Breaking down the new propane inventory number

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Wednesday, March 27 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains how the Energy Information Administration’s new data point will benefit propane industry members.

Catch up on last week’s Trader’s Corner here: Is there an opportunity in the propane market?

Over the past three weeks, the Energy Information Administration (EIA) has provided its new propane inventory number. In the Trader’s Corner we wrote Nov. 17, 2023, we discussed the significance of the number after the EIA announced it would provide this new data point. Now that the number is out, it is worth rehashing its significance.

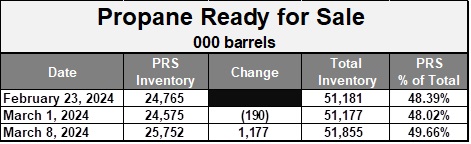

The new data point is called “Propane ready for sale.” The table provides the small sample size for the number:

For the week ending March 8, propane ready for sale (PRS) inventory stood at 25.752 million barrels. The headline total inventory number reported by the EIA was 51.855 million barrels. We now know that propane ready for sale accounts for just under 50 percent of the headline inventory number. That is good information, and we are glad we now have it.

The headline inventory number contains some propylene, propane upstream of fractionators in the storage caverns at Mont Belvieu and Conway, and fungible propane downstream of the fractionator. The PRS number is just the fungible propane already fractionated and sitting in product-specific caverns ready for shipment to demand areas via trucks, trains and pipelines.

As we have said before, it will be years before the new number has enough data points covering varying conditions for it to have a lot of relevance. For now, it will be hard for changes in that number to drive propane prices. We think the focus will remain on the total inventory number for a few more years. But we think that once that number has some history it will become the default number that the retail propane industry will focus on. We can see the day when most of the propane inventory charts and graphs we provide in our daily Propane Price Insider (PPI) reports will focus on that number. But even now it is nice to know the percentage of the total inventory that is ready for sale.

One of the most important aspects of the propane industry to understand is that propane supply is rather inelastic. What does that mean? It means that propane supply or production does not respond much to propane demand. For most commodities, production reacts quickly to demand. Refiners quickly reduce throughput if gasoline and distillate demand drops. Natural gas and crude producers adjust drilling activity based on the demand for those commodities. Farmers adjust acreage planted and make crop selections based on the price of a cash crop, which reflects demand. So why doesn’t propane respond to a decline in demand?

Propane is a small part of overall hydrocarbon production. Producers drill wells into hydrocarbon zones, and those wells yield an array of hydrocarbons. Propane is way down the list in terms of consideration on whether a hydrocarbon well is drilled or not. So even though propane inventories may be high and demand low, propane supply will not respond because the combined value and demand for all hydrocarbons is driving the decision to drill or not. Thus, the inelasticity on the propane supply side.

Fractionators of natural gas liquids may respond to the changes in overall natural gas liquids demand to some degree and decrease throughput. However, they are restricted by how much storage is available upstream of the fractionator. Remember the y-grade will continue pouring into the caverns unless overall hydrocarbon drilling slows. The new PRS will give us better insight into what is happening at the fractionators.

For propane, it is the demand side that must react to supply since the supply can be unresponsive to inventory levels or lower demand. We have been in a cycle of hydrocarbon drilling that has domestic propane supply about 1.5 million barrels per day above domestic demand. Propane prices decline in response to make exporting excess propane to an international market viable.

Now that we know the PRS number, we want to review why this is a significant number for the propane industry, and to do that we need to touch on the propane supply chain.

When hydrocarbons are produced, the heavier hydrocarbons make their way to refineries for processing. When heavy hydrocarbons or crude are refined, propane is a byproduct. About 10 percent of the nation’s propane production is yielded during the refining process, and some of it is sold into local markets around the refineries themselves.

The lighter hydrocarbons, commonly referred to as natural gas, go to natural gas processing plants generally around the production area. The lightest of the hydrocarbons, methane, is separated and sold into pipelines to natural gas utilities, which send the natural gas through their distribution systems to consumers. We wish they were called methane utility companies because it would make understanding the process a lot easier.

Some propane is sold into the local market near the natural gas processing plants, much like what happens with refineries. However, the bulk of propane, along with all of the other lighter hydrocarbons other than methane, is shipped to the two large trading hubs in the U.S. – at Mont Belvieu, Texas, and Conway, Kansas. This mix of hydrocarbons is known as y-grade. Y-grade sits in large underground caverns until it is brought into the fractionators.

The total inventory number in the table above includes an estimate of the amount of propane that is in the y-grade. In the past, before the new PRS inventory was broken out, this volume of propane that was yet to be fractionated, and that which had been fractionated was combined to provide the headline propane/propylene inventory number the industry has been following for decades. At the beginning of 2015, the EIA made a change to the number to exclude propylene at terminals. That made propane inventory a higher part of the total inventory number and thus a better reflection of the status of propane supply.

Going forward, the industry will now have an even more accurate number since the PRS will be just fuel-grade propane ready to be used in industrial, commercial and residential applications. We do not think the PRS includes propane at the local refineries and natural gas plants, but the storage available at those locations is negligible. There is generally just enough storage at those locations to facilitate loading trucks and rail cars.

There is some demand for PRS around fractionators, but most of it is shipped on pipelines to demand areas. Some may go by rail or truck, but the bulk is shipped via pipeline. Not all the PRS will be available to the retail propane industry. Owners of propane dehydrogenation plants that convert propane into propylene would also be buyers. But that does not discount the value of knowing how much of our propane supply is downstream of the fractionators.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.