Propane demand continues at record high

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates domestic demand and export demand for U.S. propane.

Catch up on last week’s Trader’s Corner here: Back to backwardation for crude

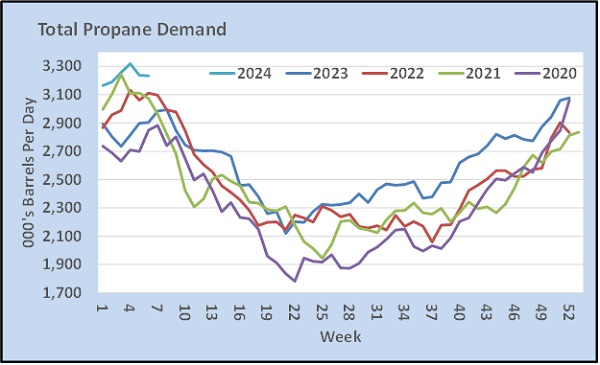

Throughout the second half of last year and into 2024, demand for U.S. propane has been at record highs.

The dark blue line in Chart 1 shows the combination of U.S. domestic demand and exports very strong in 2023, and the lighter blue line shows demand remains strong this year. Year-over-year growth is the pattern, but the increase between 2022 and 2023 was significant.

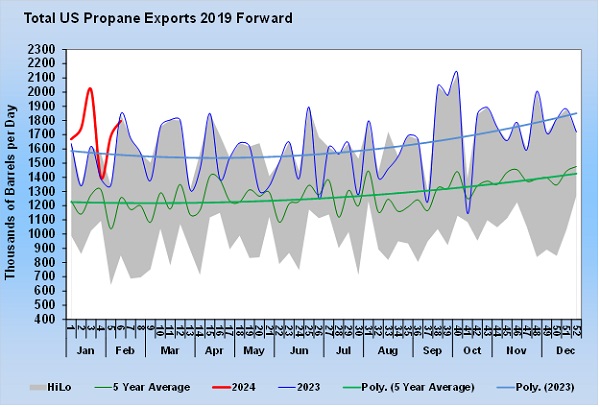

The 2022-23 above-average gain can be attributed to the crude output curbs put in place by OPEC+. Decreased crude production means decreased associated natural gas production and decreased natural gas liquids (NGL) production. That decrease in production, and U.S. propane being a relatively cheap Btu, caused exceptional growth in propane exports.

Propane exports can vary significantly week to week, so in Chart 2, we have added trendlines for the five-year average (green) and last year (blue) to make it easier to see the substantial growth. The red line illustrates the pattern of strong export growth that has not slowed in 2024.

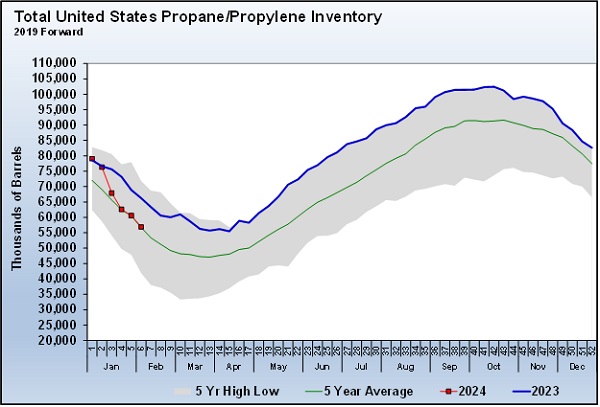

If you go back to Chart 1, note how overall propane demand started 2023 very weak. When you add the strong exports in 2024 to the impacts of the winter storm in January, you see the foundation for the massive drawdown in propane inventories that has been occurring.

Propane inventories have gone from setting five-year highs at the end of April last year through the first week of this year to now sitting at the five-year average. Such a drawdown in inventories supports prices. But as eye-popping as the drawdown in inventories has been, it has only returned the inventory position to normal.

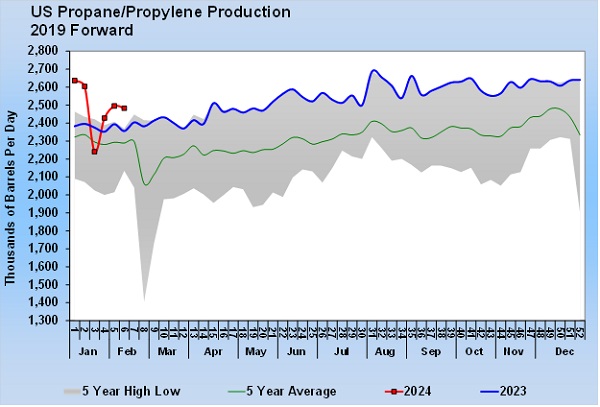

It has not been just the demand-side increases that have contributed to the recent drawdown in inventories.

The January winter storm had a dramatic impact on U.S. propane production. And while production has rebounded from the storm, it has not fully recovered. The result is continued calls on inventory during this winter.

U.S. midstream companies are steadily adding new fractionators and export facilities. U.S. crude production is growing and, with it, NGL production. There is no reason to believe that U.S. propane production will not get back to where it was at the beginning of the year or even higher.

One threat to robust supplies is the recent decision by the White House to slow down the building of natural gas export facilities. A rapid rise in such facilities has helped with the growth in propane supply since more natural gas production means more NGL production. The U.S. House of Representatives just passed a bill challenging the decision by the White House, but the bill is almost certain to die in the Senate.

Another interesting development at the end of last year was the lifting of a restriction that limited LPG vessels using the Houston Ship Channel to daytime-only operations. Those ships are now free to transit the channel 24 hours per day, which has already increased export rates.

The growth over the years of U.S. LPG exports has been nothing short of amazing. In 2010, total LPG exports were 1.04 million metric tons. This past year, propane and butane exports alone rose to 59.7 million metric tons. There are literally tons of propane supply in the U.S., and the good news is that keeps domestic supply secure. Sure, prices may have to rise to keep some of the barrels at home when needed, but it is there.

For now, we believe that once the current weather-related uptick in propane demand fades, production will be high enough to meet export demand and maintain inventories at average to above-average levels. It may take a little while to relieve some of the recent pressure on prices, but we think recent inventory tightness is more temporary than systemic.

Again, the good news is that, to this point, the recent supply tightness has only increased prices to a more normal level. U.S. propane remains a cheap Btu, helping its appeal both domestically and in the export market. Strong exports may limit propane prices from returning to some of the extremely low valuations seen recently. Still, continued growth in production limits the potential for those nasty price spikes that are not good for the industry.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.