Top 10: The best of Trader’s Corner 2023

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Brian Richesson, editor in chief of LP Gas magazine, looks back at the top Trader’s Corners of the year.

Catch up on last week’s Trader’s Corner here: Calling on winter propane demand

Propane traders use data to make important decisions on when to buy and sell their product. We at LP Gas magazine use data to learn about the articles that most interest our readers. This helps us make decisions on what topics to cover in the magazine.

As the year comes to a close, we present the top Trader’s Corner articles from 2023, ranked by page views on the LP Gas website. Except for our Propane Suppliers Guide, which we included at No. 3, these articles were written by Mark Rachal of LP Gas partner Cost Management Solutions (CMS).

If there’s a topic that you’d like for us to cover in 2024, please email me at brichesson@northcoastmedia.net. Happy holidays, everyone.

#1: Hot topic: Forward price curves

Report date: Jan. 3

A forward price curve reflects the value of the market in current and future months. It is common practice to trade propane in a 36-month window. A forward curve should not be seen as a predictor of future prices. Conditions will change, and the curve will change with those changes in conditions. At one point in time, considering all they know about the current market, buyers and sellers will come together to make deals that have established the value of propane. Trader’s Corner in January explored the shape of the curve and what it means for propane buyers. Read more: Watch propane price curves to chart a course

#2 Hot topic: Timing the propane buy

Report date: May 8

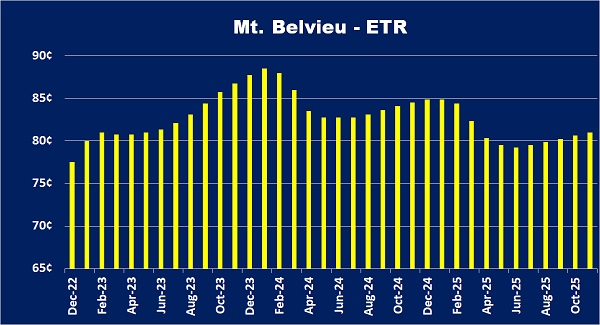

This Trader’s Corner compared the then-current price of Mont Belvieu – around the 70-cent mark – with its May price average over the past 10 years. That 10-year May price average for Mont Belvieu was 75.6426 cents. The monthly average for May propane was lower than its then-current price five times, including May 2020, at the beginning of the pandemic. This Trader’s Corner found that during the past 10 years, May propane was often valued higher than the current price, and those times when it wasn’t resulted from exceptional situations. Many market forces were at play to begin May 2023, and Trader’s Corner offered fuel for thought for retailers wondering if the time was right to buy propane. Read more: Is it a good time to buy propane?

#3 Hot topic: 2023 Propane Suppliers Guide

We thought this was a relevant resource to include on the list, and our reader data confirmed it. Our Suppliers Guide is always a popular directory of the industry’s top wholesale propane sources. Propane retailers can find our 2023 guide here, and we’re in the process of preparing the latest guide with updates for our February 2024 issue. Read more: 2023 Propane Suppliers Guide spotlights wholesale propane providers

#4 Hot topic: Record propane exports

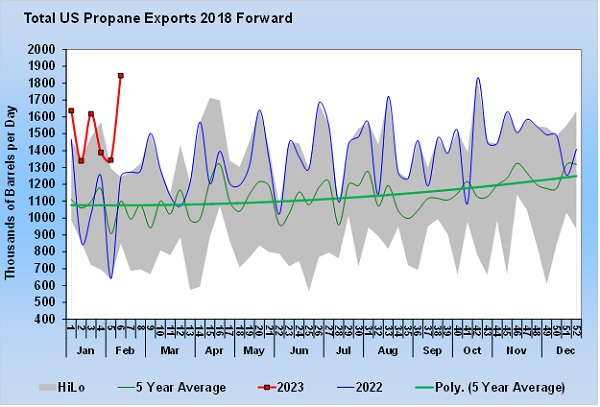

Report date: Feb. 22

The U.S. Energy Information Administration (EIA) reported the U.S. exported a record 1.845 million barrels per day (bpd) of propane. Overseas, propane values were outstripping the U.S. market, keeping demand for U.S. propane high. This Trader’s Corner tracked propane values and price spreads at points around the world. “It is amazing to have seen the transition of the U.S. propane industry over the years,” Rachal wrote. “When we began [writing Trader’s Corner], the U.S. was a net importer of propane.” This Trader’s Corner served as a reminder to propane retailers about global influences on the U.S. market. Read more: US propane exports hit record as domestic demand plunges

#5 Hot topic: Record propane production and the supply chain

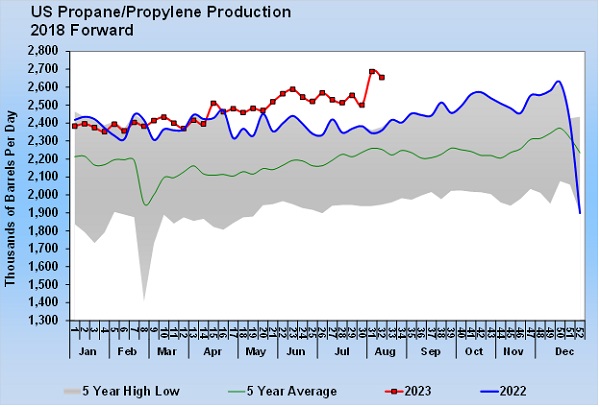

Report date: Aug. 21

This Trader’s Corner turned into a valuable lesson about the propane supply chain, but it started with a discussion about production. For the week ending Aug. 4, the U.S. produced a record 2.687 million bpd of propane. Rachal described that kind of production as a “game-changer for propane fundamentals if sustained.” CMS believed the increase in production was due to the increased fractionation capacity around Mont Belvieu. When the firm reported this development in its Propane Price Insider report, it received inquiries about propane production. “We realized from those discussions the need to review the propane supply chain,” Rachal wrote. This report offered a well-explained refresher about the propane supply chain. Read more: Propane production and where it comes from

#6 Hot topic: A bearish view of winter

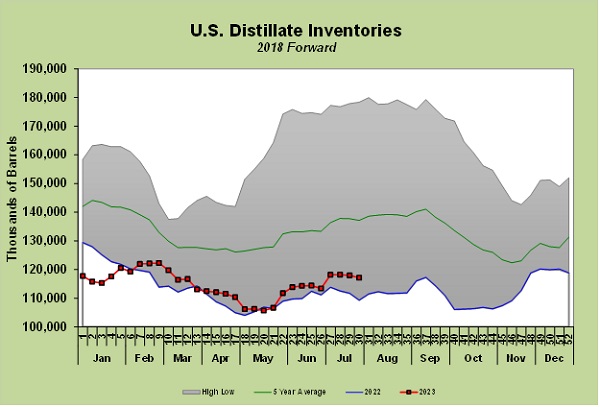

Report date: Oct. 16

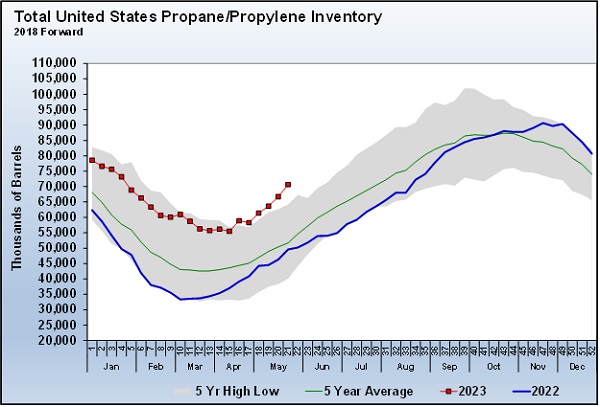

Rachal recounted a challenge to CMS’ increasingly bearish view of the upcoming winter’s propane prices. The challenge was based on exceptionally strong propane export activity and the potential for higher crude prices. The firm’s bias toward a weaker pricing environment was based primarily on its outlook for weak domestic demand, owing to weak crop drying, El Nino conditions impacting demand in the North, a weakening economy and a financially stressed consumer struggling with high prices of goods. “We enter the winter of 2023-24 with record high propane inventories and threats to domestic demand,” Rachal wrote. “If higher propane prices develop this winter, they likely will be driven by higher propane exports and higher crude prices.” Knowing the reasons behind high exports – shared in this report – will help retailers determine the future price of propane, he added. Read more: Weak propane prices expected despite strong export activity

#7 Hot topic: Propane exports and winter pricing

Report date: Nov. 6

Rachal wrote that propane exports would be key to how the winter plays out from a pricing standpoint. He called it an odd statement given that weather and heating demand are logical price drivers at this time of year. Recent Trader’s Corners had already expressed concern about weak domestic demand this winter amid record highs for U.S. propane production. Moreover, new global demand, especially from China for propane dehydrogenation plants, was leading many analysts to expect propane exports to continue to rise. Be on the lookout for 3-million-barrel-plus propane inventory draws, Rachal warned. “If we get those on a regular basis, more price protection for the second half of winter becomes viable,” he wrote. “Until then, we trade the current high inventory position and make the other data points prove they can happen.” Read more: Propane exports key to winter pricing

#8 Hot topic: Comparing propane and heating oil

Report date: Aug. 14

Because of Btu content differences in various sources of energy, it’s not always easy to make a price comparison. To do so, you must convert other energy sources to a propane Btu equivalent basis. If you do that, Rachal wrote, you will see quite readily that propane is a cheap Btu. This conversion showed how propane (71 cents Mont Belvieu/70 cents Conway) compared at the time to crude (131 cents), heating oil (208 cents), gasoline (215 cents) and natural gas (25 cents). Apart from natural gas, propane is significantly less expensive than other energy sources. But because propane retailers (and Trader’s Corner readers) either sell some heating oil or compete against it, Rachal focused on propane’s comparison to heating oil and explained why propane holds the advantage. Read more: How propane compares with heating oil

#9 Hot topic: Inventory and the price curve

Report date: June 5

EIA reported a huge propane inventory build (of 3.957 million barrels) for the week ending May 26, revealing a trend toward higher inventories and lower propane prices. Rachal compared the difference in inventory at that time to last year’s low inventory position and bullish market and showed the impacts to the forward price of propane. The bottom line: Buyers were in a much better position this year than last. The high price to hedge last winter caught a lot of buyers off guard, resulting in many taking longer-term risks to get the cost of last winter’s hedges down. This year presented an opportunity to take advantage of a favorable pricing environment throughout the price curve. Read more: Inventory position has changed price curve

#10 Hot topic: Domestic propane demand

Report date: Aug. 7

Analysts look for what’s different in the data from what they’ve seen historically. They look for what’s unusual. This Trader’s Corner had Rachal searching for answers for anomalies in domestic propane demand. Data showed exceptionally low propane demand through the first half of the year yet higher heating degree-days compared to the previous year. Propane demand in July also stood out as this year’s demand line broke above last year’s demand line. Rachal wondered if consumers had been holding lower inventories in their tanks and were demanding more in preparation for winter. Whatever the reason, the demand boost also raised propane values – and the trend is a data point worth watching. Read more: Domestic propane demand is recovering

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.