Propane finding domestic, foreign buyers

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Wednesday, May 29 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates propane prices and why there has been a separation in price direction between propane and crude.

Catch up on last week’s Trader’s Corner here: Expected La Niña could heighten hurricane season

Propane prices have been on the rise since May 16. Runs like this happen, but generally, crude is leading the way this time of year.

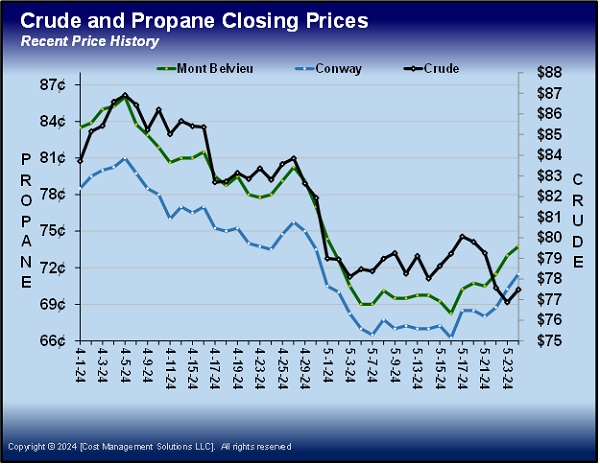

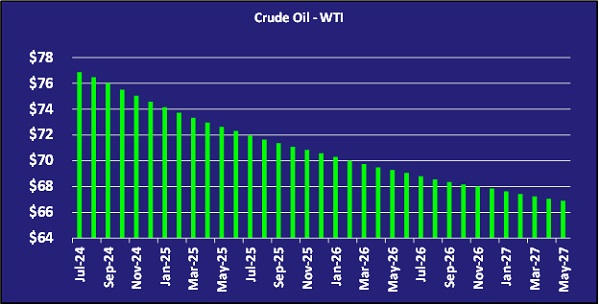

Chart 1 plots Mont Belvieu and Conway propane prices against WTI crude’s price. The price direction of propane and crude are strongly correlated, as most of the chart of recent prices shows. The exception is at the end of the chart, which shows the recent increase for propane, while crude prices moved lower.

Now, if this chart reflected prices in the middle of winter, the separation between propane and crude would not be surprising. Of course, winter is the high-demand period for propane and the slow-demand period for crude. We all know winter demand can put some pressure on propane supplies from time to time and cause the kind of separation reflected in Chart 1. Thankfully, because propane has been so oversupplied in recent years, the separations have been relatively short-lived, not turning into those dreaded spike situations.

The thing is, it’s not the middle of winter. It’s May, nearly June. If anything, this time of year we would expect any separation in price direction between propane and crude to be crude going higher, while propane prices go lower. It’s the offseason for propane, while crude demand is picking up as refineries come out of seasonal maintenance and begin building inventories for the summer driving season.

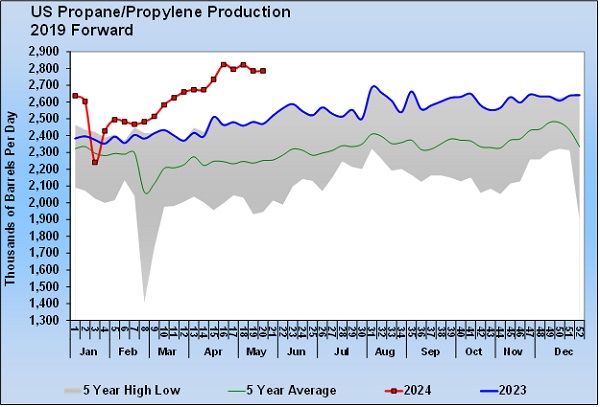

So, is there some issue with propane supply? That’s hardly the case. Propane inventories are near five-year highs.

And there are certainly no problems with propane production. It recently set new all-time highs and isn’t far off from those levels. So, what gives? We believe it’s simply that propane’s value got low enough that buyers couldn’t pass it up. There’s been a lot of buying interest domestically from propane retailers, but foreign buyers of U.S. propane also have been active.

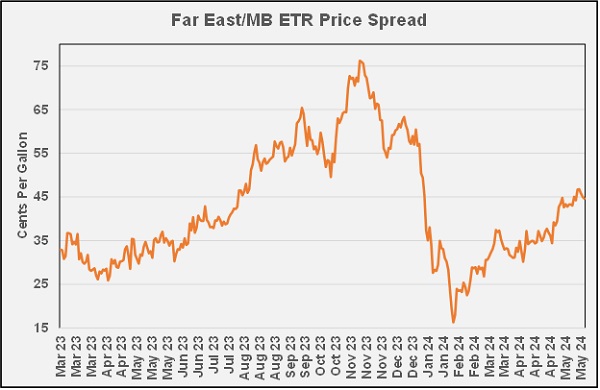

Chart 3 shows the price spread between Mont Belvieu ETR propane and the Far East. Obviously, export economics have greatly improved. A chart of the price spread to Europe would also show an increase, and buyers from there have been active in the U.S. market as well.

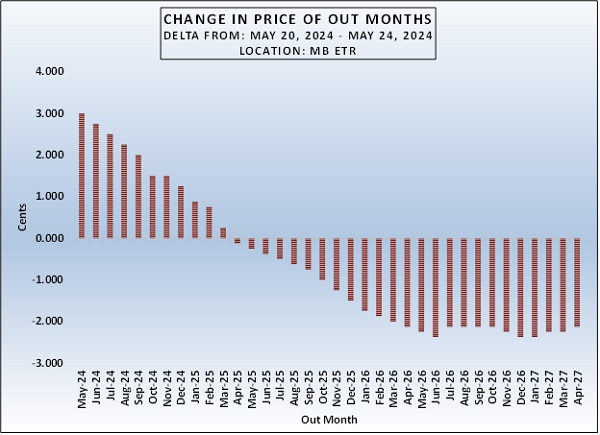

The good news – if there’s ever good news when propane prices rise – is that the increased cost to hedge propane has generally been contained to the nearest months. Chart 4 shows the change in out-month propane prices at Mont Belieu ETR last week.

The price of the out months in the front of the curve has gone up. The primary pressure has been in the nearest five months, which doesn’t hurt most propane retailers trying to get price protection on their winter sales. The increase in cost to hedge from October to March has only gone up about a penny. Someone looking at the May propane price could easily assume that hedging for this winter has been going up a lot during this rally, but so far, the gains in the value of the winter months have been contained.

If you like that positive spin, then you’ll be ecstatic with the price changes beyond March 2025. The value of propane beyond that month has decreased this week, making hedges further out look even better. So why would this be?

Foreign buyers are largely looking for supply for propane dehydrogenation plants and other petrochemical facilities. Those folks are going to be buying near-term supply for their respective facilities. That concentrates their buying interest for the next few months.

Additionally, propane fundamentals have a lower impact on pricing further out than crude. Crude prices have been going down, and its price curve is backward-dated, meaning the price of crude is highest in the nearby months.

This is a typical price curve for crude in a well-supplied market. Those lower crude prices further out are helping hold down propane prices out there as well.

So yeah, propane prices have been going up, but not all the news is bad. This gives us a good idea of why it’s happening at such an odd time and why most of the damage has been done in the nearby months. Keep in mind that weaker economic conditions will hurt foreign buying activity and leave more supply domestically. Should that develop, it should take some of the recent heat off prices.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.