Opening the buying window

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, July 30 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains how the buying window for propane retailers could reopen.

Catch up on last week’s Trader’s Corner here: The buying window has closed

Last week, we discussed that the buying window for propane has closed. As propane buyers, we would like to know what will open the window again. Most propane retailers probably still have gallons they would prefer to get price protection on for this winter. As we pointed out last week, May and June are usually the prime months for obtaining that protection, but the buying window hasn’t been open much over the last two months.

Buyers need the buying window to open again. In this Trader’s Corner, we will look at why there is an increased chance that won’t happen. First, we must realize that the run-up in propane’s price is directly related to a rally in crude’s price.

Chart 1 plots propane prices at Mont Belvieu ETR and Conway against crude. Propane is in cents per gallon and crude in dollars per barrel. The focus of the chart is simply to reveal if the two commodities’ prices are trending together or not.

The chart reveals a strong correlation. Propane prices turned higher with crude at the beginning of June. Propane disconnected a little from crude in the middle of the month, moving in a more sideways or neutral pattern, while crude continued higher. But recently, propane has made up the ground and then some. We are hoping this latest strength in propane might be end-of-month tightness and that prices will get back to tracking more closely with crude at the start of July.

Our hope of lower crude and lower propane prices could be fulfilled if whatever drove the crude rally reverses. Crude started going up on reports that travel was trending higher this summer, leading to higher demand for gasoline and distillates. That has caused crude and refined fuel prices to move higher.

In this Trader’s Corner, we will focus on actual gasoline, distillate and total petroleum products demand to see if what the market believes about demand is happening.

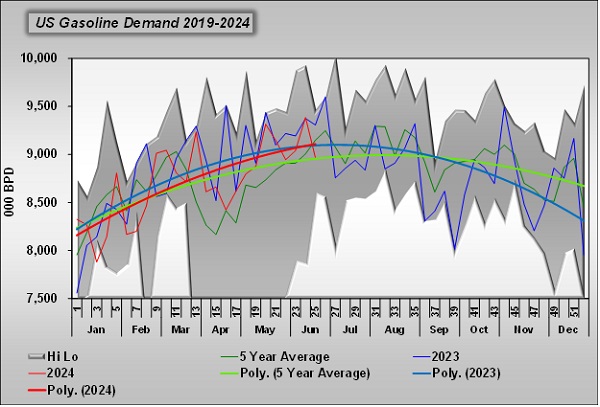

U.S. gasoline demand is about where it was at this time last year. However, we can see what has the market’s attention. The weekly data is very volatile, so we focus on the trend lines. The bold red trend line for this year started the year below last year and the five-year average. It is now well above the five-year average and slightly above last year. The trend would certainly put gasoline demand on a pace to be higher than last year in the third quarter.

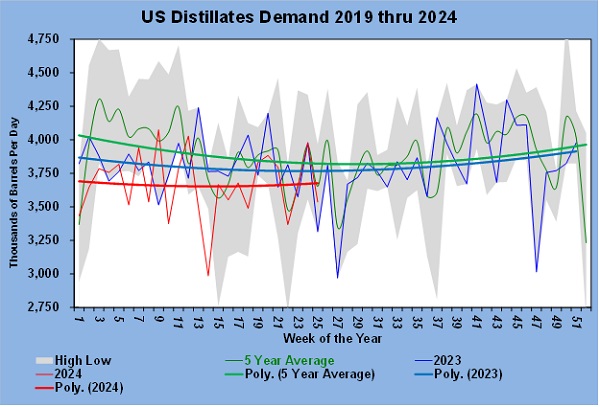

Distillate demand is running below last year and the five-year average. But, again, the trend line is on an upswing such that one can see demand in the third quarter likely to be much closer to last year and the five-year average.

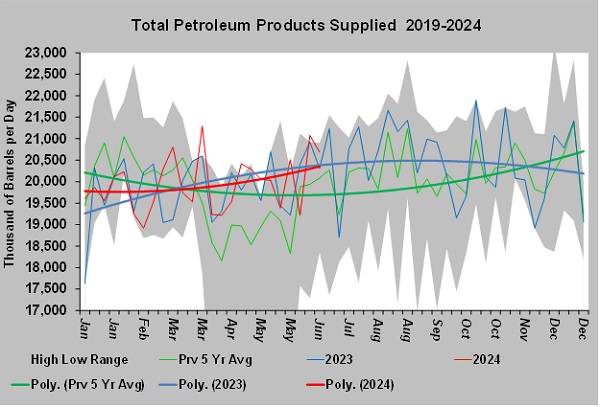

Chart 4 plots all petroleum products the U.S. is consuming. Once again, the bold red trend line supports the current hype in the market concerning demand. This year started below the five-year average but is now well above it. Total demand this year lagged the uptrend demonstrated last year during the first quarter. Demand in the second quarter of this year is showing a more bullish trend line and looks poised to break above last year during the third quarter.

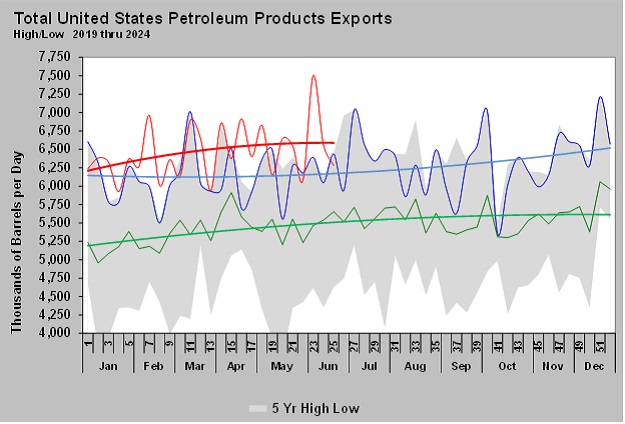

Given that increased travel demand is not just a U.S. phenomenon, and that the U.S. is helping our European friends with supply as they try to wean off Russian supply, exports are an important part of the equation as well.

Last year’s total petroleum products export rate was much higher than the five-year average as we provided help to Europe. This year’s rate has increased further.

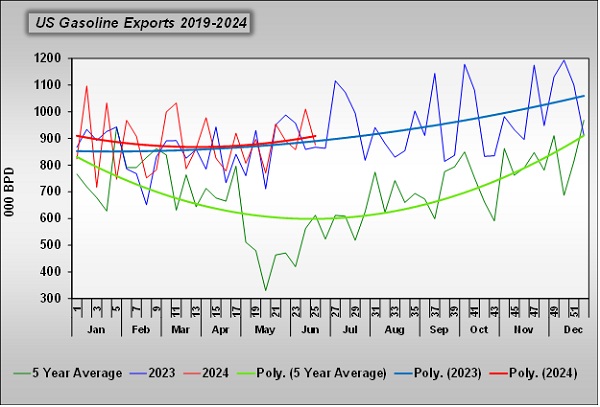

Perhaps the most important component of the total product exports is gasoline.

The gasoline export rate has been running higher than last year, though not as much as total petroleum products. Still, this year’s trend line has started separating to the upside from last year’s trend line over the last few weeks.

Based on this look, one must conclude that the outlook for higher demand for U.S. refined fuels in the third quarter is not overdone. The prospect of strong demand increases the chance that crude prices will stay firm during July and August. Thus, the buying window for propane may be hard to pry open again.

As we discussed last week, as propane retailers, we try to protect our customers from high prices by getting price protection on some of our projected winter sales volume. But when we do, we are speculating and therefore assuming the risk that prices will fall. Therefore, we must be careful in overreaching on a price.

This winter’s price protection is currently above where we would want to enter the market and has increased risk. We must hope the cost of price protection comes down in the coming months so we can get our customers protected at a reasonable number. Unfortunately, the study above means this may be a year where we go into winter with a lot less protection than we would want. Those who took some protection on the dip in late May can count their lucky stars and be happy they took advantage of the opportunity the market provided them, even if briefly.

The rest of us need to cross our fingers and hope something unforeseen undermines the value of crude. A resolution to the war in Ukraine or Gaza would be nice for a lot of reasons, with likely lower crude prices being one of them. An announcement by OPEC+ that they are increasing production would help. A slowdown in travel and thus a lowering of refined fuel demand as the summer progresses could benefit propane buyers.

In the meantime, we must be cautious about overreaching when taking a price protection position. As much as it is the right thing to do for our valued customers, at current numbers, the risk to lower prices is elevated. Anything we buy here will be doubly hard to average down in a falling market.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.