US is oversupplied with propane

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the balance of U.S. propane supply and demand.

Catch up on last week’s Trader’s Corner here: Tighter refined fuels inventories could be ahead

The U.S. has far more propane production than it does domestic demand. We all know this, but in this Trader’s Corner, we look at key components of supply and demand to identify just how significant the imbalance is between supply and demand in the U.S.

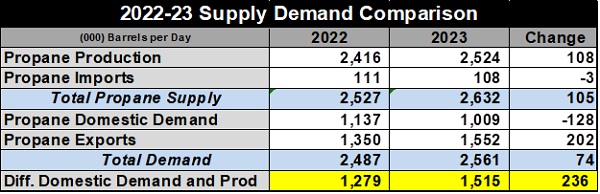

The table above compares supply and demand changes between 2022 and 2023. Supply consists of production and imports. U.S. production increased, continuing an uptrend. Increased propane production is driven by increases in U.S. natural gas and crude production.

Propane imports have been trending lower. Essentially, all U.S. propane imports come from Canada. Canada has increased its capability to export propane via rail to Mexico and via water to Asia. The U.S. is the export destination of last resort, with most occurring in areas where there are logistical advantages near the border.

Demand consists of U.S. domestic demand and exports. On the domestic side, demand comes from propane retailers and petrochemical companies. Petrochemicals are around 25 percent to 30 percent of demand, leaving the balance on the retail side.

Petrochemical demand varies based mostly on economic conditions and on how propane’s price compares to ethane and other feedstocks. Ethane is significantly cheaper than propane, so it is by far the preferred feedstock, but the demand for propane remains because its properties are needed for certain end products the petrochemicals need to make. Retail demand varies primarily on heating demand, which is highly dependent on weather.

A combination of weak economic conditions, cheap ethane and a series of weak winters has domestic demand trending lower in recent years. U.S. domestic demand fell by 128,000 barrels per day (bpd) between 2022 and 2023. Meanwhile, higher crude and natural gas production and more fractionation capacity increased U.S. propane production by 108,000 bpd.

With domestic supply and demand going in opposite directions, the difference between propane supply and its demand grew 236,000 bpd to 1.515 million bpd. This excess supply is either exported or stored. Even though propane exports grew by 202,000 bpd and imports fell by 3,000 bpd, it was not enough to offset the combination of increasing production and decreasing domestic demand, resulting in inventory growth that put downward pressure on pricing throughout 2023.

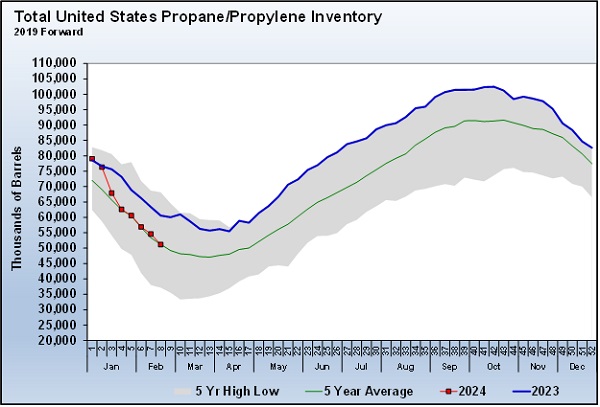

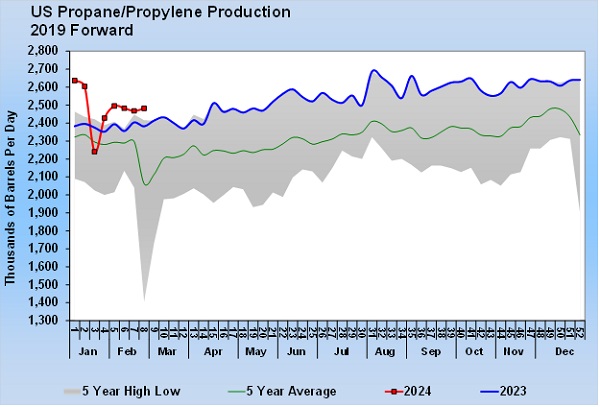

In 2024, the overhang on propane inventories has been eliminated, causing inventories to return to about the five-year average. Note that the decline began with the winter storm in January. Increased demand during that time was a factor, but the larger factor was the disruption to U.S. propane production.

Note how production remains well below where it was before the winter storm. We know at least part of that production decline can be attributed to refineries deciding to go into seasonal maintenance after operations were disrupted by the storm rather than starting up only to go down again in a few weeks for maintenance. But we don’t think lower refinery throughput is responsible for all of the production decline. Refineries only account for 10 percent of U.S. propane supply.

More likely, operators are using less fractionation capacity than they were before the storm. Perhaps there is some maintenance work going on at the fractionators as well. Regardless of the reason, there is a good chance propane production will increase back to pre-storm levels sometime during the coming weeks.

The fact that propane prices have been retreating even as inventories have fallen back to more normal levels suggests that traders believe propane production will eventually rebound, and that will once again cause propane inventory levels to trend upward at an above-average pace.

Remember that propane production is largely inelastic. Propane supply is determined by crude and natural gas production. Last year was a good example of how inelastic propane production can be. Demand went down, but production continued to grow. Propane supply showed little ability to respond to propane demand. The only way to keep domestic supply and demand balance is to export more.

The good news is that there is an abundance of propane in the U.S. Again, on average last year there was 1.515 million bpd more supply than demand. In fact, there was never a week last year when propane demand exceeded propane production. The highest demand week had a daily average of 1.853 million bpd. The lowest week of production had a daily average of 2.352 million bpd.

This overabundance of propane does not mean there can’t be upward pressure on prices. If domestic demand gets strong enough, prices will rise, and eventually producers can make more by selling into the domestic market than they can make exporting propane. While propane prices will go higher in this situation, they are unlikely to spike in a way that would cause harm to our industry.

For propane prices to truly spike like we have seen in the past, global demand for U.S. propane would have to be so robust, so intense, so hot that foreign buyers would be willing to pay whatever was necessary to get it. For that to happen, we would likely have to have major disruptions to other supply or a global economy so strong that foreign buyers would continue to compete with the U.S. domestic markets for the supply. Disruptions to supply are hard to predict. However, at this point, there is more concern than optimism about the global economy.

Despite the recent tightening in U.S. inventory, propane prices have been falling even as crude prices have increased. Propane remains a relatively cheap Btu, making it much friendlier to be a seller of propane. Propane is trading at 84 cents at Mont Belvieu, while HO is selling at the Btu equivalent of 177-cent propane, and gasoline is at the equivalent of 192-cent propane.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.