Propane inventory adjustment could spike prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the current state of U.S. propane inventory and the expected impact on pricing.

Catch up on last week’s Trader’s Corner here: Managing supply price risk in the second half of winter

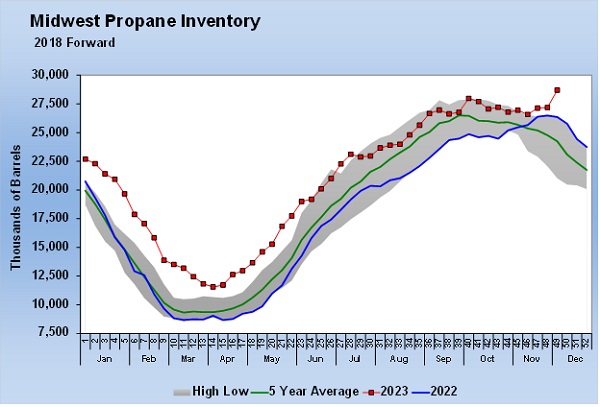

Regular readers of Trader’s Corner will recall that, just before Christmas, we were lamenting the lack of winter demand in recent years. We were nostalgic for a winter with tension and angst because of supply tightness. In that article, we included Chart 1 on Midwest propane inventory.

We followed Chart 1 with this statement: Midwest demand is largely weather dependent. What the heck is that over the past three weeks? Need we remind anyone this is occurring in December? Bah humbug!

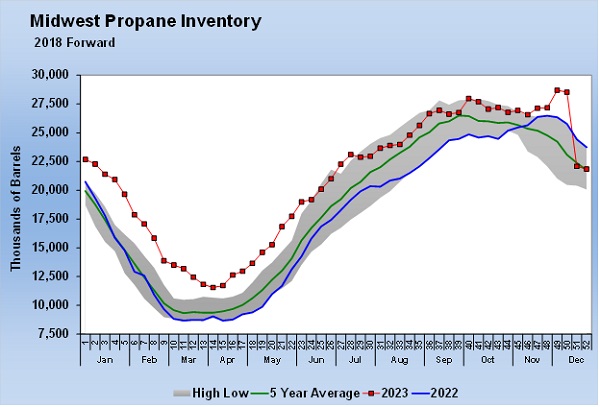

Don’t tell your grandchildren, but apparently whining does pay off. The U.S. Energy Information Administration (EIA) made an inventory adjustment in its report for the week ending Friday, Dec. 15. The data for that report was released on Wednesday, Dec. 20. Apparently, Midwest inventory had become overstated starting with the week ending Nov. 15. For the week ending Dec. 15, the EIA reported just over a 9-million-barrel draw on total U.S. propane inventory. The bulk of the draw came from Midwest inventory, which included about a 5-to-6-million-barrel adjustment.

Chart 2 is where inventories stand after the adjustment.

Obviously, the adjustment changes the complexion of the inventory situation. If we focus on the red line for the year, Midwest inventories were above both 2022 and the five-year average levels all through 2023. Now, inventories are 1.893 million barrels, 8 percent, below 2022 and 0.2 percent below the five-year average.

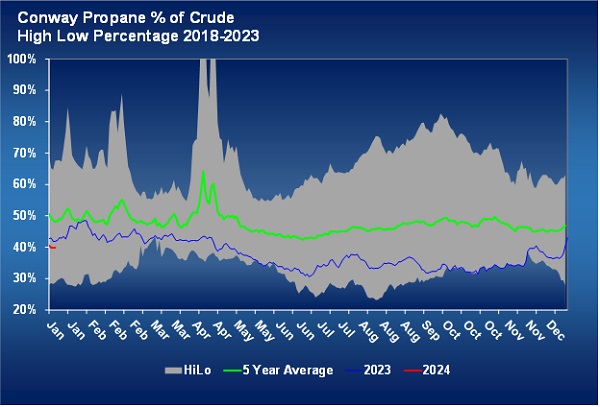

Chart 3 plots propane’s value relative to crude on a simple percentage basis. Over the past 10 years, Conway has averaged 47 percent of the value of West Texas Intermediate (WTI) crude. The relative value is slightly higher this time of year at around 50 percent. In 2023, Conway averaged 38 percent of WTI crude. That was understandable given the persistently high level of inventories all through the year.

Presently, Conway is valued at 40 percent of the value of WTI crude. With the inventory adjustment and the current level of inventories, is that justified? In November, Conway was valued at 34 percent of WTI crude and moved up in December. But Conway’s price hasn’t responded much to the inventory adjustment.

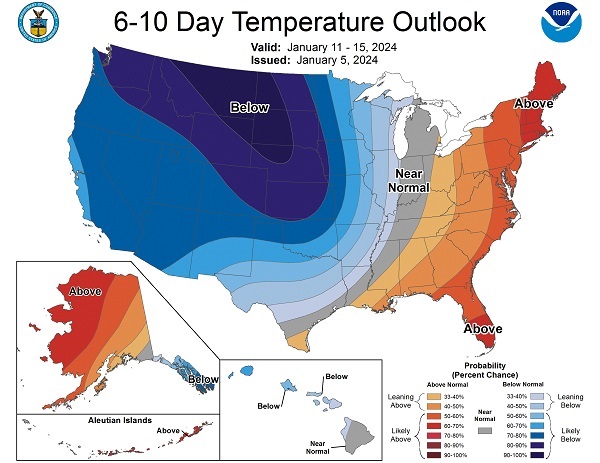

The temperature probability in Chart 4 shows increased potential for weather-related demand in the Midwest. The outlook applies to the Jan. 11-15 time frame.

This demand may result in a call on Midwest propane inventories that will bring them even further below the five-year average. Our concern is that the market, with a little nudge from the weather, realizes that Conway propane valued at 40 percent of WTI is not appropriate given the significant change in inventory position over the past few weeks.

If crude stays at $74 per barrel, and Conway gets revalued to 47 percent of WTI, it would be a 12-cent gain in Conway’s price. Given the situation, we think short-term price protections for propane supplies valued relative to Conway are appropriate for January. That can be done by filling tanks early, doing a pre-buy or using a forward/swap to cover short-term needs. To us, there is an increased upside price risk that is worth managing in some way.

Further, we don’t think the risk is necessarily confined to the Midwest. If traders feel Conway needs to be revalued, that likely will carry over to Mont Belvieu as well.

Unless noted, all charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.