Part II: How US energy has changed since Russia invaded Ukraine

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, continues his examination of why U.S. energy sources have changed since Russia invaded Ukraine.

It has been two months since Russia invaded Ukraine. In response to the invasion, the U.S. and its allies, especially those in Europe that were dependent on Russia for energy, have been trying to reduce Russian energy imports to punish it for its actions. The U.S. has pledged to help Europe with its energy needs in an effort to supplant Russian energy. You may want to take a look at last week’s Trader’s Corner as it sets up what we are discussing.

We listed seven data points we’re going to check to see how the U.S. supply picture is changing to meet its stated goal. Last week, we found out that refinery throughput has increased, but it has not been enough to offset the lost supplies from Russia.

U.S. refinery capacity utilization is up, but part of the reason is that more U.S. refinery capacity is being shuttered. U.S. refinery capacity is down 202,000 barrels per day (bpd) in the past 12 months. At 17.941 million bpd, capacity is well down from the peak of 18.976 million bpd. That’s more than 1 million bpd of capacity that has been lost as older, less efficient refineries

are permanently shut, and new capacity is not being built. Capacity utilization dropped from 91 percent to 90.30 percent last week. Under the circumstances, we believe a utilization rate of close to 95 percent should be the goal.

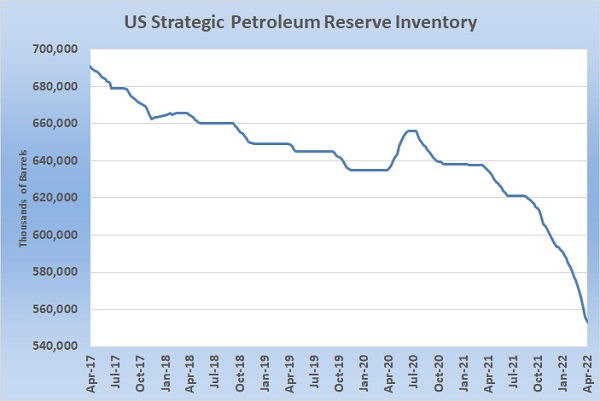

The next data point on our list is U.S. crude inventory. There are two distinct areas of crude inventory: the Strategic Petroleum Reserve (SPR) and commercial inventory. The SPR is crude bought by the government and stored for emergency use. Commercial stocks are those available for refining and other commercial purposes.

The SPR held 553.07 million barrels last week.

The drop in the SPR is alarming. At its maximum level, the SPR held 726.617 million barrels. It has come down 173.547 million barrels from its high and is down 137.740 million barrels in just the past five years. It is already down 80.357 million bpd in the past 12 months.

The Biden administration has made available another 180 million barrels from the reserve over the next six months. That will bring the reserve down to 373.07 million barrels, a 32.54 percent reduction from the current level. It is unfortunate and concerning that the SPR is being used more and more as a political tool to manipulate pricing than its purpose as a true emergency reserve. At the end of the drawdown over the next six months, the SPR will be down 48.7 percent from its peak.

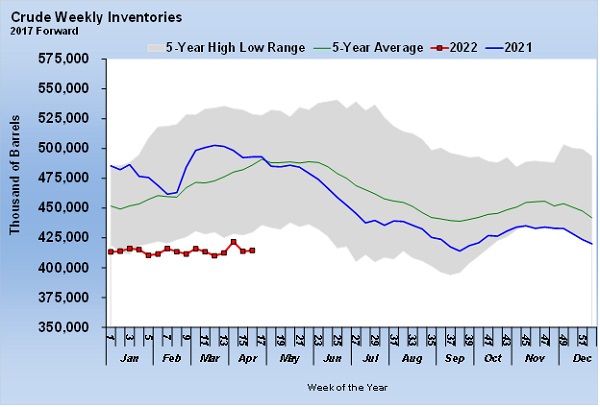

On the commercial front, conditions aren’t much better.

Current commercial inventory is setting five-year lows for this time of year. It is also not building as it usually does this time of year. U.S. crude production is down 900,000 bpd from this point last year and 1.3 million bpd from the pre-pandemic peak. We will get into more detail on crude imports and exports in future discussions, but so far this year, the U.S. has increased crude

exports by 87,000 bpd and increased crude imports by 519,000 bpd. That is only a net gain of 431,000 bpd in crude supply and obviously doesn’t replace the lost production, which pressures inventories.

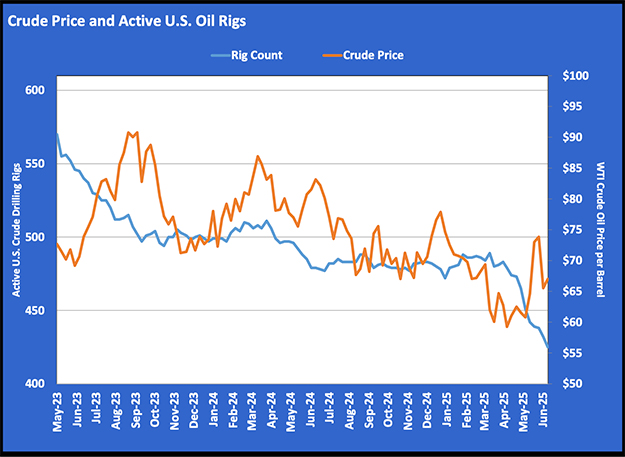

The draws on the SPR are an attempt to replace production. In fact, it could make the situation much worse. If U.S. production does not increase enough in the next six months to meet commercial demand, build commercial inventory to normal levels and replace the SPR, prices could go even higher. That is a very tall order. To this point, the government is not signaling it is foreseeing this

possibility. In fact, it is restricting more areas from drilling and just last week proposed making it easier for the FTC and states’ attorneys general to go after oil companies for price gouging. So far, we are not aware of a single government initiative to increase crude production.

In the context of the subject of this research, which is to see how the U.S. is doing in helping Europe wean itself off dependency on Russian crude, we do not appear to be progressing. To have an impact on that front, the U.S. must increase crude production. Increased production will allow more of what we import to go to Europe. With enough effort in that area, the U.S. could actually

export more crude to Europe. But data so far is suggesting there is no sense of urgency to address production by the government or industry.

Read the rest of the series here:

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.