Sorting out Midwest propane inventory confusion

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, parses out a discrepancy in Midwest propane inventory.

Catch up on last week’s Trader’s Corner here: Could propane prices fall in December?

Before we look at today’s main Trader’s Corner topic, we want to give an update related to last week’s Trader’s Corner. We wrote that article the day before Thanksgiving, and it was released on Dec. 2. The topic was the possibility of propane prices retreating in December.

Mont Belvieu ETR propane hit its November high of 83.5 cents on Nov. 22. As we write, ETR is priced at 77 cents. Conway has dropped 4 cents since the day we wrote the article. Also, U.S. propane production came in at over 2.8 million barrels this past week, very close to its all-time high. Meanwhile, there are forecasts of crude being oversupplied next year, which is keeping its price under wraps. So far, so good for propane buyers in December. Let’s hope the trend continues.

This week, we are going to cover an issue with Midwest propane inventory that could cause some confusion in the coming weeks. We know it could cause confusion because we were confused for a while ourselves until we were able to jar some of the cobwebs out of memory. Our confusion came when we updated our Midwest inventory chart for our daily reports. The numbers we had in our spreadsheet for last year didn’t match what was being reported by the U.S. Energy Information Administration (EIA).

We spent several frantic minutes trying to figure out where we had messed up our spreadsheet and checking links between spreadsheets, etc., before some of our dormant neurons came to life and synapses started firing again. We have a large and growing inventory of dormant neurons and incidents of synapses misfires.

Anyway, we started remembering an inventory adjustment made by the EIA late last year that impacted Midwest inventory. What had occurred was a mysterious December inventory build, and then the EIA made a massive downward adjustment. For background, look at our Jan. 8 Trader’s Corner and the related Jan. 16 Trader’s Corner.

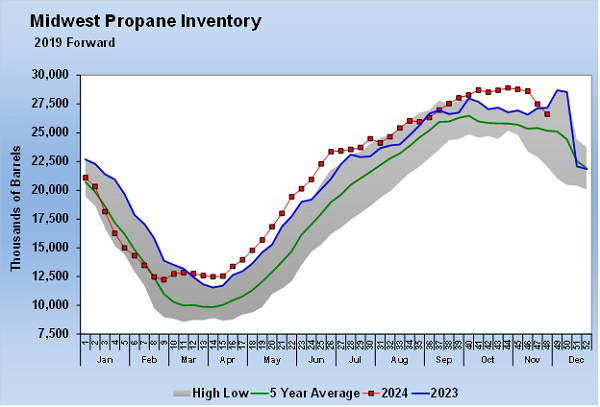

Interestingly, when the EIA found the mistake, it did not go back to adjust the data, but instead simply made one large adjustment. Based on that decision, this is what the Midwest inventory chart looks like using data as reported by the EIA.

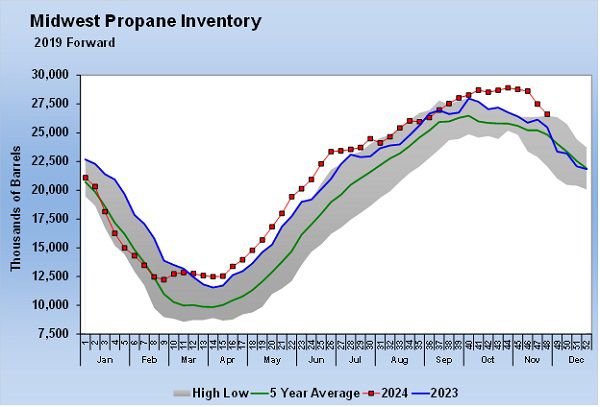

However, last year, we felt our readers needed a better understanding of how the inventory actually changed, so we reached out to the EIA to get the actual numbers, allowing us to create the chart below, which we have been using and updating since.

The rub came when we updated our tables and charts with the EIA data that came out this week, and it showed this year’s Midwest inventory below last year. Our chart using the real data from last year shows that Midwest inventory remains above this time last year.

So, this creates a conundrum. If we use the real numbers, it will make us look out of sorts at what the overall market will be reporting and saying about current Midwest inventory and its relationship to last year when each week’s EIA data comes out. From that standpoint, the easy thing to do would be to go back to the data as reported by the EIA. That way, what we are reporting and what is widely being reported about last year’s Midwest inventory position will match.

However, we still think that paints a false picture of the real situation and could cause readers and clients to make wrong assumptions about the market. What we are going to do is continue reporting the actual inventory changes for 2023 and make mention of why that is different than what the EIA is reporting.

This will all sort itself out in due course. But for now, it is simply important to understand the issue and to know why the inventory comparisons between last year and this year in the Midwest might look odd. Our fear is that if we do choose this course, propane buyers could assume Midwest inventory is running below last year, compelling them to buy, when inventory is actually above last year and in excellent shape. No need to panic, to be sure.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

To subscribe to LP Gas’ weekly Trader’s Corner eNewsletter, click here.

Read more Trader’s Corner: