Potentially weak winter demand

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses propane demand for the upcoming winter.

Catch up on last week’s Trader’s Corner here: Revisiting the state of crude prices

Those that read Trader’s Corner regularly know that we expected propane prices to rebound from lows earlier in the year. As we pointed out last week, that has occurred. But we now think the runway for higher propane prices could be getting shorter.

When we think of the direction propane prices might trend, we must weigh influences from two separate but related arenas. The first is what is going on pricing wise in the overall energy complex, most specifically with crude. The second is what is specifically going on with propane fundamentals. Fundamentals being all those factors that affect propane supply and demand.

Imagine approaching a sports complex that has three football fields, but for our purposes we will call it the energy complex. For our analogy the football fields represent where the propane pricing game will be played. Which field we will play the propane pricing game on during the winter of 2023-24 will be determined by the price of crude. One field is the low-price field, one is the normal-price field, and the other is the high-price field.

Over the last 10 years, WTI crude has averaged $67 per barrel. It has had a crazy range between a low of minus $37.63 and a high of $123.70. The minus $37.63 was on a wild day during the pandemic when demand was crashing because of shutdowns and an extremely overbought situation had developed. Those long crude were literally paying counterparties to take positions off their hands to close.

Using the average-per-barrel price, we could say a normal range for crude might be $57 to $77 per barrel. When prices are in that range, the propane price game will be played in the middle or normal pricing field at our complex. Below $57, the venue will be the low propane pricing field, and above $77 it will be the high propane pricing field.

The current price of crude dictates the game will be played on the high-price field. The venue could change, but for now, traders are expecting tight crude supplies for the next six to nine months, which will take us through winter. It will take something significant to move the game over to the normal-price field. Something like the collapse of the global economy might result in a venue change. For now, though, the game is being played on the high-price field, and we must be prepared to select a seat in that stadium.

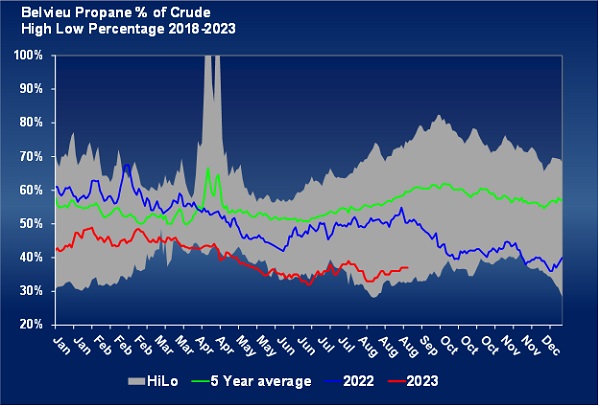

Once we are comfortably seated in the correct stadium at the energy complex, the location of the pricing action on the field will be determined by propane’s fundamentals. Over the last 10 years, propane’s value has averaged 50 percent of the value of WTI crude. When the market sees propane and crude fundamentals about equal, propane’s value relative to crude would be around 50 percent. When propane fundamentals are less price supportive than crude’s – for example, propane supply is exceeding demand – then propane will be valued at less than 50 percent of WTI. For a visual, let’s say that is the left side of our pricing field. When propane fundamentals are more price supportive than crude’s – for example its demand is greater than its supply – prices will move toward the right side of the field.

Currently, propane fundamentals are far less supportive than crude’s fundamentals. Consequently, the propane pricing action is toward the left side of the field. Propane is valued at 37 percent of WTI crude, and that is up from earlier this year. Though propane’s inventory is setting five-year highs for this time of year, its surplus relative to last year and the five-year average has been lessening due to slightly less than normal inventory builds. The smaller builds have generally occurred because of an improvement in domestic demand, but as we will discuss that pent up demand could play out after preparation for winter is complete.

Chart 1 covers the last five years plotting propane’s value relative to WTI crude. It’s a simple percentage. The red line is this year, and you can see the relative value to crude went down to around 30 percent in early August but has been improving over the last couple of months. Though propane’s value to crude has improved, it hasn’t been much compared to the significant increase in propane’s price. Most of the gain in propane has been because the rise in crude’s prices have taken us from the normal pricing stadium at the energy complex to the high-price stadium. Propane’s price has simply moved with the rest of the energy complex to the new venue.

Now the question is if propane will continue to move from left to right on our playing field. In other words, will the red line in the chart above keep going higher, will it stay the same or, as it did last year, go lower? Our bias has become that it is likely to start flattening out or going lower based on the following:

- As stated, propane inventories remain at five-year highs.

- Propane production has recently set a record.

- Propane exports are good but struggle to offset production increases.

- Propane domestic demand has improved since the first of the year but remains low.

- Crop drying demand this fall is likely to be normal to below normal.

- El Nino conditions are likely this winter that could lower heating demand in the higher demand upper third of the U.S.

We recently discussed the first four on the list so let’s focus on the last two. This year’s corn crop is expected to be 10 percent higher than last year at 15.1 billion bushels. There were 94.9 million acres planted in corn, up 1 percent this season. The yield is expected to be up a half bushel per acre but, just a month ago, it was expected to be up 1.3 bushel per acre. Data shows 82 percent of the country is experiencing abnormal dryness. Currently, the drought conditions are the second worst in the last 22 years.

Between the record high temperatures and drought conditions, expected demand for propane to dry crops is normal even with the increased crop size. We suspect that crop-drying will ultimately be below normal this year. It takes well above normal crop drying demand to move the needle on propane prices. That happens about every four to five years, and it seems to be getting even farther apart. There is no reason to expect this year’s crop drying demand will stress supplies.

The National Oceanic and Atmospheric Administration says that El Nino conditions could become strong this winter. Though currently moderate, the El Nino conditions are expected to intensify through the fall and winter. There is a 20 percent chance El Nino conditions could become historically strong. There is a greater than 90 percent chance El Nino conditions will continue through the winter.

An El Nino is the periodic warming of a strip of water along the equator. That changes weather patterns. The last El Nino was four years ago. The impact of an El Nino causes warmer temperatures in Alaska, Canada, the northern tier states in the U.S. Conditions are also likely to be much drier around the Midwest and Great Lakes. The southern part of the nation can be wetter and colder during El Nino conditions. From a propane demand perspective, the net impact would likely be less demand since the higher consuming areas will be less cold and drier.

The fundamental conditions for crude are likely to keep the energy complex high-priced overall this winter, which might keep propane prices from falling to exceptionally low levels. However, there is a good chance the recent improvement in propane’s relative value to crude could be reversed given the reasons above. That could keep propane at a low value relative to crude and likely at a very comfortable level for retailers and consumers.

If El Nino conditions do develop in the moderate to intense range, it will most impact demand in the latter stages of winter. If economic conditions do not improve, causing an increase in propane demand by petrochemicals, especially propane dehydrogenation units that would increase propane exports to offset the weaker domestic demand, propane inventories could be relatively high at the end of winter. As we said last week, it might be a bridge too far to expect a significant improvement in economic conditions over the winter period. That increases the risk of downward price pressure on propane in the latter stages of winter.

The high price of crude probably helps any speculative propane position at the front half of winter. Those that are long speculative propane positions for the second half of winter need to stay on top of propane fundamentals. With the increased risk to speculative positions during the second half of winter, selling swaps to close positions may become appropriate.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.