Propane prices turn lower

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, gives an overview of propane prices headed into winter.

Catch up on last week’s Trader’s Corner here: Potentially weak winter demand

On Sept. 1, Mont Belvieu ETR propane closed at 72.5 cents and Conway at 70.5 cents.

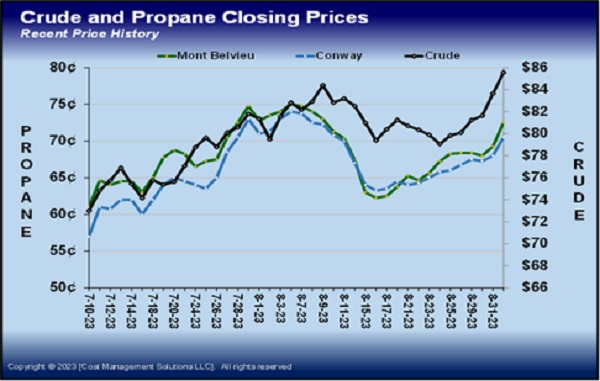

Chart 1 shows the trend in propane and crude closing prices leading up to and including that day. You can see that both are in a sharp uptrend. That day, we wrote a Trader’s Corner titled “The latest factors impacting propane demand,” released on Sept. 5 (delayed a day because of Labor Day).

Below are excerpts from what we wrote on Sept. 1:

We have been adamant that the prices of propane and crude would rally from the lows early this year, and they have. Propane has gone from lows of 53.875 cents at Mont Belvieu to 72 cents, Conway from 52 cents to 70.5 cents per gallon, and crude from $66.74 to $84.74 per barrel. But we now must wonder how much runway is left for propane prices to climb.

We do think propane prices will get support from higher crude. Crude fundamentals are a lot more supportive of its price than propane fundamentals are for propane’s price. But beyond the support from higher crude prices, we think that weather conditions this winter are likely to hurt domestic propane demand and keep it below normal. It may be a bridge too far to expect economic conditions to improve enough to offset the weaker domestic demand with stronger export demand.

Some buyers took advantage of the opportunity that low propane and crude prices offered them early this year. But the rally in prices is adding risk to any type of speculative position for this winter. Hedges, where the retailer is locking down the supply cost and making a corresponding sale to the consumer, are almost always a good thing. But be aware that speculative positions, where a supply price is committed to without a corresponding sale, have increased risk – not only because of the rally in propane’s price to this point but also due to the uncertainty about propane’s supply/demand balance this winter.

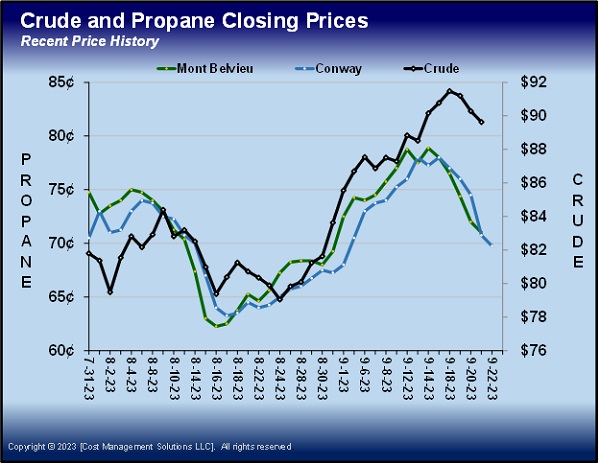

Chart 2 is the same closing price chart for Sept. 21, the day before we are writing this current Trader’s Corner.

After our expression of doubt that propane prices would continue to climb, they did until Sept. 14 when the rally started topping out at 78.875 cents for MB ETR and 78 cents for Conway. Since then, prices have retraced the gains and now stand below where they were when we wrote the Trader’s Corner on Sept. 1.

In last week’s Trader’s Corner, we listed six reasons why propane prices could remain under pressure for much of this winter. Regular readers will recall several Trader’s Corners in early summer discussing the unusually low domestic demand for propane. Our theory was that inflation had hurt consumers, putting household budgets under stress. Food and gasoline were taking much larger-than-normal chunks out of household budgets. Our theory was that consumers were holding lower levels in their propane tanks as they tried to pinch pennies. If true, we warned that pent-up demand could tighten the supply/demand balance for this winter.

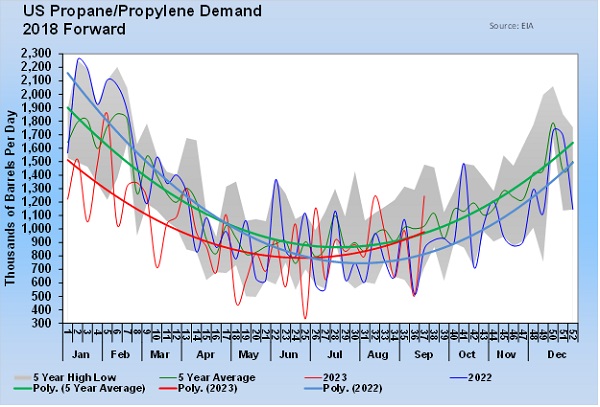

Chart 3 shows U.S. domestic propane demand.

The weekly demand numbers are volatile, so focus on the smoother trend lines. The red line is this year, and you can see how low it was through the front half of the year but is now well above last year and at the five-year high. To us, this is proof there was pent-up demand. We think this is simply consumers that had let tanks run low buying a little more than usual to prepare for this winter. Inflationary pressures had eased a little over the summer, and that may have allowed consumers to be a little more aggressive in filling tanks.

But now, there are many things that are threatening demand again. We expect weak crop drying demand, and winter heating demand is threatened by El Nino conditions. We can probably add another factor as well. Unfortunately, we have come full circle on inflation. Moderation in energy prices for a while in the summer had helped reduce inflationary pressures.

Now, crude is more than $90 per barrel, and there are calls for $100 crude soon. Global crude demand hit a record 103.7 million barrels per day (bpd) in August. Meanwhile OPEC+ is cutting 3 million bpd from its benchmark production rates. There are estimates that global crude inventories went down 2 million bpd this quarter and will still be dropping 1.1 million bpd in the fourth quarter. Russia just announced it is banning the export of gasoline and diesel because of domestic shortages. Refined fuels prices, especially distillates like heating oil and diesel, have risen sharply since the lows hit in May and June.

Stubborn inflation now has central banks raising, or considering raising, interest rates more. Many had presumed that the U.S. Federal Reserve would not have to raise interest rates again, but it is warning it very well may need to raise rates again before the end of the year.

Once again, consumer budgets could be coming under stress. This could result in conservation over the winter months on top of potentially lower demand due to weather conditions. U.S. propane inventories went over 100 million barrels for the week ending Sept. 15. That puts them just a little more than 2 million barrels below a record high. They could eclipse that mark before drawing down over the winter. And if the threats to demand that we have mentioned come to fruition, draws on inventory might be below normal this winter.

Again, we encourage caution with any speculative positions for this winter. Hedges with committed sales against fixed supply agreements are fine, but this does not look like a year that would pay from a purely speculative standpoint.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.