Propane inventory starts winter at record high

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, revisits the latest propane inventory position and how it might impact heating season.

Catch up on last week’s Trader’s Corner here: Cushing trading hub for crude becomes central focus

In a Trader’s Corner readers would have received on June 26, we wrote about the Energy Information Administration’s (EIA) report for inventory positions as of June 16. In that Trader’s Corner, we showed a forecast of where propane inventories could be at the start of winter. Throughout the industry, the beginning of October marks the beginning of the heating season. Propane inventories can continue to build beyond the start of October, but we generally all want to know where inventories will be to start winter. Providing some outlook on where inventories might be to start winter was the purpose of that June 26 Trader’s Corner.

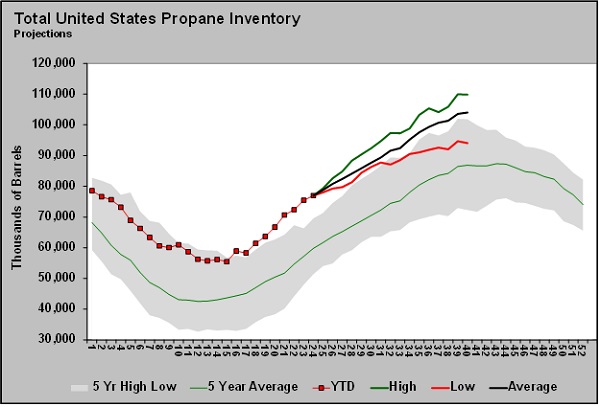

In the article, we provided three scenarios using history as our guide. One scenario used the highest inventory build from that point in the year to the start of winter, one the lowest build and one the average build during that period.

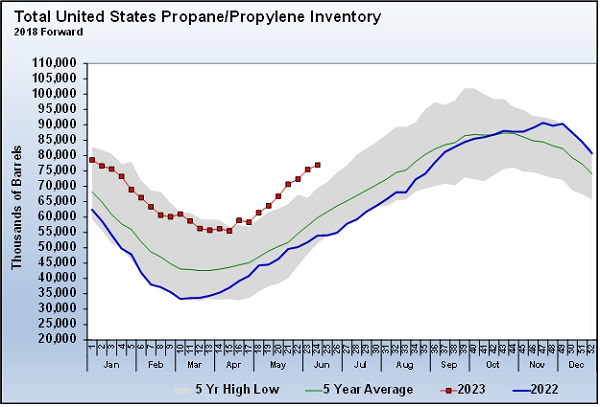

Chart 1 shows where propane inventories were on June 16 when the EIA had last captured inventory positions. To that, we added the three forecasts.

Here are some comments we made about the scenarios:

No matter the case inventory position to start, winter should be very good for buyers and consumers. The base case using the five-year average build in inventories would put levels at 103.985 million barrels. That would be both a five-year high and the highest start-of-winter position on record.

The higher or more bearish case for prices would put inventory at a blockbuster 109.827 million barrels. Keep in mind that inventories do continue to build beyond the first week of October during some years. In 2005, inventory built all the way to the last week of November. So, there is a scenario where inventory could hit 110 million barrels or higher.

The lower build case, based upon what happened in 2021, would put inventory at a comfortable 94.046 million barrels. We are not forecasting any of these scenarios. They are simply examples of where inventories could be to start this winter based on recent history. What we can say, though, is that the market seems to iron out inventory imbalances on a consistent basis. But in this case, it may not be before the start of winter. There would have to be much lighter inventory builds, like the last one from the EIA, to even follow the low case scenario.

As it turns out, the base case scenario was the most accurate.

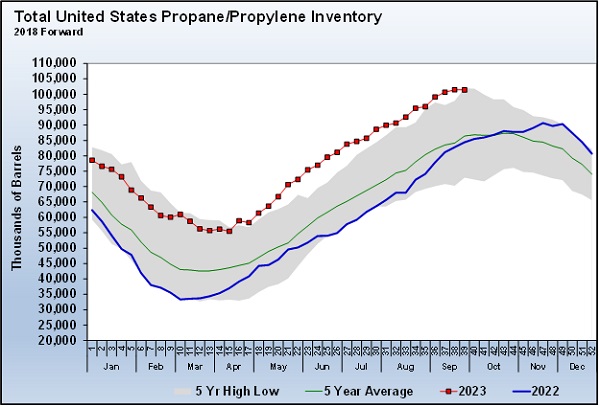

Chart 3 shows the latest from the EIA based on data that was collected Sept. 29. Inventory stood at 101.408 million barrels. That was 2.577 million barrels below where the base case had projected inventories. Had inventories built at the five-year average of 2.256 million barrels for week 39 of the year, instead of the surprise 25,000-barrel draw reported, the current inventory position would almost be exactly equal to the base case projection.

It turns out that our reservations that the low case would develop were warranted. It would have taken a lot of very light inventory builds. While at the time we were projecting stronger domestic demand to develop before winter, which did occur, we believed increasing production wouldn’t allow low enough inventory builds to follow that path.

Meanwhile, the high case didn’t develop either. As we said, the market tends to respond to imbalances. The improvement in domestic demand and strong exports did enough to offset the higher production to keep the inventory builds off that high track.

To a large degree, the high inventory position coming out of last winter has persisted. At the end of March, propane inventories were 21.333 million barrels above the previous end-of-March position. Currently, inventory is 17.017 million barrels above the previous end-of-September position. Even though inventories will begin October at a record start-of-winter level, a reduction in the surplus inventory over last year has been modestly price supportive.

Unless a more compelling topic comes along before next week, we may provide a forecast of where propane inventories might be as we exit this winter. We will reveal our bias before we make that projection. We tend to side on the higher inventory position by the end of this winter. We think there is a good chance that the gains against last year’s position could be given back over the course of the next six months.

In recent Trader’s Corners, we have listed our reasons, including weak crop drying outlooks and El Nino conditions. We think deteriorating economic conditions are going to affect demand this winter as well. We foresee consumers making strong conservation efforts this year. It is not going to be because propane prices are high. In fact, propane is a cheap Btu compared to other energy sources.

Instead, we see general pressure on the consumer. During this period of high inflation, consumers have relied more on credit to get by. Data we read suggests those sources of credit are getting tapped out. After several years of strain on the consumer from COVID-19 to inflation, it appears we are finally getting to the point where consumers have no more credit, and the only response left is to reduce spending. Like the consumer, the U.S. government is tapped out as well. There won’t be more money printing and robbing the national treasury beyond the already excessive budget deficit that the government does not have the will to reign in.

We think consumers responded to rapidly rising prices by conserving everywhere they could, including propane usage. Last year was a juggling act. Save on things like propane to cover higher gasoline, rent or food and use credit to make up the difference. But this year, it appears an increasing number of households will not have the available credit to fill the gap. A sharp reduction in spending across the board is likely to occur. Propane will not be immune to the impacts of stressed consumers at the end of their financial options.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.