Tighter refined fuels inventories could be ahead

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the impacts of a tighter inventory for refined fuels this summer.

Catch up on last week’s Trader’s Corner here: Propane demand continues at record high

There could be more upward pressure than usual on U.S. refined fuels prices this summer if the fighting in Ukraine and Gaza continues. In this Trader’s Corner, we look at the state of U.S. crude and refined fuels inventories as the summer driving season approaches and why those inventories could tighten this summer.

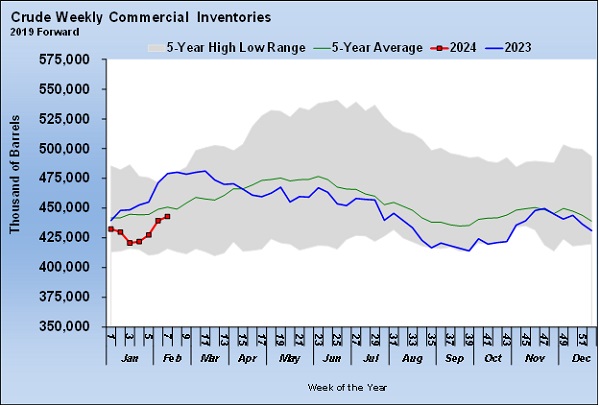

U.S. crude inventories are recovering from the January winter storm and are once again near the five-year average for this point in the year. A key reason for the rapid recovery in inventory has been very low refinery throughput.

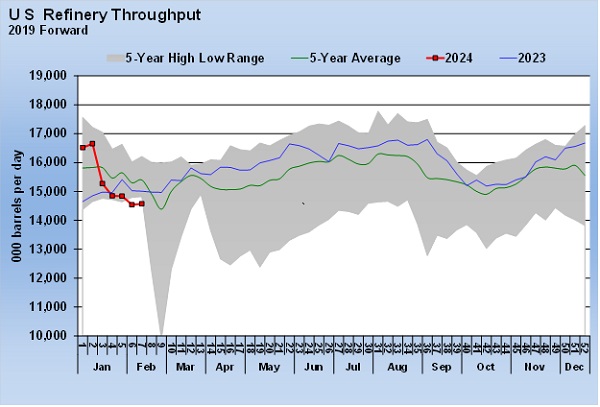

Refinery throughput dropped sharply in January as frigid temperatures from the winter storm impacted operations. Spring is the typical maintenance season for refiners as they try to optimize operations heading into the high-demand summer period for refined fuels. After the winter storm negatively impacted operations, many decided to move up maintenance work rather than going through restarting and shutdown processes again.

While that has been good for crude inventories, it has been a negative for refined fuels. Lower output by the refineries has resulted in more calls on refined fuel inventories.

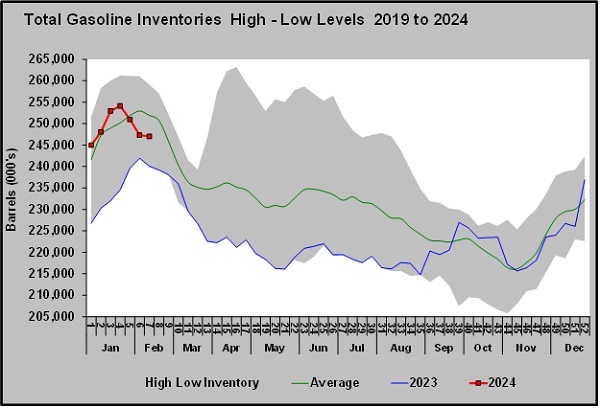

U.S. gasoline inventory had jumped above average as the winter storm slowed demand. But the rise was only temporary without normal refinery throughput to keep the pressure off inventories.

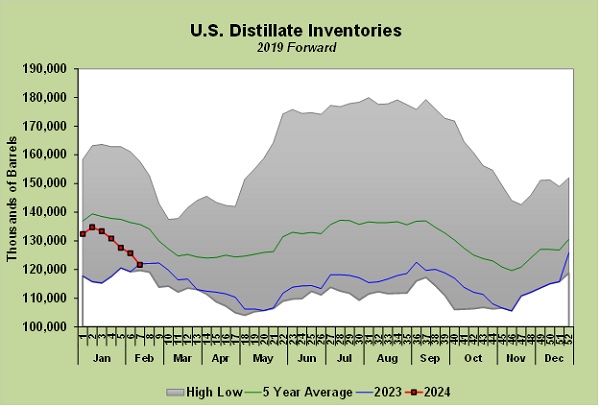

U.S. distillate inventories were already below normal, and the low refinery throughput has pushed them down to the low levels experienced last year and not far above a five-year low. Globally, distillate inventories have been tight because of increased use for power generation. As Europe banned natural gas imports from Russia in response to Russia’s invasion of Ukraine, diesel was used to offset the loss of that fuel for electrical generation.

The good news is that refiners will be coming out of maintenance sooner than normal, so recovery in refined fuels inventories should occur before the heaviest domestic demand hits. Unfortunately, building inventories back to normal, or even above normal, may not be enough to remove more upward price pressure than usual this summer. The wars in Ukraine and Gaza may cause increased demand for U.S. refined fuels globally. If more gets exported, domestic prices will rise.

Ukraine has recently started attacking Russian refineries with drones. As Russia’s refined fuel output has declined, so has its export of those products. The U.S. has stopped sending as much aid to Ukraine as it was in the early phases of the war. Some politicians are tying aid to Ukraine to improving U.S. border security. As a result, Ukraine is running desperately short of supplies, and Russia is making battlefield gains. There are reports that Russia is firing 10 artillery shells to every one Ukraine expends. Ukraine has become desperate, so there is little reason to believe it will stop attacks on Russian refineries to reduce the revenues its adversary has to fuel its war machine.

The war in Gaza is also impacting refined fuel supplies. Houthis in Yemen in support of Palestinians fighting against Israel have been attacking shipping in the Red Sea. Many shipping companies are now avoiding the area. The U.S. and its allies have been trying to protect shipping by providing defense against missile and drone attacks. Seeing that was not enough, the coalition conducted offensive operations against Houthi facilities, trying to degrade its attack capabilities. Successful attacks on shipping continue despite these efforts. Now the Houthi movement has said it has submarine capabilities to attack shipping, which makes defense far more difficult.

With shipping companies seeing no alternative but to avoid the area, fuel supplies to Europe are being disrupted. That is almost certain to cause more calls on U.S. refined fuels supplies over the summer if the wars continue to rage.

None of this should directly impact U.S. propane supplies and pricing. There is a good chance the recent pressure on U.S. propane inventories will lessen over the summer and that they will replenish, helping limit the upward pressure on propane’s price. However, tighter refined fuel supplies will put upward pressure on crude’s price. Higher crude prices will put upward pressure on propane prices or could at least offset downward price pressure that could occur because of rising propane inventories.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.