Is there an opportunity in the propane market?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses why propane prices have been declining since the middle of February.

Catch up on last week’s Trader’s Corner here: US is oversupplied with propane

Propane prices have been declining since the middle of February. The market feels bearish – and with good reason.

The end of winter is in sight, and the temperature outlooks for the remainder of this month look like they will be higher than normal. Heating degree-days so far this year are 12 percent below normal and 3 percent below last year, continuing a concerning trend.

There hasn’t been much interest in the market to fix future supply costs. In fact, most of the effort has been to close positions for the remainder of this winter, into the summer, and even next winter. With the market vibe bearish, is it possible an opportunity is being overlooked?

We can’t know what propane prices will be for this coming winter. Our Trader’s Corner last week focused on the oversupply of propane in the U.S. As we pointed out, U.S. propane production is running about 1.5 million barrels per day (bpd) more than domestic demand. Without robust exports, U.S. propane would be essentially free. We also pointed out that the highest demand day last year stayed well below the lowest propane production day. Should global demand for U.S. propane slow, then more downward pressure on prices could develop.

We don’t know for sure if global demand for propane will decrease or increase. Most analysts seem to believe foreign demand for U.S. propane is going to remain strong. There is a lot of new demand for propane being created with the construction of more propane dehydrogenation units (PDH). PDH plants take fuel-grade propane and turn it into propylene for the petrochemical industry. Over the last few years, China alone has been adding around six new PDH plants per year.

Last year, China increased LPG imports by 21 percent – from 26.6 million metric tons to 32.21 million metric tons. That is an increase of 5.61 million metric tons. There are 12.7 barrels of propane in a metric ton, so that is an equivalent increase of 71.247 million barrels of propane. To put that in perspective, the U.S. currently has 51.177 million barrels of propane/propylene in storage. So just the LPG increase in demand from one country last year exceeded what the U.S. currently has in storage. Not all the increase was propane, but it was the bulk of it.

The point is that U.S. propane prices are highly dependent on the health of the global economy, which makes projecting propane prices in the future much more difficult than years ago when we were a net importer of propane. Because propane demand for heating in the U.S. is becoming proportionally less of total demand, seasonal pricing patterns are less predictable.

There are things we do know, and that is where we should focus when making decisions about hedging. We know that propane is a relatively cheap Btu, and while the U.S. consumer has seen inflation wreak havoc on household budgets, propane has remained on the friendlier side of those budgets. Given that, if propane retailers can offer a price for next winter near where they are offering this winter, there isn’t likely to be much pushback. In fact, most consumers would appreciate any price that has not looped the moon a few times since last year.

Since the beginning of October, propane has averaged just under 75 cents per gallon at Mont Belvieu and just under 72 cents at Conway. Most hedges for this winter have been priced higher than that, so in reality, the base cost of supply FOB Mont Belvieu was likely higher than those numbers for the industry overall.

Because we can’t know each reader’s hedging position or activity, let’s compare the current price to hedge this coming winter to the MB and Conway prices above. Currently, a retailer can fix a price at Mont Belvieu using forwards or swaps at around 80 cents Mont Belvieu and 82 cents Conway. For reference, at this point last year, fixing a winter strip was at 95 cents MB and 99 cents Conway.

Before dismissing the idea of hedging at the current numbers, look at the data points below:

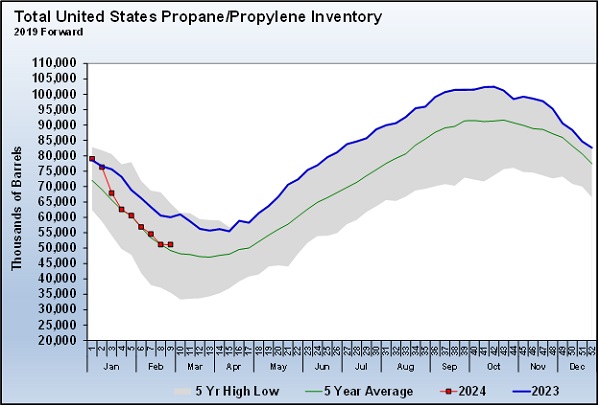

Currently, U.S. propane inventory is 8.876 million barrels, or 14.8 percent, below this time last year. Gulf Coast inventory is 19.6 percent below last year, yet the current hedge price for next winter is only 6.6 percent higher than this winter’s average. Midwest inventory is 11.9 percent below this time last year, and its price is 13.9 percent higher. Obviously, Mont Belvieu buyers get the win here. But we think Conway prices will come more in line as this winter fades.

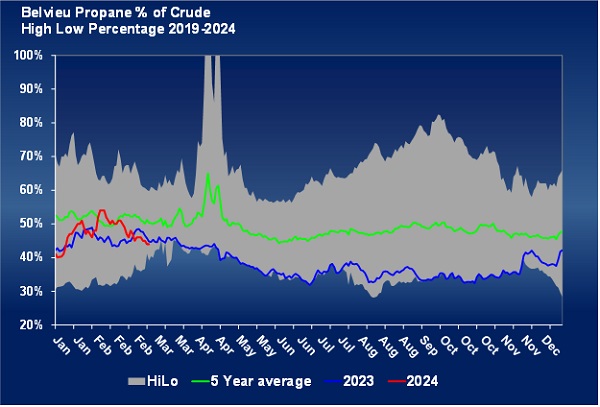

WTI crude is priced about a dollar higher than it was this time last year. Yet propane is currently valued at 44 percent MB and 40 percent Conway of WTI’s value. They were priced at 48 and 44 percent, respectively, at this time last year.

The chart shows MB ETR’s price to WTI crude’s price. It reveals Mont Belvieu propane’s favorable value to WTI crude’s value. Conway’s relative value is even more favorable.

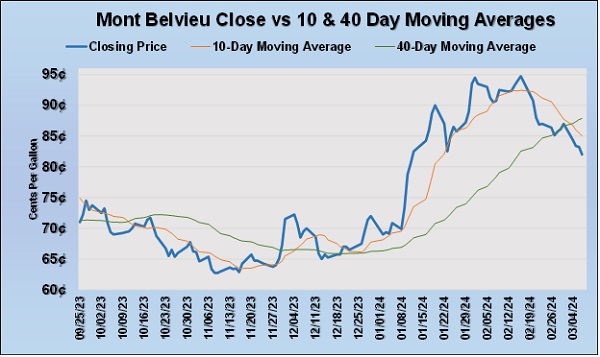

Finally, let’s look at propane’s technical chart.

Chart 3 shows propane’s current closing price compared to its 10- and 40-day moving price averages. Mont Belvieu ETR propane is trading below its 40-day moving price average. Historically propane bought below its 40-day moving price has an excellent chance of being a good buy.

Currently, propane prices are trending lower. It would be wise to let prices show some sign they have bottomed out before considering a hedge for next winter. The important thing is to use the average price of propane for this winter as a buying benchmark. When prices do turn, look at where winter hedges are priced at that point. Then consider those hedges are likely going to allow a retailer to offer a price to their customers comparable to last year.

In a world of inflation where heating oil is pricing at the Btu equivalent of 176-cent propane and gasoline at 186-cent propane, coming in close to last year’s price is going to be palatable, if not appreciated, by most propane consumers.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.