The good and bad of refinery throughput for propane

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Wednesday, June 26 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why it’s important for propane retailers to pay attention to refined fuel inventories and refinery throughput.

Catch up on last week’s Trader’s Corner here: Propane finding domestic, foreign buyers

The recent Memorial Day weekend marked the beginning of the summer driving season in the U.S. U.S. refineries plan their year to maximize throughput during the summer months when gasoline consumption is at its highest. They do seasonal maintenance through the winter so they will be at peak capacity and performance by May to build inventories and keep up with demand.

That maintenance activity reduces throughput during the winter and can cause crude inventories to build while refined fuel inventories decline. But once May comes, the demand for crude at the refineries increases.

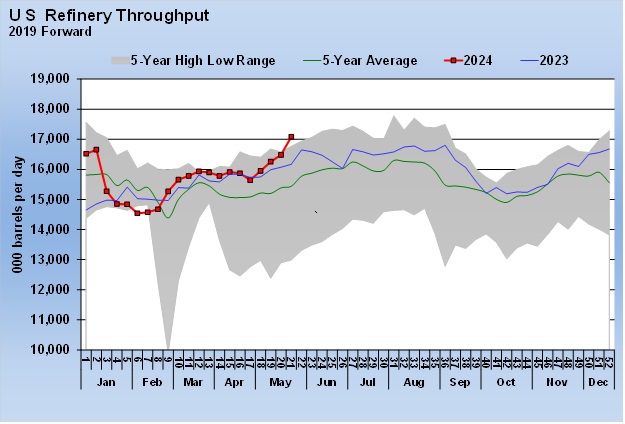

Chart 1 plots refinery throughput, which is simply the barrels per day of crude that refineries are processing. It shows the reduced throughput during core winter, which is a time when everyone hopes crude inventories build.

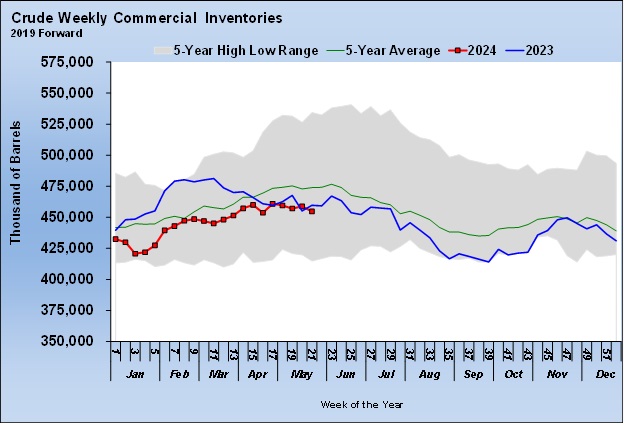

Chart 2 shows that crude inventories did build from January through April. The path taken was different than 2023, but by the end of April, the crude inventory level was near where it was last year. Both years failed to build inventories as much as usual. That is at least partly because the U.S. is exporting more to help Europe, and importing much-needed heavy crude has become harder.

Looking at the two charts together, it is easy to see the correlation between increased refinery throughput and the resulting pressure on crude inventories. In May, crude inventories were already trending lower, and the overall trend is likely to be downward until October.

Propane prices are often their lowest in May and June. Of course, the end of the heating season is a factor, but so is the fact that crude inventories are generally at their highest, which keeps pressure off crude’s price. However, events like the outbreak of war between Russia and Ukraine override the fundamentals.

Conversely, propane prices are often high leading into winter. Yes, it’s partly because of the hype ahead of winter, but more importantly, it’s because crude inventories are at their lowest, and crude prices are often at their highest that time of year. As we all know, most of the time propane and crude prices trend together. There are times of separation as we discussed last week, but most of the time, the two commodities’ prices are trending in the same direction.

So, there is good and bad news for propane due to increased refinery throughput.

The good

Refineries are a source of propane supply. When throughput increases so does propane supply by refineries. That’s good news, but it’s limited good news. The last official propane supply data is for February. We are about to get March’s data, but the February data will be fine for illustrating our point.

In February, the U.S. produced 2.346 million barrels per day (bpd) of fuel-use propane. Refineries supplied 253,000 bpd of that total or only 10.78 percent. In the summer, the supply can climb to around 300,000 bpd. At current throughput levels, somewhere between 290,000 bpd to 300,000 bpd is very possible. So, from a supply perspective, there is something to be gained from the increased throughput.

The bad

The very formidable offset to that increase in propane supply will be the drawdown in crude inventories, which will cause upward price pressure on crude. Late last week, JP Morgan said it believed crude’s price would be up $10 per barrel by September. It is obvious they are looking at our chart above, right?

With throughput setting a new five-year high for this time of year last week, the pressure on crude supply is likely to be greater than in recent years. Throughput last week was 918,000 bpd, 5.68 percent above the same week last year.

Remember our Trader’s Corner from last week where we showed the oversized impact crude’s price has on propane prices, especially in the further out months? Those are the months that propane retailers are generally looking for price protection.

It is very possible we are going to see a steeper drawdown on crude inventories this summer than has occurred since the pandemic because refinery throughput is finally returning closer to normal.

Propane production will be high this summer, and that will limit propane’s price gain. But that doesn’t mean propane prices won’t go up if crude prices are trending up. It happens year in and year out. Propane prices will almost certainly trend up with crude prices, though the high propane production is likely to make propane prices lag the gain in crude’s price.

The table is set for upward pressure on crude prices this summer. If that occurs, don’t think for a minute propane’s price won’t also trend higher through the summer months. Therefore, the opportunity to get price protection may be better in early summer than later.

Now, a word of caution. If propane inventories build at an above-average pace this summer, then when the pressure on crude supplies falls at the end of October when refinery throughput slows, crude prices will likely fall as they usually do. That could result in low propane prices in late November and December.

Remember that over the past 10 years, propane prices have averaged the lowest of the year in December. That sounds crazy, but here’s why. There generally have been good inventory builds during the decade, and that is coupled with the seasonal pricing pattern for crude to cause propane prices to be low in December. If you are going to be light price protection for any winter month, make it December. If inventories don’t build at a normal to above-normal pace this summer, it could be a different story, but right now it looks like they will.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.