Cushing trading hub for crude becomes central focus

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the impact of crude inventory at the major crude trading hub in Cushing, Oklahoma.

Catch up on last week’s Trader’s Corner here: Propane prices turn lower

After falling into a downtrend from Sept. 19-26, WTI crude’s price suddenly surged Sept. 27. On that day, WTI crude gained $3.29 per barrel to close at $93.68. Prices spiked again the next morning, reaching $95.03 before tumbling to a $91.39 close.

The sudden bullishness in crude came from a seemingly out-of-nowhere focus on Cushing, Oklahoma, crude inventories. Cushing is the major crude trading hub in the United States. It is where crude futures contracts are settled. Therefore, what goes on at Cushing tends to have an oversized impact on the market.

Cushing has 98 million barrels of storage capacity. It is also a hub for imported crude from Canada and U.S. production fields. It has many outgoing pipelines that provide crude to refineries across the Midwest and South.

It seemed that on Sept. 23 the market suddenly became aware that crude inventories at Cushing were seriously low. Out of nowhere, the news wires were filled with warnings that Cushing inventories were reaching their minimum operational level at 20 million barrels.

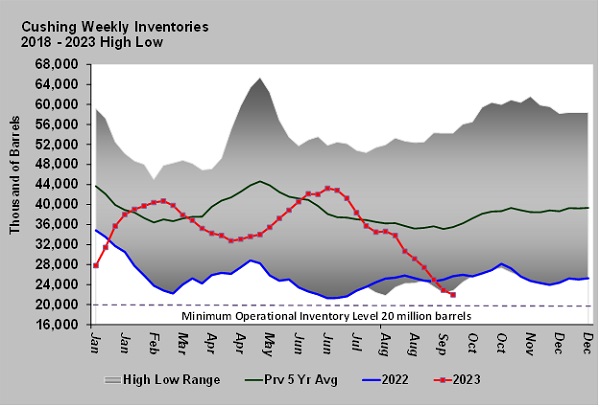

Chart 1 shows Cushing inventory is setting a new five-year low for this point in the year. Inventories were low most of last year and even approached the minimum level in June 2022. During that month, WTI peaked at $123.68 per barrel on June 14, 2022. Prices began to fall after that date, hitting $76.25 on Sept. 26, 2022. The drop in price came as inventory levels pulled away from the minimum operational inventory level.

Crude has fallen below the 20-million-barrel mark before. The most recent case was in 2014. Crude prices were around $107 per barrel during that time. The operational requirements may not have been as high back then. One thing is for sure: These low Cushing inventory events have generally resulted in high crude prices.

Cushing inventory was at 43.244 million barrels just 13 weeks ago. It has averaged a draw of 1.637 million barrels per week during that 13-week stretch. Inventory is now 1.958 million barrels above the minimum. That means Cushing could be out of deliverable crude in a little over a week.

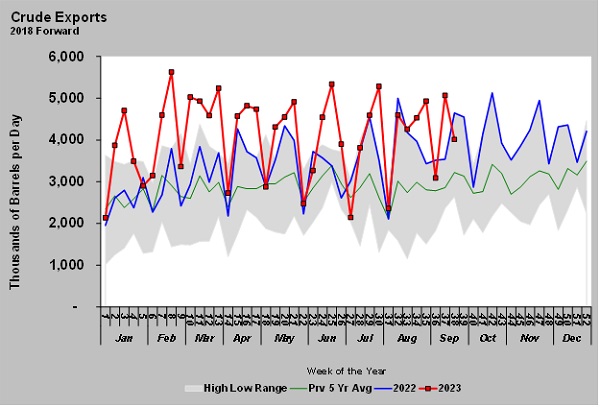

A reason for low inventories in Cushing has been the movement of barrels to export.

So far this year, U.S. crude exports have averaged 4.088 million barrels per day (bpd) compared to 3.334 million bpd over the same period last year. That is an increase of 754,000 bpd. Perhaps the higher prices will slow the exports and help recover Cushing inventories.

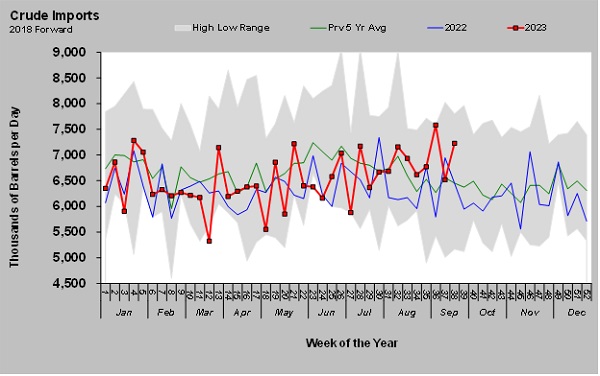

Crude imports have also increased this year, but only by 174,000 bpd, making net exports 580,000 bpd. Also, it’s important to note that crude imports from Canada are down 1.452 million bpd through July of this year compared to the same time last year. It’s important because Canada is a key feed source into Cushing.

According to sources, once crude inventories get below 20 million barrels, the remaining crude can be thick and sludgy due to the settlement that goes on while the crude is stored in the tanks. It makes it difficult to get the crude out of the tanks. It also impacts the quality of the crude. There are also safety issues. The tops of crude storage tanks drop with the level in the tank to prevent vapors that increase the risk of fire. The roofs have stops on them that will not allow them to fall to the bottom of the tank. The result is that between 10 percent to 20 percent of Cushing storage capacity is unusable from an operational standpoint.

The draw on Cushing inventory was only 943,000 bpd the past week – well below the 13-week average. But even that low rate means that Cushing could be at minimum operating levels in two weeks. Fortunately, WTI crude prices retreated after the big spike on Sept. 27. We are concerned that crude’s price will start rising again when the new month starts, with the Cushing unknown still influencing traders. There is little doubt that crude prices will stay elevated as long as Cushing inventories are falling. We must hope that the downward trajectory ends, and inventories start showing signs of recovery. If Cushing inventories were to fall below operational levels, we are not sure how the market will react, but elevated prices would seem the only logical reaction to slow outflows and encourage inflows of crude at Cushing.

Catch up on the rest of this Trader’s Corner series here:

- Part I: Evaluating the state of crude prices

- Part II: Evaluating the state of crude prices

- Part III: Evaluating the state of crude prices

- Part IV: Evaluating the state of crude prices

- Revisiting the state of crude prices

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.