Evaluating the state of crude prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates the current state of crude prices through 2024.

Catch up on last week’s Trader’s Corner here: Propane retailers fulfill ‘dual mandate’ to manage price risk

Catch up on this rest of this Trader’s Corner series here:

- Part II: Evaluating the state of crude prices

- Part III: Evaluating the state of crude prices

- Part IV: Evaluating the state of crude prices

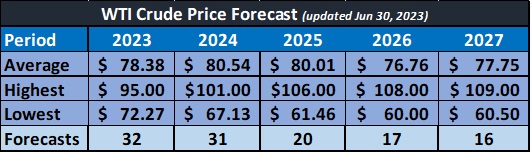

A recent poll of crude analysts shows a decline in expected crude prices this year and next.

For 2023, the average price projected by 32 analysts on June 30 was $78.38. The highest average price for the year was $95 and the lowest $72.27. Crude has averaged $74.69 so far this year, so we are not worried about a $95 average for the year happening. However, our bias is that crude is going to at least maintain its current average or have a higher average by the end of the year.

Crude prices have been held in check this year on expectations that weak economic conditions are going to keep crude demand growth down or even reduce it. China’s economy has struggled much more than expected as it opened after maintaining strict COVID-19 related lockdowns far longer than other countries. Economies elsewhere are struggling to get high inflation under control. That struggle includes central banks raising interest rates to slow economic activity. The worries about demand destruction are certainly legitimate.

On the supply side, Russian and Iranian crude continues to move to market despite sanctions. Despite all the political posturing about wanting to punish Russia for invading Ukraine or punishing Iran for its threats to stability in the Middle East, nations are happy to see the crude flowing. Without the crude flowing, inflation would be worse and the negative economic impact on the collective world economy would far outweigh the political benefit of limiting revenue to Russia and Iran.

OPEC+ has responded to demand threats and more supply from Russia and Iran by trying to support prices with production cuts. It currently has production targets that are about 5 million barrels per day (bpd) below its collective benchmark production rate. Kingpin Saudi Arabia voluntarily cut a million bpd more than it was committed to under OPEC agreements during July and has extended that voluntary cut into August. Russia has also announced it will cut 500,000 bpd from its exports in August. Its production will not change; it will simply consume more at home.

Also, in August, the U.S. government will flip from transferring crude from the Strategic Petroleum Reserve (SPR) into the commercial market to filling the SPR, which will put it in competition with commercial markets for available supply. In August and September, it will purchase around 3 million barrels per month for the SPR, and it is expected to keep those purchases going through the end of the year. Since March, the government has transferred a total of 24.42 million barrels of crude from the SPR to commercial markets as mandated by the FAST Act. The transfers will end this month, when a total of 26 million barrels have been sold. The revenue generated makes sure the U.S. federal government has the funds to support state transportation projects.

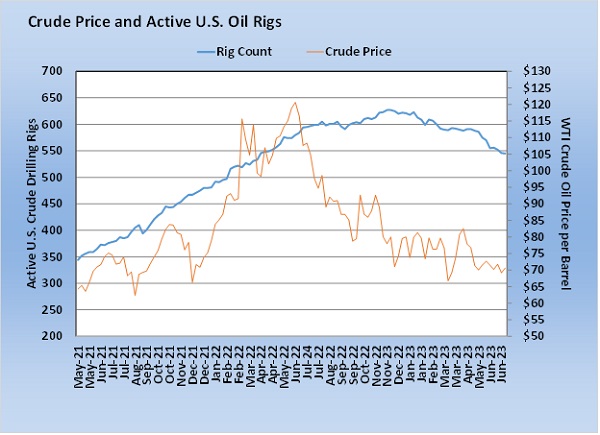

U.S. crude producers have remained remarkably disciplined, and drilling activity suggests they will remain so. The U.S. Energy Information Administration’s (EIA) weekly estimates on crude production have averaged 12.261 million bpd this year. That is well below the peak production of 13.1 million bpd before the pandemic. In its Short-Term Energy Outlook, the EIA is projecting U.S. crude production will average 12.61 million bpd this year and 12.77 million bpd next year.

U.S. producers have been reducing the number of drilling rigs employed to drill crude wells despite production running below peak. For the week ending June 30, there were 545 rigs drilling for crude in the U.S. That is 50 rigs below the same week last year. The bulk of U.S. production is coming from shale formations that have a fast depletion rate. It takes a lot of new drilling to replace depleted wells. We are not sure how many wells would have to be drilled just to maintain production, but we are certainly trending in that direction.

“The bulk of U.S. production is coming from shale formations that have a fast depletion rate.”

So, there are things in the works on both the supply and demand side that make us believe that the crude supply/demand balance will remain tight enough to keep crude prices about where they are now or higher. For all the concerns about demand destruction last week, the U.S. consumed 771,000 bpd more crude products than it did the year before. Year-to-date total petroleum products demand is down 541,000 bpd, but the current trend suggests that gap will close as the year progresses.

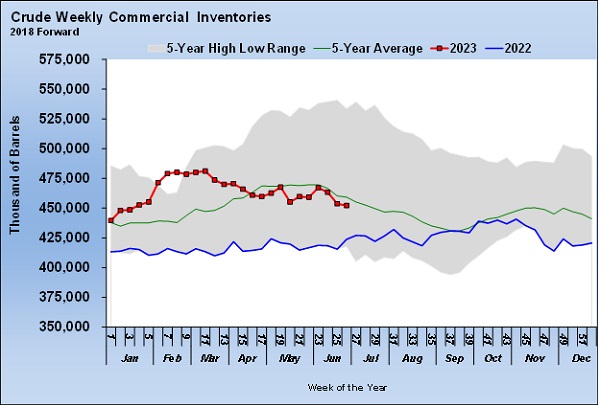

Chart 3 shows U.S. crude inventory. The surplus that was present at the beginning of the year, that was helped by the massive releases from the SPR, is eroding away. Inventory started coming down once those releases went away. The resumption of smaller releases since May has not prevented inventory from trending lower. U.S. demand for petroleum products is stronger at this point in the year than it was at the beginning. Refinery capacity is up, so the ability to chew up more crude is present. As we pointed out above, the pressure on inventories could accelerate starting in August.

In our view, the massive release from the SPR provided a false sense of security concerning crude supply. One must be concerned that, without those releases, the inventory trend will continue toward last year’s line. In July of last year, crude prices were at $100 per barrel. We are hopeful we will not get anywhere near that price this year. However, you can see from all we have discussed above why we believe that crude’s price is more likely to increase from where it is now than decrease.

Again, if crude prices stay where they are or trend higher, with propane so beaten up against crude, it won’t take much improvement in the propane fundamental picture to see a rapid rise in propane’s price. Propane is valued at an extremely low 31 percent to 33 percent of WTI crude. We are seeing a little rally in propane prices currently as propane inventories have built below average in two of the last three weeks. We have seen predictions that the builds in propane inventories are going to return to an above-average pace before the summer is through. If they don’t, we suspect propane’s value relative to crude will climb to at least 40 percent in short order.

Remember, the last two times propane was valued where it is currently, crude was trading at $45 per barrel. If our prediction that crude will remain above $70 going forward holds up, the pressure to improve propane’s value relative to crude will be acute. That means a little improvement in propane’s fundamental conditions likely will have an oversized impact on its pricing. A resumption of the above-average propane inventory build would prevent that from happening, but more upside price risk is currently present than we had been seeing.

Catch up on this rest of this Trader’s Corner series here:

- Part II: Evaluating the state of crude prices

- Part III: Evaluating the state of crude prices

- Part IV: Evaluating the state of crude prices

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.