The buying window has closed

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Wednesday, June 26 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why the buying window for propane retailers has likely closed for the time being.

Catch up on last week’s Trader’s Corner here: Why get price protection at all?

U.S. propane prices have risen sharply this month, closing the buying window for this winter’s propane and significantly taking away the opportunity to obtain price protection for the following two winters at good numbers as well.

It is important to note that we are referring to buying price protection on gallons that a retailer does not have a corresponding sell against. As we said last week, even though it is justified speculation since it is designed to protect our valued customers from high prices, it is nonetheless speculation and has risks. Conversely, locking in supply costs on gallons that will be pre-sold to customers as close to simultaneously as possible is hedging and really holds little risk for the retailer.

Also, a retailer’s operational and business needs override anything we say here about prices. For example, a retailer may send out letters in June to customers to offer a pre-buy program. They must know the cost of supply before sending out the pre-buy letter to customers and therefore must lock down the supply cost at whatever the market gives them at the time that program is being rolled out. The only advice we can give is: don’t wait until a week before you must quote a price in a pre-buy letter to consider locking down price protection. A retailer could have locked in supply costs for a pre-buy program at much better numbers in late May.

The point is, when we write these Trader’s Corners, we are writing generically for a wide range of readers with varying operational situations and conditions. So, what we write may apply to general situations, but it may not apply to an individual retailer’s specific needs. A retailer’s competitive, operational and market conditions may be quite unique, and what the retailer knows about his specific market would always take precedence over anything we discuss.

Last week, we defined the buying season for propane retailers as May through August. Retailers generally take price protection for the winter months, defined as October through March, during those four summer months. This doesn’t mean that a retailer might not buy price protection in other months, even during winter months. Remember, December has averaged the lowest for propane prices over the past 10 years. But, that is a year-to-year phenomenon as December prices can be really high or really low depending on propane’s fundamentals.

During the buying season from May through August, the first of the two months stand out as the best buying months over the past 10 years. Those two months – May and June – have had the lowest monthly averages over the past 10 years, outside of December. Rising crude prices during the summer months and some hype about winter, and maybe a hurricane or two, can push prices higher in July and August. But, as we see in this Trader’s Corner, things don’t always go according to plan for buyers in those two prime months.

Last May and June went according to plan, if you will, providing the typical buying window, so let’s look back so we can contrast with what has gone on this year. WTI crude averaged $70.97 during those months and held fairly steady with a low of $70.64 and a high of $75.66.

Propane fundamentals also cooperated, allowing propane prices to stay low relative to crude. Propane at Mont Belvieu averaged 36.1 percent of WTI, and Conway averaged 34.8 percent. The long-term average at Mont Belvieu has been 51 percent during those months. Conway has averaged 49 percent. These averages resulted in favorable values throughout those months for getting price protection on October 2023 through March 2024 propane. For example, at this point last year, those months were valued at 66-cent Mont Belvieu and 68-cent Conway. That is about 14 cents below where this coming winter can be hedged.

So, let’s move to current conditions and look at what winter buys look like. As we write, WTI crude is trading at $81.17 and is valued at an average of $78 for the October 2024 through March 2025 time frame. That is $7 per barrel higher than where crude was averaged for the winter months last year. Propane is trading at 41 percent Mont Belvieu and 39 percent Conway. That is 4 or 5 percentage points higher than last winter’s average. Most importantly, propane for October 2024 through March 2025 currently has an average value of 82 cents at both Mont Belvieu and Conway. Again, that is about 14 cents higher than last year at this time.

We believe the buying window is open when price protection for the winter months can be taken at a price of 78.5-cent Mont Belvieu and 76.8-cent Conway. Again, at this point last year, we would have been under those thresholds by 12.5 cents and 8.8 cents, respectively. Those prices would have made us aggressive buyers of winter price protection. The current price is above our threshold and thus the buying window is closed.

Propane was not in the buying window at the beginning of May but got there briefly during late May and early June.

Crude has been on a strong run since June 5, which has elevated propane prices including the winter months. WTI was at $79 on May 1 and dropped to $73.25 by June 4, bringing down propane prices and opening the buying window briefly, but is now at $81.17, slamming the buying window shut.

Since June 4, propane has rallied with WTI. June through September propane is up 12.25 cents; October 2024 through March 2025 is up 10.7292 cents; October 2025 through March 2026 is up 8.5208; and October 2026 through March 2027 is up 8.9583 at Mont Belvieu ETR. Those increases have slammed the window shut for this coming winter.

The buying window for the 2025-26 winter is barely cracked open at Mont Belvieu and shut at Conway. Both windows are open for the 2026-27 winter but not nearly as wide as they were on June 4.

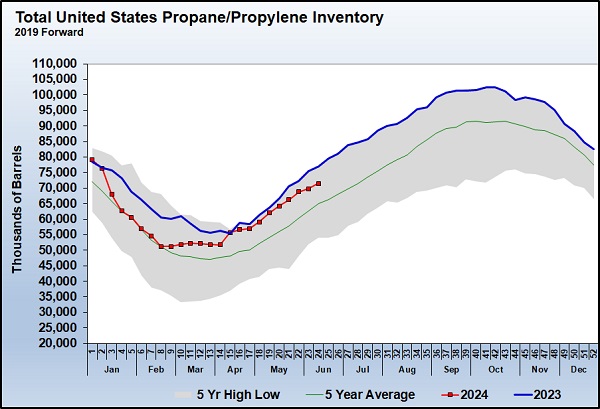

This May and June by and large haven’t gone well for buyers of price protection. That puts us in wait-and-hope mode if waiting is an option. Buyers must hope for a pullback in crude, but that is going against crude’s typical pattern of rising over the summer months when refinery throughput is high, thus chewing up a lot of crude. Buyers also must hope propane fundamentals turn more in their favor. Inventories are in good shape and propane production is very good. Yet, propane inventories have been having below-average builds recently.

Propane inventories were in great shape at the start of April and looked as if they would soon be running higher than last year. Though they are still comfortably above the five-year average, inventories are trending below last year’s build rate. That is not what buyers want to see.

While buyers are now in hope mode for the buying window to reopen, the trends are not going in their favor currently. Buyers will be hoping for things like an end to the wars in Gaza and/or Ukraine quickly, but those seem like big asks now. Or a drop in energy demand this summer. Or news that OPEC+ is not adhering to production quotas. Or a big drop in U.S. propane exports.

There is no shortage of events that could help buyers, but right now, fate appears to be smiling on sellers.

All images courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.