Crude could push propane prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, takes a look at the latest inventory draws and the reflected propane prices.

Catch up on last week’s Trader’s Corner here: Inventory draws support propane prices

In last week’s Trader’s Corner, we looked at the recent draws on propane inventories. Propane inventory, production, exports, imports and demand are known as propane fundamentals. Any commodity’s fundamentals have a huge influence on its price. Factors other than fundamentals, such as geopolitical events and the economy, also influence a commodity’s price.

Because propane is a byproduct, its price is also heavily influenced by what is going on with other commodities. No one is drilling propane wells. About 86 percent of propane comes from processing of natural gas liquids (NGLs) that come from crude and natural gas wells. The remaining supply of propane comes from refining crude. Even though most propane comes from natural gas, NGLs are valued relative to crude once they are processed. Therefore, the value of crude sets the base value of NGLs, and then their own fundamentals push their value up or down relative to crude.

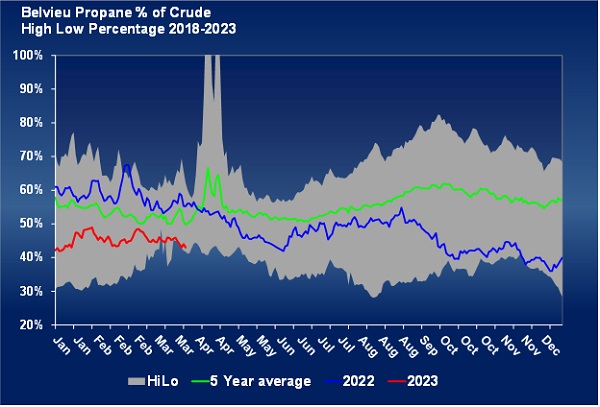

The fact of the matter is that propane fundamentals may not be price supportive because of too much supply relative to demand. That generally leads to high inventories, as is currently the case, and yet propane prices can still be high if crude’s price is high. Chart 1 shows the value of propane at the Mont Belvieu ETR price point as a simple percentage of West Texas Intermediate (WTI) crude’s prices. WTI is the U.S. benchmark crude.

The red line is the current relative value, and the green is the five-year average. The high level of propane inventories, and the expectation that inventories could build significantly this summer, have propane valued well below normal relative to crude. In March, crude hit a low of $64.12. Such a situation is the best of both worlds for a propane buyer – low crude prices and weak propane fundamentals.

On March 20, when that crude low was hit, Mont Belvieu ETR propane was valued at 72.75 cents. Since then, crude has rallied to over $80 per barrel, and propane is at 82.75 cents. Even though there have been a couple of higher-than-expected propane inventory draws during that period, propane’s value relative to WTI crude is actually slightly lower, dropping from 43 percent to 42 percent. This tells us the market really wasn’t influenced much by the inventory draws. For the most part, the draws prevented propane from losing value relative to crude. This is a perfect illustration of the influence of crude’s price on propane’s price. Propane values were climbing with crude more than they were rallying because of the inventory draws.

The timing of this Trader’s Corner is driven by the decision of OPEC+ to cut its production by 1.66 million barrels per day starting in May and continuing through the end of the year. It was announced the first weekend of April, and crude prices jumped $4.75 per barrel on April 3. The announcement had analysts raising their crude price forecasts for this year, with some predicting $100 for crude. Currently, propane is valued at 43 percent of WTI crude’s value. If crude goes to $100, propane would be valued at 102.38 cents per gallon. Propane would have to drop to 35 percent of WTI to stay valued at about where it is today.

Let’s put that in perspective. Over the past 15 years, propane has averaged 53 percent of the value of WTI crude. Over the past 10 years, the average has been 50 percent, and the past five years 52 percent. The lowest average for any single year was 48 percent in 2015. Propane fell to as low as 27 percent of crude that year. But that was a year when propane inventories rose to a record 102 million barrels. Propane production had simply outrun domestic demand and export capacity. Export capacity has since caught up.

As we said above, if crude moves to $100 per barrel, for propane to stay where it is currently valued, it would require propane to be valued at 35 percent or less of crude’s value. Going back to 1991, there have only been nine months when propane averaged 35 percent of WTI crude or less. Out of 387 months, only nine saw propane valued that low.

At this point in the year, propane inventory is currently higher than it was in 2015 when propane inventories built to their record high. But, again, we want to point out that export capacity is much higher now than it was then. Essentially the bottleneck has been removed. As prices go lower, there is going to be more call on U.S. propane. In 2015, the demand was there, but the export capacity was not. That is not the case in 2023.

Yes, propane could certainly be valued at or below 35 percent, keeping it at its current price or lower this year if crude goes to $100 per barrel. It has happened before, and it could certainly happen again. We have learned to never say never in this business. However, this analysis puts the probability of that into proper perspective. The key point is that, with propane, we simply cannot focus on its own fundamentals and make assumptions about its future price. Forecasting propane prices has always been complicated by its byproduct nature and the influence of crude. So even with propane fundamentals unsupportive of prices currently, a buyer must watch the developments in crude’s value very carefully.

Chart courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.