Crude, natural gas drilling is slowing

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, analyzes how slower crude and natural gas drilling may impact propane prices going forward.

Catch up on last week’s Trader’s Corner here: Propane exports reach record high

As we have said many times before, the byproduct nature of propane makes anticipating its supply situation difficult. If crude supply is getting too high, producers are likely to cut back on drilling and production as the value falls. The same applies for natural gas. However, propane could be significantly oversupplied, but that likely wouldn’t cause a slowdown in drilling that would result in less supply. This is why propane supplies tend to swing widely, resulting in corresponding volatility in propane pricing.

As propane buyers, we must monitor what is going on with crude and natural gas production, as well as refinery throughput, in order to anticipate where propane supply may be headed. That begins with monitoring crude and natural gas drilling.

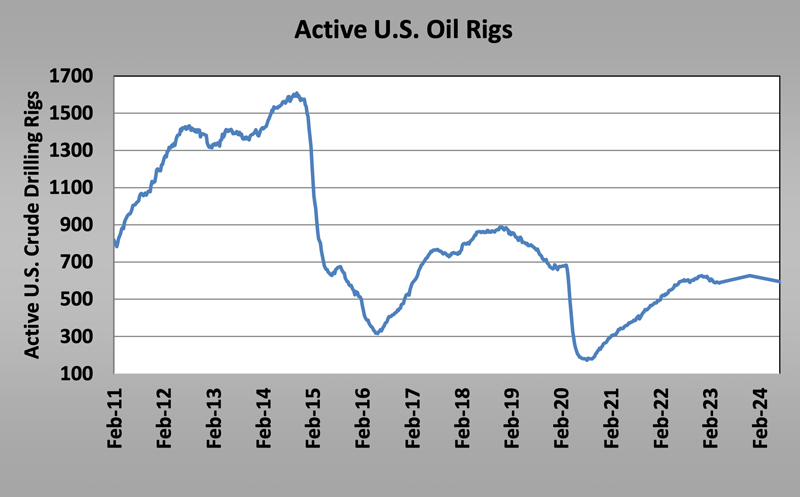

U.S. crude production companies appear to have finally accepted their place as swing crude producers. A look at long-term active drilling rig counts will help explain that statement.

Until the end of 2014, U.S. crude producers were singularly focused on increasing output. They committed huge capital investments into that goal at the expense of investors and eventually creditors. The growth in production came almost exclusively from shale formations, which have high production costs compared to conventional wells. For years, OPEC+ members cut lower-to-produce crude wells to keep all of the high-cost U.S. production from crashing the market. Doing so kept prices high enough to make the high-cost U.S. production viable, which drove OPEC members nuts.

Eventually, OPEC took off its production controls, crashing the price of crude and hoping the high-cost U.S. producers would be put out of business. Both sides were damaged a lot by this action and weakened financially, especially the U.S. producers, but eventually OPEC backed away from that strategy, with many U.S. shale producers barely hanging on. But when OPEC started controlling production again in 2016 to support prices, U.S. producers started increasing drilling. Then the pandemic hit. What OPEC+ could not accomplish, the pandemic did. It put many shale producers out of business, and those that remained had to control capital spending to pay down debt and try to win investors back.

U.S. producers have been drilling more, and production has been increasing since the pandemic, but it is still running somewhere around 800,000 barrels per day (bpd) below peak production. OPEC+ is limiting its production by 3.66 million bpd to try to support prices. This time around, U.S. producers aren’t raising production to offset the cutbacks made by OPEC+, thus making their cuts more effective in supporting prices.

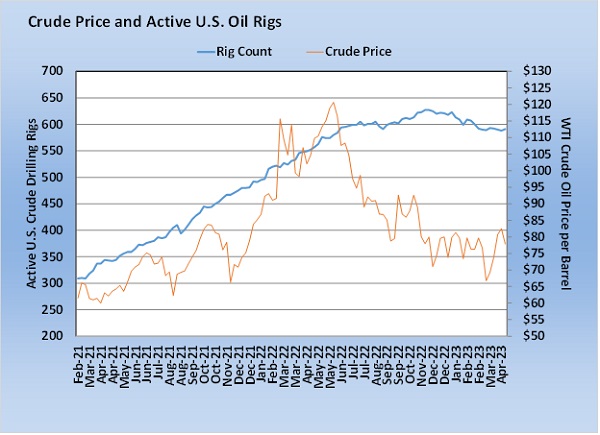

Even though crude prices have been more than high enough to make production from shale formations profitable, U.S. drilling activity has been declining recently.

U.S. producers are now responding to falling prices much more like OPEC+ and decreasing drilling activity as prices have declined. Again, the current price is more than enough to break even on wells, which, in the past, would have led U.S. producers to increase drilling. But their operating philosophy has changed to a more conservative, fiscally responsible model.

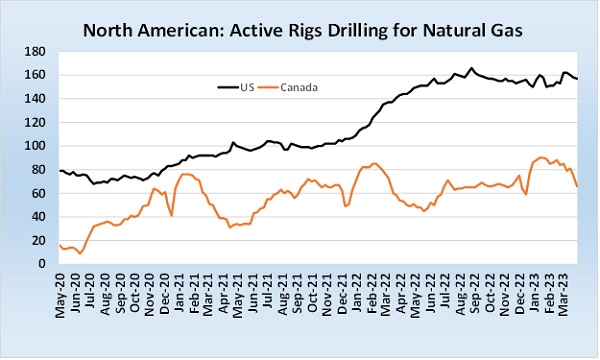

Most new propane supply in recent years has come from the associated natural gas and natural gas liquids (NGL) production from crude wells. So, even though propane was well supplied, the supply kept increasing along with more crude production. The U.S. is fairly maxed out on natural gas production as inventories build, even with liquefied natural gas exports nearing capacity.

As Chart 3 shows, producers are responding by ending the growth in natural gas well drilling. It takes a while for slower drilling to show up in actual production. Natural gas is still oversupplied, and its price dipping below $2 per MMBtu reflects that oversupply.

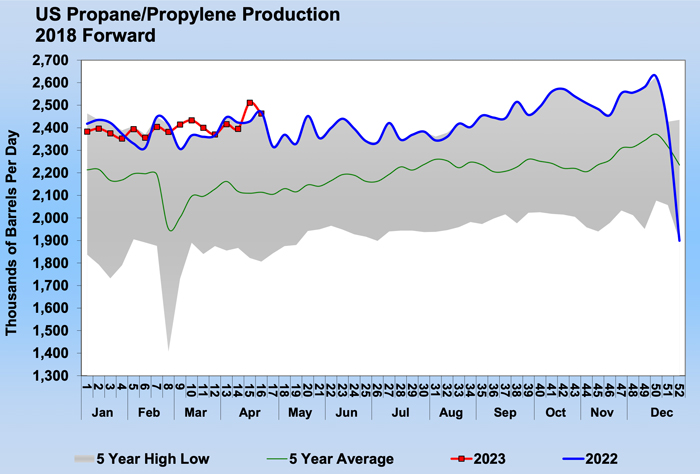

With the context above, we can look at U.S. propane production with greater understanding.

For all of 2022, U.S. propane production averaged 118,000 bpd higher than in 2021. Year to date, this production is just 8,000 bpd higher than 2022. Propane supply is robust, to be sure, but it is no longer growing as U.S. crude production has stopped growing. The growth in natural gas production is slowing as well.

As we mentioned last week, OPEC+’s decision to cut its crude production by another 1.66 million bpd will also cut NGL production, including propane. That alone could cause more call on U.S. propane supplies. Also, China is rapidly increasing demand for propane by building propane dehydrogenation units. It is expected to add another 400,000 bpd in 2023-24, which is about a 70 percent increase. At the same time, it is projected about 300,000 bpd of tanker capacity will be added in 2023, which will likely lower shipping costs and enable U.S. producers to export on a more consistent basis.

The dominoes are falling into place for more export demand for U.S. propane. At the same time, the drivers that were increasing propane supply are slowing down, and we are already seeing that reflected in much slower growth. Yes, the fundamentals for propane are absolutely bearish at the moment, and we can’t be sure that won’t continue. But, our theme all year in Trader’s Corner has been to point out what could cause that to change, resulting in a higher pricing environment this winter than many have been expecting and projecting.

Charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.