Propane is a cheap Btu

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses propane’s value to crude and inventory options this winter.

Catch up on last week’s Trader’s Corner here: Potential end-of-winter inventory positions

Before the development of shale fields, U.S. crude and natural gas production was falling. U.S. crude production fell to below 5 million barrels per day. Since propane comes from crude and natural gas, there was not enough propane to meet domestic demand. The U.S. was a net importer of propane. As a result, propane held a higher value relative to WTI crude than it does today. On average, propane ran about 70 percent of the value of crude.

After the shale production revolution, U.S. propane supply began to exceed domestic demand, turning the U.S. into a net exporter of propane. Consequently, propane’s value relative to crude began to fall consistently below its previous 70 percent relative valuation benchmark.

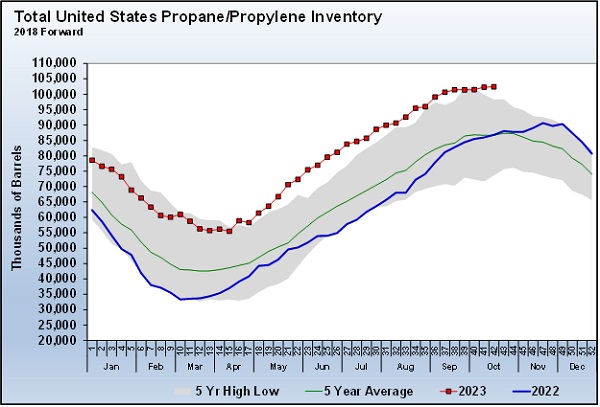

Propane’s average value to crude has been 50 percent in the past 10 years, reflecting the increased abundance of propane. Currently, propane is well below the 10-year average at 33 percent. It is unusual for propane to be valued this low relative to crude during this time of year. In fact, propane is setting new lows each week for this time of year, but it is still above its all-time low of 24 percent set in 2015. That also happens to be the year propane set its all-time highest inventory level of 102.804 million barrels. Currently, propane inventories are less than 500,000 barrels below that record with potential to increase more.

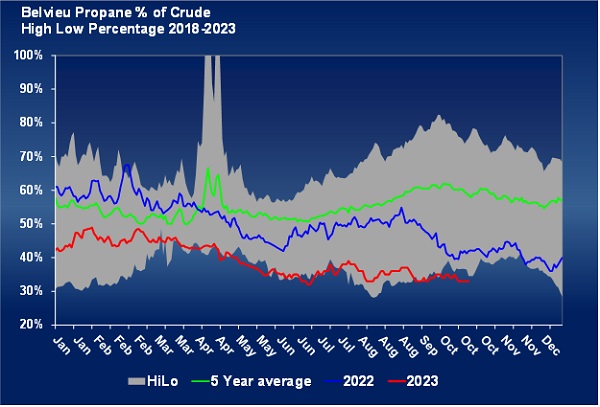

Chart 1 plots propane’s value as a percentage of crude’s value. The five-year average line shows the tendency for propane’s value to increase relative to crude in the lead-up to winter. Propane was following that pattern last year until a weak winter and consumers stressed by inflation caused propane prices to tumble. Propane’s relative value has been well below average since then, and the pre-winter uptick ended this year much more quickly than even last year.

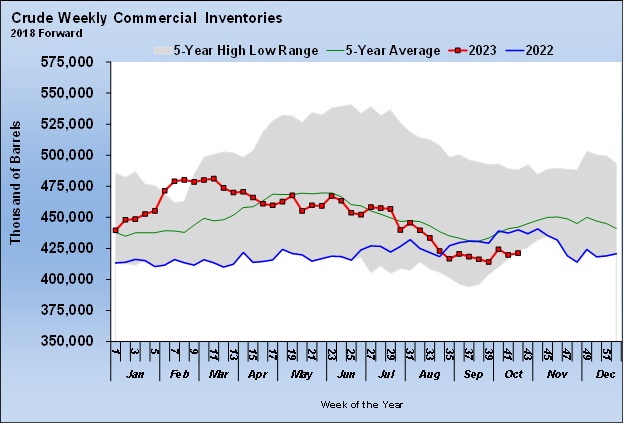

Propane’s weak relative value to WTI crude is a combination of unsupportive fundamentals for propane and supportive fundamentals for crude as the inventory Charts 2 and 3 will show.

Propane’s inventory is setting five-year highs, while crude’s inventories are setting five-year lows for this period during the year. If propane’s fundamentals became more supportive, its relative value to crude would improve, and its nominal value would go up as well. If crude’s fundamentals improve (get less price supportive), crude prices could be driven lower and cause propane’s relative value to crude to increase. But that could happen without an increase in propane’s nominal value.

Normally, we would be excited about the potential buy opportunity propane valued at 33 percent of crude presents. The market tends to move toward its norms. That means the market reacts to cause propane inventories to come down. However, if you will recall last week’s Trader’s Corner, we explored three scenarios projecting where propane inventories might be at the end of winter. Two of the three scenarios put propane end-of-winter levels high to very high. Even the scenario where inventories pulled down the hardest would still leave them slightly above the five-year average.

We also looked at 2015 when the record high inventory level was set to see how low propane’s relative value went. So yes, 33 percent is low, but we can’t rule out propane could get valued even lower against crude. If crude’s price were to stay at its current level of $84 per barrel, propane valued at 24 percent would be at 48 cents.

What if crude goes to $100 per barrel as some predict over the winter, but propane demand is weak and does not bring down inventory significantly, keeping propane valued at its current 33 percent of WTI? That would put propane at 78.5 cents. That is only about 12 cents higher than what it would cost to hedge winter prices. It wouldn’t be good to see prices rise that much, but retail prices built off that price are probably not going to shock customers. If a retailer is underhedged and buying at market prices during winter in that scenario, it’s manageable. We must remember that propane is a cheap Btu anyway, so it is going to look favorable to consumers when they compare it to other energy sources they might buy to fuel their automobiles. Heating oil/diesel is at the Btu equivalent of $1.97 propane, and gasoline is the equivalent of $1.66 propane.

Finally, let’s say that domestic demand turns out to be more than expected, and propane exports remain robust. Propane inventories come down over the winter, allowing propane to climb to 40 percent of crude, and at the same time, crude goes to $100 per barrel. That would put propane at around 95 cents.

That kind of price probably makes us look back and wish we had hedged more. But we would probably get some heads-up if this kind of scenario develops. If we are concerned about this scenario, perhaps we hedge a little more in the front half of winter but cover less in the second half of winter. If this kind of scenario does develop, perhaps we leave some money on the table by waiting to place our hedge.

But right now, this feels like a winter when it is better to be underhedged than overhedged, at least at this point in time.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.