Crude releases could make propane buyers complacent

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates how releases from the U.S. Strategic Petroleum Reserve will impact prices.

Catch up on last week’s Trader’s Corner here: Crude could push propane prices

In last week’s Trader’s Corner, we looked at the relationship between propane and crude prices. Knowing the typical relative valuation between the two makes it much easier to identify when propane might be a good buy. Buying propane when its valuation to crude is low has less risk than when its relative valuation is high. We were prompted to write about the propane-crude relationship because recent events have some predicting crude will reach $100 per barrel this year.

Those predictions came after OPEC+ made a surprise announcement that it will lower production quotas by another 1.66 million barrels per day (bpd) from May through the end of the year. On April 14, the International Energy Agency said that it believed global crude supply would be down 400,000 bpd by the end of the year, while it is predicting global crude demand to rise by 2 million bpd. Such a development would be price supportive for crude.

In this Trader’s Corner, we are going to look at a current event that could lull us into a false sense of security concerning crude fundamentals in the short term.

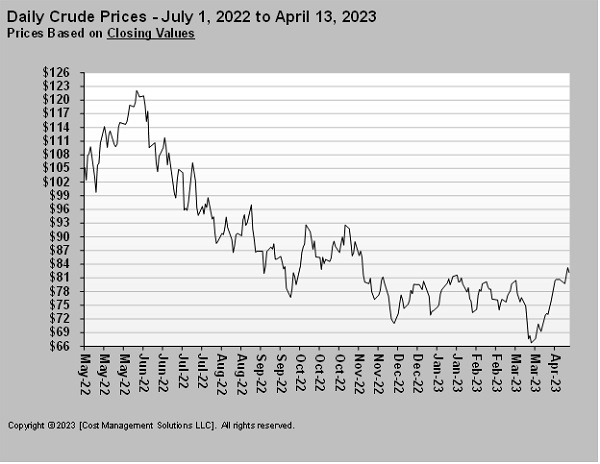

West Texas Intermediate (WTI) crude, the U.S. benchmark crude, peaked on June 8, 2022, with a close of $122.11. It then fell into a downtrend until last month. In August, it broke below its 200-day moving price average, which put it in bear market territory. During the downtrend, crude was largely driven by macroeconomic developments. High inflation caused central banks to tighten monetary policy, slowing economic activity and hopefully inflation. The potential for slower economic activity has the potential to lead to lower energy demand.

WTI crude hit a low of $66.74 on March 17 and has been in an uptrend since. The rally has been prompted by several factors: the belief that inflationary pressures have slowed enough that central banks are near the end of raising interest rates; and the value of the U.S. dollar has been falling and is now near a one-year low. A lower dollar encourages the buying of crude. Crude exports from Kurdistan totaling 450,000 bpd were halted because of an internal conflict between the regional Kurdistan government and Iraq central government. Talks are underway to rectify that issue, and supposed progress is being made, but as of today, flows have not resumed. Then there was the big surprise by OPEC+ at the end of March. This latest rally has WTI trading right at its 200-day moving price average and threatening to break out of its bear trend.

The rally has pushed WTI from the $66.74 low to $82.93 as we write. That is a gain of $16.19 per barrel, or 24.26 percent. For reference, Mont Belvieu propane has risen 12.375 cents per gallon, or 17.22 percent, during crude’s rally even though propane inventory is near five-year highs. Propane has lagged the gain in crude because of the high inventories, but it has still been pulled higher by the rising crude prices.

Though crude has already logged a strong rally, it has a long way to go to get to $100 per barrel. It will essentially have to double the gains it has made so far.

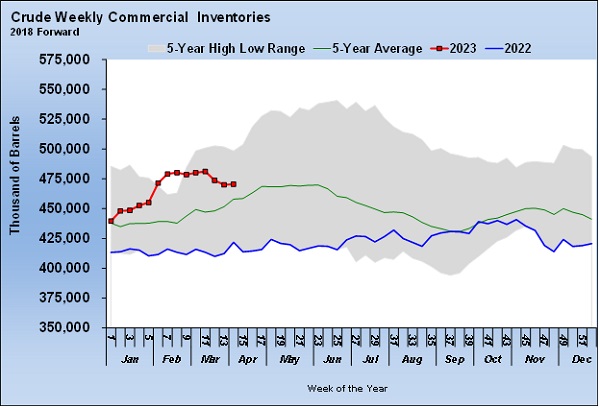

U.S. crude inventories had remarkably strong builds during the first quarter of this year and were at least a part of the reason crude hit its low for the year in mid-March. But recently, commercial crude inventories have been drawing. However, last week, commercial inventory increased 597,000 barrels. The build likely came because of a 1.6-million-barrel release from the U.S. Strategic Petroleum Reserve (SPR). There are likely more releases coming, and this is going to cloud the market’s ability to understand what is really going on with crude fundamentals.

The U.S. government released 180 million barrels of crude from the U.S. SPR last year. Those releases had been stopped over the past three months until last week. The releases last year came as the Biden administration tried to hold down energy prices leading up to the November mid-term elections. The current releases are mandated by law. On Dec. 4, 2015, President Obama signed into law the Fixing America’s Surface Transportation Act (FAST). The law was designed to assure state and local governments that the federal government would have the funds to back their transportation projects. The funds to meet the federal obligation come from selling crude from the SPR. Congress had considered not making the release for FAST this year because reserves have been drawn down so low by last year’s releases, but they didn’t act, and the Biden administration announced it was moving forward with the releases as the law requires. On Feb. 13, it announced it would sell 26 million barrels of crude from the SPR to cover the requirements of FAST.

It is not our purview here to discuss the logic of forcing the government to sell crude from its SPR regardless of market conditions to fund ongoing road maintenance. Instead, we will focus on the fact that yet another release of crude from the SPR further clouds everyone’s ability to evaluate fundamentals in the commercial crude market. While these releases are going on, the market is going to get a false sense of security concerning crude supply, just as it did last year. Theoretically, at some point, the government is going to replace the crude drawn from the reserves. It should have made some purchases when crude dropped below $70 per barrel based on its own commitment to do so. Of course, it reneged on that pledge because our government is fiscally irresponsible in every possible way. That irresponsibility has now reached epic proportions with a national debt of more than $31 trillion. Every U.S. taxpayer’s share of that debt is now $246,868. The U.S. government will spend more than $6 trillion this year and take in revenue of just over $4.6 trillion.

It has promised to buy crude for the SPR next fiscal year, until it doesn’t. The need to fill the SPR is likely to hang over the market for a long time. In the shorter term, the 26-million-barrel release from the SPR needs to be considered for its impact on limiting the upside for crude prices. The U.S. refined 15.585 million bpd of crude last week. The SPR release represents less than two days of demand, so it may seem insignificant, but last week’s data shows it isn’t. Had the 1.6 million barrels not been released from the SPR last week, the Energy Information Administration would have likely showed a 1-million-barrel drop in U.S. commercial crude inventory. That would make Chart 2 look a lot different. Instead of crude struggling to break its 200-day moving price average this week, it might have blown right through had the inventory data not been influenced by the SPR release.

As propane buyers, we must realize this crude release may keep prices more subdued than they otherwise would be, and that could keep the propane buy window open longer than it may have been otherwise. However, we must also be aware that when the release ends, there could be a steep decline in crude inventories. If the buy window isn’t closed before that point, it could certainly slam shut when the release from the SPR ends. The releases are scheduled to end June 30.

Charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.