Propane inventory posts largest draw on record

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates the largest inventory draw on record.

Catch up on last week’s Trader’s Corner here: Closing propane forward positions

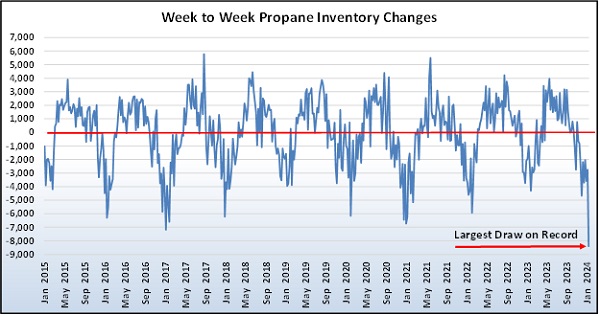

One of the challenges of writing Trader’s Corner is choosing a new subject each week. When the largest propane inventory draw on record occurs, the choice is made for you.

For the week ending Jan. 19, the U.S. Energy Information Administration (EIA) reported an 8.399-million-barrel draw on inventory. The EIA changed what it included in inventory as of January 2015 so our research only goes back to that date. The previous high draw had been 7.188 million barrels for the week ending June 13, 2017.

Some may be thinking about the draw just five weeks ago of more than 9 million barrels. But that draw included about a 6-million-barrel adjustment by the EIA. Chart 1 reflects inventory draws as they should have been reported. The adjustment still had a major impact on the way inventories were looking. Now, the record draw makes inventory positions even tighter.

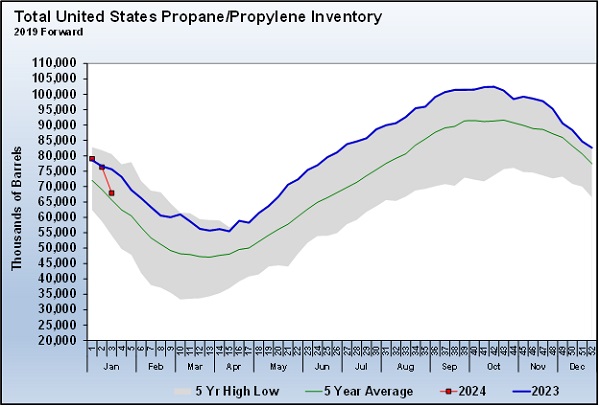

The good news for buyers is that inventory went from very high to about normal over these past few weeks.

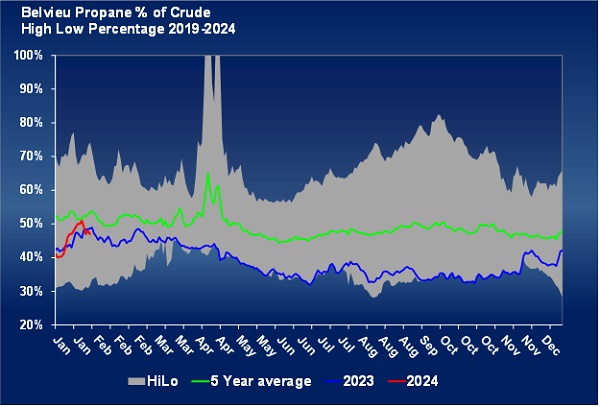

Inventories were setting five-year highs most of last year, which had propane prices suppressed. Propane has been a cheap Btu compared to other energy sources because of its high inventory position, low domestic demand and robust production. Its value relative to crude was at the lower end of the typical range through much of last year, dropping to around 30 percent. During the spike in Mont Belvieu prices the week before last, the relative value reached 50 percent but has now slipped back to around 47 percent.

Chart 3 shows the current relative valuation is below normal for this time of year and even below where it was at this time last year. The point is that the adjustment in inventories and the record-breaking draw that have occurred over the past five weeks have not caused propane prices to get out of hand. They have pushed valuations back closer to normal, to be sure, but not off the rails.

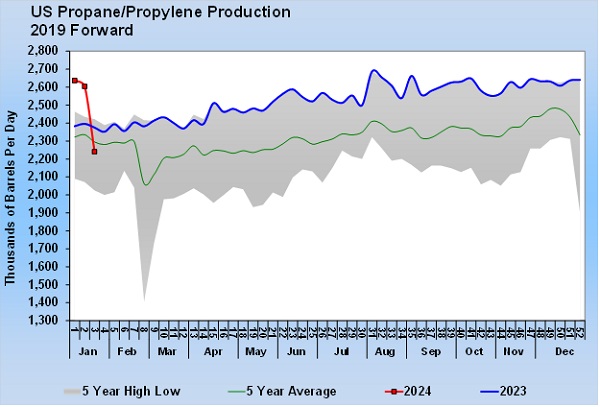

The record-setting draw on inventory had plenty of contributing factors. Domestic and export demand was up for the week. Domestic demand was up just 130,000 barrels per day (bpd), far less than expected given the cold weather. Meanwhile, exports were up 273,000 bpd. We found that surprising given export economics aren’t favorable. On the supply side, propane imports were down, likely a combination of logistical issues and a need for propane in Canada. But the biggest factor contributing to the draw was a 363,000-bpd drop in U.S. propane production.

Chart 4 shows the record-high levels of propane production before the storm. That level of propane production can power us through just about any uptick in demand. But in this case, it was the cold weather impacting crude and natural gas production, refining and natural gas processing, natural gas liquids fractionation, and transportation that was the key issue.

The impacts of the weather were not completely behind the market with the data gathered on Jan. 19. There could be another above-average draw on inventory next week, but after that, production should get back to normal.

Propane prices jumped when the EIA released its inventory report. Traders seem to have gotten over the shock, and prices are more stable now. We would not expect prices to return to their levels before this latest run for the remainder of winter given that inventories are now in the normal range. But they could settle in a little lower than where they are now if weather conditions and propane production return to normal.

The developments of the past few weeks mean a very bearish view of propane is not warranted at this time. At the same time, the changes that have moved things closer to normal do not mean a very bullish view of propane is warranted. Unless the weather goes dramatic again, things are likely to coast along for the rest of winter.

After winter, it will be a matter of how exports go in determining propane price direction. Propane production should return to record levels, and domestic demand is likely to fade away to the lackluster levels seen in the past few years. That will make exports the wild card and the key to balancing propane supply and demand. How that balancing act goes will determine if pricing stays more normal this summer or takes on a more bearish slant again.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.