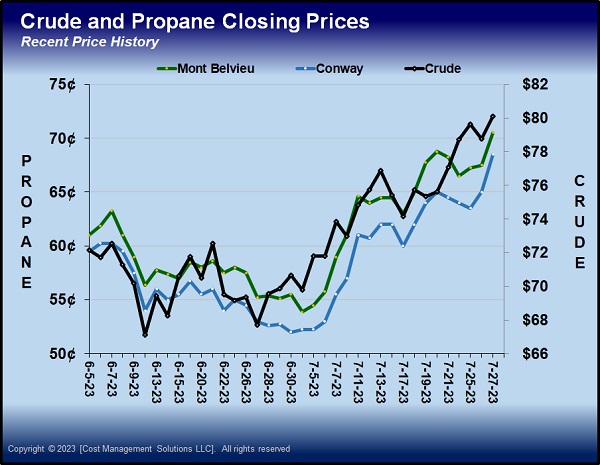

The day we wrote the first installment of the series, WTI crude closed at $73.86. Mont Belvieu ETR propane closed that day at 59 cents and Conway at 55.5 cents. On July 27, WTI closed at $80.09, breaking into bull market territory and above the $80 mark we suggested could fall. So, as we write on July 28, WTI through July 27 had made a $6.23, or 8.43 percent, run since the first TC on the state of crude was written. WTI is up $12.39, or 18.2 percent, since beginning its current rally on June 28.

Mont Belvieu ETR propane closed at 70.5 cents and Conway at 68.5 cents on July 27. Those marked 11.5-cent, 19.49 percent, and 13-cent, 23.42 percent, gains respectively since the first TC on crude was written. Propane has outpaced crude because propane inventory builds have been on the lighter side during this time frame.

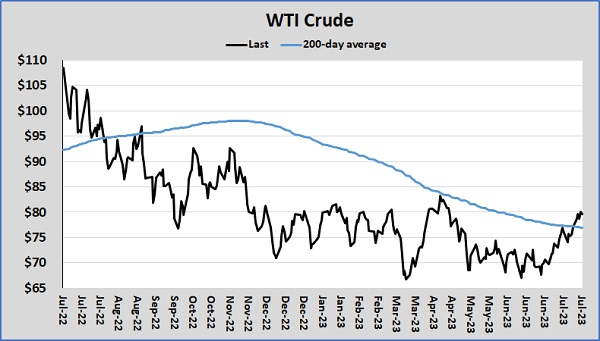

Chart 1 is updated since it was used during the second installment of this series. It shows that WTI’s closing price is now above its 200-day moving price average. This is significant because the 200-day moving price average is considered the demarcation line between a bear and bull crude market. With several days of closes above the 200-day moving price average, WTI has begun a new bull market phase. This kind of break can give buyers, especially technical traders, more confidence to take long positions in crude. Their buying keeps the rally going.

Chart 2 shows recent propane and crude prices. It illustrates the velocity in the uptrend, but it also shows how closely they moved together.

The rally in crude mostly has been caused by a change in what is driving the market. During the bear market that started last August and ended last week, WTI has been driven by worries about crude demand destruction stemming from a weaker global economy. Now, traders and investors are less pessimistic about economic conditions. Inflation is slowing.

2023 LP Gas Growth Summit · Find out how to apply for the annual event

A report showed headline inflation at an annual rate of 3 percent in June. That was down from an annualized rate of 3.8 percent in May. Data also showed that the upward pressure on wages was less. Rising wages have been a key concern of the Federal Reserve. Core inflation, which excludes fuel and food, is at 4.1 percent. That reading is well above the Fed’s 2 percent target rate but down from 4.6 percent in May. Federal Reserve Chairman Jerome Powell said last week that he believed the U.S. economy may avoid a recession despite all the monetary tightening by the Fed.

Concerns about the economy have now given way to concerns about tighter crude supplies this year. OPEC+ has made hefty cuts in production and U.S. crude production is flatlined in the 12.2 million to 12.4 million barrels-per-day range. Given the trend in drilling, that rate appears more likely to stay flat or go lower than to grow. If crude demand doesn’t fall, then the lower production is likely to cause a call on inventories, which could lift prices even more. The situation already has some analysts calling for $90 Brent crude by the end of the year. Brent is currently trading $4 above WTI, so we could infer a $86 price for WTI.

We aren’t sure investors are confident enough in economic conditions to push crude to those heights. Crude already has been on a tremendous run as have other commodities and equities prices. We feel crude needs to be somewhere in its current price range at this point. While we think it will remain in bull market territory above its 200-day moving price average, we feel it is more likely crude will settle into its current $80-ish price range. Again, we won’t be so foolish as to predict that outcome, but we will suggest it as a possibility simply based on a history that shows any market having difficulty maintaining that degree of upward momentum.

As for propane, it was so beaten up relative to other energy sources it wasn’t going to take much to move it higher. The lighter inventory builds over the past five weeks have allowed it to run with crude. Propane is still a very cheap Btu. It is only valued at 38 percent of WTI, and we like it closer to 40 percent here. But with inventories still setting five-year highs at this point, we think this upward momentum is more likely to play out, and propane needs more fundamental support to continue to improve in relative value to WTI. So, if crude does stall here, we think the rally in propane will too. Then, it will just be a matter of what propane fundamentals do. If the inventory builds remain light, we think we could see more firming in prices as fall demand nears.

We believe the odds favor a pause in both the crude and propane rallies at around current valuations, with next moves dependent on how fundamentals trend for both. We are simply dropping that thought in the suggestion box, nothing more.

Catch up on this Trader’s Corner series here:

- Part I: Evaluating the state of crude prices

- Part II: Evaluating the state of crude prices

- Part III: Evaluating the state of crude prices

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.